Fintech PR

Artmarket.com: the Artprice100© index was up 1.55% in 2023

PARIS, April 4, 2024 /PRNewswire/ — The simulated portfolio put together by Artprice to evaluate the annual performance of a weighted investment in the world’s 100 top-selling blue-chip artists on the global art auction market continued to grow with an overall return on investment of 1.55 % between January 1, 2023, and December 31, 2023.

The portfolio’s yield in 2023 was lower than the annual average of 10% recorded since 2000, but it nevertheless proves that works by blue-chip artists still grow in value even during periods of art market adjustment. Lacking major masterpieces since the sale of the Paul G. Allen Collection in 2022, the major auction houses have focused on offering a greater volume of works, including works that are more accessible, more recent or, which return to auction more quickly. But, even during this shift in focus, the popularity of blue-chip artists has continued to increase.

“Artprice’s latest annual report, “The Art Market in 2023” underscores the shift from a sellers’ market to a buyers’ market in 2023, explains thierry Ehrmann, CEO and Founder of Artmarket.com and its Artprice department. “During such periods, the balance of power tends to switch from the sellers to the buyers with the latter now being able to afford to be more demanding. But this shift has the effect of slowing the high-end segment, by reducing the availability of works likely to fetch over a million dollars. However, even in these circumstances, Artprice recorded a slight increase in prices for works by Blue-Chips artists.

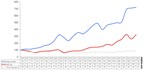

Artprice100© vs. S&P 500 and STOXX Europe 50 – Base 100 in January 2000

Calculation principle of the Artprice100©

On 1 January 2023, Artprice updated its portfolio respecting the same investment strategy as in previous years. This consists of maintaining fictitious stakes in the world’s 100 top-selling artists on the secondary market, with the stakes adjusted annually based on the artists’ annual auction turnover and the market liquidity of their works over the previous 5-year period. The relative weight of each artist in the portfolio at the start of every year is therefore proportional to the relative turnover their works have generated over the previous five years, and this figure is then adjusted by a market liquidity factor. The exact breakdown of the portfolio as of 1 January 2023 is provided below in the section Composition of Artprice100© as of 1 January 2023.

On 31 December 2023, Artprice noted the theoretical change in value for each of the 100 artists in the portfolio based on the evolution of their respective price indices over the previous year. These indices are calculated by Artprice on all auction results recorded during the year 2023, for all categories of Fine Art works, with the exception of Prints and Multiples which constitute a separate market.

For example, investment in works by Gerhard Richter (1932) represented 2.8% of the Artprice100© portfolio on 1 January 2023, and his price index increased by +21% over the following twelve months. The investment in works by Jean-Michel Basquiat (1960-1988) represented 3.9% of the portfolio at the start of 2023, but his price index fell by -15% in 2023.

But, despite the heaviest-weighted artists recording price contractions in 2023 (particularly Pablo Picasso, Andy Warhol, and Claude Monet who between them accounted for almost a fifth of the portfolio) the Artprice100© portfolio, which is highly diversified, ended the year in positive territory. So, at the end of 2023, the overall ROI for the 100 artists in the Artprice100© was +1.55%.

Composition of the Artprice100© Index as of 1 January 2023

Due to the rarity of works by Old Masters, they are now practically absent from the composition of the Artprice100© portfolio. Only the great Chinese master Dong Qichang (1555-1636) was included at the start of 2023 with a 0.3% theoretical investment.

The share of 19th-Century artists has increased significantly. The spectacular results recorded in 2022 for Vincent van Gogh (1853-1890) and Paul Cézanne (1839-1906) during the sale of the Paul G. Allen Collection significantly raised their participation when the portfolio was adjusted at the start of the following year (2023). In total, 19th Century artists represented 12% of the portfolio at the start of 2023, compared with 10% at the beginning of 2022.

