Fintech PR

Euroclear achieves robust third quarter results

BRUSSELS, Oct. 31, 2024 /PRNewswire/ — Results for the first nine months of 2024

Highlights

Euroclear’s business income and interest earnings reached record levels

- Underlying operating income increased by 6% to reach €2.18 billion. Net profit increased by 8% to €890 million.

- Underlying business income is up by 5% to €1,302 million, driven by record levels in settlement and safe keeping activities, with assets under custody crossing the €40 trillion mark for the first time ever. In Q3 2024, business income increased by 8% compared to Q3 2023, driven by strong performance especially in the Eurobonds & European assets and funds business.

- Underlying interest income continues to increase, up 9% to €882 million in the context of sustained high interest rates environment and gradual policy rate cuts.

Pace of cost growth continues to slow

- After a step-up in investment in digital capabilities, workforce and IT infrastructure in 2023, the growth of underlying operating expenses slowed to 3% for the first nine months of 2024.

- In Q3 2024, underlying costs decreased by 1.5% compared to Q3 2023, reflecting Euroclear’s continued focus on cost mitigation and non-recurrence of specific items.

- As a result, the business income operating margin improved to 24.7% for the first nine months of 2024.

Strong shareholder return and capital position

- Underlying earnings per share increased by 8% to €283 in line with continued increase in net profit.

- Euroclear group retains a very strong capital position, comfortably above regulatory requirements with an underlying Common Equity Tier 1 capital ratio slightly below 60%[1].

Russian sanctioned assets

- Following the implementation of the EU windfall contribution regulation, Euroclear provisioned €2.9 billion as windfall contribution for the first nine months of 2024, of which a first tranche of €1.55 billion for H1 2024 was paid to the European Fund for Ukraine in July 2024.

- Gradual rate cuts have led to a decline in interest income related to the Central Bank of Russia’s assets in Q3 2024 with the outlook for future interest earnings dependent on policymaking decisions.

- The impacts of the Russian sanctions are detailed in the last section of this press release.

|

Euroclear Holding |

||||||||

|

(€ m) |

YTD Q3 23 |

Russian sanctions impacts |

YTD Q3 23 underlying |

YTD Q3 24 |

Russian sanctions impacts after Windfall Contribution |

YTD Q3 24 underlying |

Underlying |

|

|

Operating income |

5,052 |

2,996 |

2,056 |

4,424 |

2,240 |

2,184 |

128 |

6 % |

|

Business income |

1,226 |

-18 |

1,243 |

1,282 |

-20 |

1,302 |

59 |

5 % |

|

Interest, banking & other income |

3,826 |

3,013 |

813 |

6,030 |

5,148 |

882 |

69 |

9 % |

|

Windfall contribution |

-2,888 |

-2,888 |

0 |

0 |

||||

|

Operating expenses |

-991 |

-34 |

-956 |

-1,049 |

-68 |

-981 |

-24 |

-3 % |

|

Operating profit before Impairment |

4,061 |

2,961 |

1,100 |

3,375 |

2,172 |

1,203 |

103 |

9 % |

|

Impairment |

0 |

0 |

0 |

-5 |

0 |

-5 |

-5 |

|

|

Pre tax profit |

4,061 |

2,961 |

1,100 |

3,370 |

2,172 |

1,198 |

98 |

9 % |

|

Tax |

-1,018 |

-740 |

-278 |

-1,573 |

-1,265 |

-308 |

-30 |

-11 % |

|

Net profit |

3,043 |

2,221 |

822 |

1,797 |

907 |

890 |

68 |

8 % |

|

EPS |

966.8 |

261.2 |

570.9 |

282.9 |

||||

|

Business income operating margin |

19.2 % |

23.1 % |

24.7 % |

|||||

|

EBITDA margin (EBITDA/oper.income) |

82.0 % |

57.5 % |

59.1 % |

|||||

Valerie Urbain, Chief Executive Officer of Euroclear, commented:

“We are maintaining our trajectory of strong financial results and excellent performance, with our settlement and safe keeping activities reaching once again record levels. We remain focused on the execution of our strategy and delivering outstanding service to our customers, while continuing to invest to support our long-term growth.

We believe digital assets offer significant benefits and our teams have continued to innovate to advance their adoption across geographies and asset classes. After two successful issuances, Euroclear now welcomed the first issuance in USD by an Asia-based issuer on its Digital Securities Issuance (D-SI) platform. Euroclear took part in a groundbreaking pilot project to tokenise gold, Gilts and Eurobonds for collateral management and completed the dress rehearsal of its trial for Eurosystem wholesale Central Bank Digital Currency (CBDC) exploratory work. Finally, Euroclear joined forces with Singapore-based Marketnode to help establish a key market infrastructure in Asia-Pacific designed to simplify the management of fund flows and reduce settlement times by using Distributed Ledger Technology (DLT).

As a group with European roots, Euroclear reiterated its commitment to supporting the European Capital Markets Union. With Europe entering a new political cycle, Euroclear presented a detailed memorandum on the competitiveness in Europe’s markets and engaged with key stakeholders to chart the course for enhanced market development and integration in Europe. I firmly believe that by attracting more issuers and investors, by removing barriers to efficiency, competition and integration and by supporting innovation, European capital markets can become more liquid, resilient and competitive.”

Business performance

The key operating metrics (end of period unless stated otherwise) demonstrate an excellent business performance during the period.

|

Q3 2023 |

Q3 2024 |

YoY evolution |

3-year CAGR |

|

|

Assets under custody |

€37 trillion |

€40 trillion |

+9 % |

+3 % |

|

Number of transactions |

224 million |

243 million |

+9 % |

+4 % |

|

Turnover |

€813 trillion |

€850 trillion |

+5 % |

+5 % |

|

Fund assets under custody |

€3 trillion |

€3.4 trillion |

+14 % |

+6 % |

|

Collateral Highway |

€1.67 trillion |

€1.9 trillion |

+14 % |

+2 % |

|

Underlying cash deposits (average) |

€24.3 trillion |

€22.