Weight of the five major creative periods in the Artprice100© in 2023

Modern Art remained the largest segment in the composition of the Artprice100© index, accounting for 43% of the initial 2023 investment. The Belgian Surrealist René Magritte (1898-1967) and the Chinese master Qi Baishi (1864-1957) have both been included in the composition of the Artprice100© for around ten years, but the dynamics of their respective markets are currently following very different paths: while the prices of works by René Magritte are increasing quickly (+38%), Qi Baishi’s prices recorded a contraction of around -22% in 2023.

This year, the Post-War Art period accounted for 5 of the top 10 artists in the Artprice100© Index. Among them, the weight of the Japanese artist Yayoi Kusama (b.1929) in the portfolio is continuing to grow, driven by tremendous global success. With 812 lots sold at auction in 2023 for a total of $193 million, Yayoi Kusama is currently the 8th top-selling artist on the global art auction market (all creative periods combined) and the world’s most in-demand female artist. In 2023, Gerhard Richter was the only living artist whose auction turnover was higher than Kusama’s.

Lastly, in our 2023 Artprice100© portfolio, Contemporary Art represented 13% of the initial investment. The youngest artist in the portfolio was the Romanian painter Adrian Ghenie (b.1977), represented by the Plan-B, Thaddaeus Ropac, Tim Van Laere, and Pace galleries.

Composition of Artprice100©: Artist and weight in the initial Artprice100© portfolio for 2023

- Pablo PICASSO (1881-1973) (Modern Art): 8.3%

- Andy WARHOL (1928-1987) (Post-War Art): 5.1%

- Claude MONET (1840-1926) (19th Century): 5.0%

- Jean-Michel BASQUIAT (1960-1988) (Contemporary Art): 3.9%

- ZAO Wou-Ki (1921-2013) (Post-War Art): 3.4%

- Gerhard RICHTER (1932-) (Post-War Art): 2.8%

- David HOCKNEY (1937-) (Post-War Art): 2.4%

- Yayoi KUSAMA (1929-) (Post-War Art): 2.1%

- René MAGRITTE (1898-1967) (Modern Art): 2.1%

- QI Baishi (1864-1957) (Modern Art): 2.0%

- Willem DE KOONING (1904-1997) (Modern Art): 1.9%

- Vincent VAN GOGH (1853-1890) (19th Century): 1.9%

- Alberto GIACOMETTI (1901-1966) (Modern Art): 1.8%

- WU Guanzhong (1919-2010) (Modern Art): 1.8%

- Cy TWOMBLY (1928-2011) (Post-War Art): 1.6%

- FU Baoshi (1904-1965) (Modern Art): 1.5%

- Yoshitomo NARA (1959-) (Modern Art): 1.5%

- Paul CÉZANNE (1839-1906) (19th Century): 1.5%

- Alexander CALDER (1898-1976) (Modern Art): 1.4%

- Roy LICHTENSTEIN (1923-1997) (Post-War Art): 1.4%

- Marc CHAGALL (1887-1985) (Modern Art): 1.4%

- SAN Yu (1895-1966) (Modern Art): 1.3%

- Joan MIRO (1893-1983) (Modern Art): 1.3%

- BANKSY (1974-) (Contemporary Art): 1.3%

- Joan MITCHELL (1925-1992) (Post-War Art): 1.2%

- François-Xavier LALANNE (1927-2008) (Post-War Art): 1.1%

- Amedeo MODIGLIANI (1884-1920) (Modern Art): 1.1%

- Jean DUBUFFET (1901-1985) (Modern Art): 1.0%

- Lucio FONTANA (1899-1968) (Modern Art): 1.0%

- Henri MATISSE (1869-1954) (Modern Art) : 1.0%

- XU Beihong (1895-1953) (Modern Art): 0.9%

- Pierre-Auguste RENOIR (1841-1919) (19th Century): 0.9%

- Ed RUSCHA (1937-) (Post-War Art): 0.9%

- George CONDO (1957-) (Contemporary Art): 0.9%

- CHU Teh-Chun (1920-2014) (Post-War Art) : 0.9%

- Edgar DEGAS (1834-1917) (19th Century): 0.8%

- Fernand LÉGER (1881-1955) (Modern Art): 0.8%

- Paul GAUGUIN (1848-1903) (19th Century): 0.8%

- Jeff KOONS (1955-) (Contemporary Art): 0.8%

- Pierre SOULAGES (1919-2022) (Modern Art): 0.8%

- CUI Ruzhuo (1944-) (Post-War Art): 0.8%

- Christopher WOOL (1955-) (Contemporary Art): 0.7%

- KAWS (1974-) (Contemporary Art: 0.7%

- Wassily KANDINSKY (1866-1944) (Modern Art): 0.7%

- PAN Tianshou (1897-1971) (Modern Art): 0.7%

- Morton Wayne THIEBAUD (1920-2021) (Post-War Art): 0.7%

- LIN Fengmian (1900-1991) (Modern Art): 0.6%

- Jasper JOHNS (1930-) (Post-War Art): 0.6%

- Richard DIEBENKORN (1922-1993) (Post-War Art): 0.6%

- Paul SIGNAC (1863-1935) (Modern Art): 0.6%

- Georgia O’KEEFFE (1887-1986) (Modern Art): 0.6%

- Keith HARING (1958-1990) (Contemporary Art): 0.6%

- Peter DOIG (1959-) (Contemporary Art): 0.6%

- Frank STELLA (1936-) (Post-War Art): 0.6%

- Henry MOORE (1898-1986) (Modern Art): 0.5%

- Camille PISSARRO (1830-1903) (19th Century): 0.5%

- Damien HIRST (1965-) (Contemporary Art): 0.5%

- Georg BASELITZ (1938-) (Post-War Art): 0.5%

- Yves KLEIN (1928-1962) (Post-War Art): 0.5%

- Robert RAUSCHENBERG (1925-2008) (Post-War Art): 0.5%

- ZHOU Chunya (1955-) (Contemporary Art): 0.5%

- LIU Ye (1964-) (Contemporary Art): 0.5%

- Philip GUSTON (1913-1980) (Modern Art): 0.5%

- Adrian GHENIE (1977-) (Contemporary Art): 0.5%

- Louise BOURGEOIS (1911-2010) (Modern Art): 0.4%

- Richard PRINCE (1949-) (Contemporary Art): 0.4%

- ZENG Fanzhi (1964-) (Contemporary Art): 0.4%

- Fernando BOTERO (1932-2023) (Post-War Art): 0.4%

- Brice MARDEN (1938-2023) (Post-War Art): 0.4%

- Helen FRANKENTHALER (1928-2011) (Post-War Art): 0.4%

- Tsuguharu FOUJITA (1886-1968) (Modern Art): 0.4%

- PU Ru (1896-1963) (Modern Art): 0.4%

- Gustav KLIMT (1862-1918) (Modern Art): 0.4%

- Auguste RODIN (1840-1917) (19th Century): 0.4%

- Sigmar POLKE (1941-2010) (Post-War Art): 0.4%

- Salvador DALI (1904-1989) (Modern Art): 0.4%

- Ufan LEE (1936-) (Post-War Art): 0.4%

- Bernard BUFFET (1928-1999) (Post-War Art): 0.4%

- Sam FRANCIS (1923-1994) (Post-War Art): 0.4%

- Takashi MURAKAMI (1962-) (Contemporary Art): 0.3%

- Ernst Ludwig KIRCHNER (1880-1938) (Modern Art): 0.3%

- Nicolas DE STAËL (1914-1955) (Modern Art): 0.3%

- Tamara DE LEMPICKA (1898-1980) (Modern Art): 0.3%

- Whan-Ki KIM (1913-1974) (Modern Art): 0.3%

- Agnes MARTIN (1912-2004) (Modern Art): 0.3%

- Alighiero BOETTI (1940-1994) (Post-War Art): 0.3%

- Kazuo SHIRAGA (1924-2008) (Post-War Art): 0.3%

- Francis Picabia (1879-1953) (Modern Art): 0.3%

- Pierre BONNARD (1867-1947) (Modern Art): 0.3%

- Egon SCHIELE (1890-1918) (Modern Art): 0.3%

- Donald JUDD (1928-1994) (Post-War Art): 0.3%

- ZHANG Xiaogang (1958-) (Contemporary Art): 0.3%

- Edvard MUNCH (1863-1944) (Modern Art): 0.3%

- Rudolf STINGEL (1956-) (Contemporary Art): 0.3%

- DONG Qichang (1555-1636) (Old Masters): 0.3%

- Max ERNST (1891-1976) (Modern Art): 0.3%

- BALTHUS (1908-2001) (Modern Art): 0.3%

- Albert OEHLEN (1954-) (Contemporary Art): 0.3%

- Barbara HEPWORTH (1903-1975) (Modern Art): 0.3%

- Ellsworth KELLY (1923-2015) (Post-War Art): 0.3%

Images:

[https://imgpublic.artprice.com/img/wp/sites/11/2024/04/image2-artprice100-composition-2023.jpg]

The information and econometric studies produced by Artmarket.com are presented uniquely for the purpose of analyzing and understanding the statistical realities of the art market. They should in no way be considered as advice or a suggestion or a solicitation to invest in the art market or in Artmarket.com, listed on Euronext Paris.

Copyright 1987-2024 thierry Ehrmann www.artprice.com – www.artmarket.com

- Don’t hesitate to contact our Econometrics Department for your requirements regarding statistics and personalized studies: [email protected]

- Try our services (free demo): https://www.artprice.com/demo

- Subscribe to our services: https://www.artprice.com/subscription

About Artmarket:

Artmarket.com is listed on Eurolist by Euronext Paris, and Euroclear: 7478 – Bloomberg: PRC – Reuters: ARTF.

Discover Artmarket and its Artprice department on video: www.artprice.com/video

Artmarket and its Artprice department was founded in 1997 by its CEO, thierry Ehrmann. Artmarket and its Artprice department is controlled by Groupe Serveur, created in 1987.

See certified biography in Who’s who ©:

Artmarket is a global player in the Art Market with, among other structures, its Artprice department, world leader in the accumulation, management and exploitation of historical and current art market information (the original documentary archives, codex manuscripts, annotated books and auction catalogs acquired over the years ) in databanks containing over 30 million indices and auction results, covering more than 837,800 artists.

Artprice by Artmarket, the world leader in information on the art market, has set itself the ambition through its Global Standardized Marketplace to be the world’s leading Fine Art NFT platform.

Artprice Images® allows unlimited access to the largest Art Market image bank in the world: no less than 180 million digital images of photographs or engraved reproductions of artworks from 1700 to the present day, commented by our art historians.

Artmarket with its Artprice department accumulates data on a permanent basis from 7200 Auction Houses and produces key Art Market information for the main press and media agencies (7,200 publications). Its 7.2 million (‘members log in’+social media) users have access to ads posted by other members, a network that today represents the leading Global Standardized Marketplace® to buy and sell artworks at a fixed or bid price (auctions regulated by paragraphs 2 and 3 of Article L 321.3 of France’s Commercial Code).

The Art Market’s future is now brighter than ever with Artprice’s Artmarket® Intuitive AI

Artmarket, with its Artprice department, has twice been awarded the State label “Innovative Company” by the Public Investment Bank (BPI), which has supported the company in its project to consolidate its position as a global player in the art market.

Artprice by Artmarket’s Global Art Market Report, “The Art Market in 2023”, published in March 2024:

https://www.artprice.com/artprice-reports/the-art-market-in-2023

Artprice by Artmarket publishes its 2023 Contemporary Art Market Report:

https://www.artprice.com/artprice-reports/the-contemporary-art-market-report-2023

Index of press releases posted by Artmarket with its Artprice department:

https://serveur.serveur.com/artmarket/press-release/en/

Follow all the Art Market news in real time with Artmarket and its Artprice department on Facebook and Twitter:

www.facebook.com/artpricedotcom/ (over 6.5 million followers)

Discover the alchemy and universe of Artmarket and its artprice department https://www.artprice.com/video headquartered at the famous Organe Contemporary Art Museum “The Abode of Chaos” (dixit The New York Times): https://issuu.com/demeureduchaos/docs/demeureduchaos-abodeofchaos-opus-ix-1999-2013

La Demeure du Chaos / Abode of Chaos

GESAMTKUNSTWERK & SINGULAR ARCHITECTURE

Confidential bilingual work now public:

https://ftp1.serveur.com/abodeofchaos_singular_architecture.pdf

- L’Obs – The Museum of the Future: https://youtu.be/29LXBPJrs-o

- www.facebook.com/la.demeure.du.chaos.theabodeofchaos999 (over 4.1 million followers)

- https://vimeo.com/124643720

Contact Artmarket.com and its Artprice department – Contact: Thierry Ehrmann, [email protected]

Photo – https://mma.prnewswire.com/media/2379439/Artprice.jpg

Photo – https://mma.prnewswire.com/media/2379438/Artprice_2.jpg

Logo – https://mma.prnewswire.com/media/2260897/Artmarket_logo.jpg

![]() View original content:https://www.prnewswire.co.uk/news-releases/artmarketcom-the-artprice100-index-was-up-1-55-in-2023–302108358.html

View original content:https://www.prnewswire.co.uk/news-releases/artmarketcom-the-artprice100-index-was-up-1-55-in-2023–302108358.html

Fintech PR

Invitation to presentation of EQT AB’s Q1 Announcement 2024

STOCKHOLM, April 5, 2024 /PRNewswire/ — EQT AB’s Q1 Announcement 2024 will be published on Thursday 18 April 2024 at approximately 07:30 CEST. EQT will host a conference call at 08:30 CEST to present the report, followed by a Q&A session.

The presentation and a video link for the webcast will be available here from the time of the publication of the Q1 Announcement.

To participate by phone and ask questions during the Q&A, please register here in advance. Upon registration, you will receive your personal dial-in details.

The webcast can be followed live here and a recording will be available afterwards.

Information on EQT AB’s financial reporting

The EQT AB Group has a long-term business model founded on a promise to its fund investors to invest capital, drive value creation and create consistent attractive returns over a 5 to 10-year horizon. The Group’s financial model is primarily affected by the size of its fee-generating assets under management, the performance of the EQT funds and its ability to recruit and retain top talent.

The Group operates in a market driven by long-term trends and thus believes quarterly financial statements are less relevant for investors. However, in order to provide the market with relevant and suitable information about the Group’s development, EQT publishes quarterly announcements with key operating numbers that are relevant for the business performance (taking Nasdaq’s guidance note for preparing interim management statements into consideration). In addition, a half-year report and a year-end report including financial statements and further information relevant for investors is published. Finally, EQT also publishes an annual report including sustainability reporting.

Contact

Olof Svensson, Head of Shareholder Relations, +46 72 989 09 15

EQT Shareholder Relations, [email protected]

Rickard Buch, Head of Corporate Communications, +46 72 989 09 11

EQT Press Office, [email protected], +46 8 506 55 334

This information was brought to you by Cision http://news.cision.com

https://news.cision.com/eqt/r/invitation-to-presentation-of-eqt-ab-s-q1-announcement-2024,c3956826

The following files are available for download:

|

Invitation to presentation of EQT AB’s Q1 Announcement 2024 |

|

|

EQT AB Group |

View original content:https://www.prnewswire.co.uk/news-releases/invitation-to-presentation-of-eqt-abs-q1-announcement-2024-302109147.html

Fintech PR

Kia presents roadmap to lead global electrification era through EVs, HEVs and PBVs

- Kia drives forward transformation into ‘Sustainable Mobility Solutions Provider’

- Roadmap enables Kia to proactively respond to uncertainties in mobility industry landscape, including changes in EV market

- Company to expand EV line-up with more models; enhance HEV line-up to manage fluctuation in EV demand

- Goal to sell 1.6 million EVs annually in 2030, introducing 15 models

- PBV to play a key role in Kia’s growth, targeting 250,000 PBV sales annually by 2030 with PV5 and PV7 models

- Kia to invest KRW 38 trillion by 2028, including KRW 15 trillion for future business

- 2024 business guidance : KRW 101 tln in revenue with KRW 12 tln in operating profit; operating profit margin of 11.9% on sales of 3.2 million units globally

- CEO reaffirms Kia’s commitment to ESG management

SEOUL, South Korea, April 5, 2024 /PRNewswire/ — Kia Corporation (Kia) today shared an update on its future strategies and financial targets at its CEO Investor Day in Seoul, Korea.

Based on its innovative achievements in the years since the announcement of mid-to-long-term business initiatives, Kia is focusing on updating its 2030 strategy announced last year and further strengthening its business strategy in response to uncertainties across the global mobility industry landscape.

During the event, Kia updated its mid-to-long-term business strategy with a focus on electrification, and its PBV business. Kia reiterated its 2030 annual sales target of 4.3 million units, including 1.6 million units of electric vehicles (EVs). The 2030 4.3 million annual sales target is 34.4 percent higher than the brand’s 2024 annual goal of 3.2 million units.

The company also plans to become a leading EV brand by selling a higher percentage of electrified models among its total sales, including hybrid electric vehicles (HEV), plug-in hybrid (PHEV), and battery EVs, projecting electrified model sales of 2.48 million units annually or 58 percent of Kia’s total sales in 2030.

“Following our successful brand relaunch in 2021, Kia is enhancing its global business strategy to further the establishment of an innovative EV line-up and accelerate the company’s transition to a sustainable mobility solutions provider,” said Ho Sung Song, President and CEO of Kia. “By responding effectively to changes in the mobility market and efficiently implementing mid-to-long-term strategies, Kia is strengthening its brand commitment to the wellbeing of customers, communities, the global society, and the environment.”

Photo – https://mma.prnewswire.com/media/2380039/Photo_1__2024_CEO_Investor_Day.jpg

PDF – https://mma.prnewswire.com/media/2380040/Press_Release__2024_Kia_CEO_Investor_Day_240405.pdf

![]() View original content to download multimedia:https://www.prnewswire.co.uk/news-releases/kia-presents-roadmap-to-lead-global-electrification-era-through-evs-hevs-and-pbvs-302109142.html

View original content to download multimedia:https://www.prnewswire.co.uk/news-releases/kia-presents-roadmap-to-lead-global-electrification-era-through-evs-hevs-and-pbvs-302109142.html

Fintech PR

BioVaxys Technology Corp. Provides Bi-Weekly MCTO Status Update

VANCOUVER, BC, April 4, 2024 /PRNewswire/ — BioVaxys Technology Corp. (CSE: BIOV) (FRA: 5LB) (OTCQB: BVAXF) (the “Company“) is providing this bi-weekly update on the status of the management cease trade order granted on February 29, 2024 (the “MCTO“), by its principal regulator, the Ontario Securities Commission (the “OSC“), under National Policy 12-203 – Management Cease Trade Orders (“NP 12-203“), following the Company’s announcement on February 21, 2024 (the “Default Announcement“), that it was unable to file its audited annual financial statements for the year ended October 31, 2023, its management’s discussion and analysis of financial statements for the year ended October 31, 2023, its annual information form for the year ended October 31, 2023, and related filings (collectively, the “Required Annual Filings“). Under National Instrument 51-102, the Required Annual Filings were required to be made no later than February 28, 2024.

As a result of the delay in filing the Required Annual Filings, the Company was unable to file its interim financial statements for the three months ended January 31, 2024, its management’s discussion and analysis of financial statements for the three months ended January 31, 2024, and related filings (collectively, the “Required Interim Filings“). Under National Instrument 51-102, the Required Interim Filings were required to be made no later than April 1, 2024.

The Company anticipates filing the Required Annual Filings by April 30, 2024. The auditor of the Company requires additional time to complete its audit of the Company, including the Company’s recent acquisition of all intellectual property, immunotherapeutics platform technologies, and clinical stage assets of the former IMV Inc. that closed on February 16, 2024. In addition, the Company anticipates filing the Required Interim Filings immediately after the filing of the Required Annual Filings.

Except as herein disclosed, there are no material changes to the information contained in the Default Announcement. In addition, (i) the Company is satisfying and confirms that it intends to continue to satisfy the provisions of the alternative information guidelines under NP 12-203 and issue bi-weekly default status reports for so long as the delay in filing the Required Annual Filings and/or Required Interim Filings is continuing, each of which will be issued in the form of a press release; (ii) the Company does not have any information at this time regarding any anticipated specified default subsequent to the default in filing the Required Annual Filings and Required Interim Filings; (iii) the Company is not subject to any insolvency proceedings; and (iv) there is no material information concerning the affairs of the Company that has not been generally disclosed.

About BioVaxys Technology Corp.

BioVaxys Technology Corp. (www.biovaxys.com), a biopharmaceuticals company registered in British Columbia, Canada, is a clinical-stage biopharmaceutical company dedicated to improving patient lives with novel immunotherapies based on the DPX™ immune-educating technology platform and it’s HapTenix© ‘neoantigen’ tumor cell construct platform, for treating cancers, infectious disease, antigen desensitization, and other immunological fields. The Company’s clinical stage pipeline includes maveropepimut-S which is in Phase II clinical development for advanced Relapsed-Refractory Diffuse Large B Cell Lymphoma (DLBCL) and platinum resistant ovarian cancer, and BVX-0918, a personalized immunotherapeutic vaccine using it proprietary HapTenix© ‘neoantigen’ tumor cell construct platform which is soon to enter Phase I in Spain for treating refractive late-stage ovarian cancer. The Company is also capitalizing on its tumor immunology know-how and creation of a unique library of T-lymphocytes & other datasets post-vaccination with its personalized immunotherapeutic vaccines to utilize predictive algorithms and other technologies to identify new targetable tumor antigens. BioVaxys common shares are listed on the CSE under the stock symbol “BIOV” and trade on the Frankfurt Bourse (FRA: 5LB) and in the US (OTCQB: BVAXF). For more information, visit www.biovaxys.com and connect with us on X and LinkedIn.

ON BEHALF OF THE BOARD

Signed “James Passin“

James Passin, Chief Executive Officer

Phone: +1 646 452 7054

Logo – https://mma.prnewswire.com/media/1430981/BIOVAXYS_Logo.jpg

![]() View original content:https://www.prnewswire.co.uk/news-releases/biovaxys-technology-corp-provides-bi-weekly-mcto-status-update-302108920.html

View original content:https://www.prnewswire.co.uk/news-releases/biovaxys-technology-corp-provides-bi-weekly-mcto-status-update-302108920.html

-

Latest News6 days ago

China remains stabilizing force for global economic growth

-

Latest News5 days ago

Kylian Mbappé and Accor Forge Alliance to Empower Younger Generations

-

Latest News4 days ago

Martello Re announces closing of $1.3 billion capital raise consisting of $935 million in equity and a $360 million upsize of the Company’s credit facility

-

Latest News4 days ago

Market Dojo Celebrates Prestigious Inclusion in Ardent Partners 2024 Strategic Sourcing Technology Advisor

-

Latest News5 days ago

BioCatch completes best first half in company history, grows ARR by 43% YoY

-

Latest News5 days ago

COP28 President calls on all stakeholders to bring spirit of solidarity that delivered UAE Consensus to drive implementation and sustainable socio-economic development

-

Latest News2 days ago

Driving Innovation Forward: CFI Welcomes Seven-Time Formula 1™ World Champion Lewis Hamilton as new Global Brand Ambassador

-

Latest News4 days ago

TWSE Becomes the First Exchange to Receive ISO 14068-1 Carbon Neutrality Certificate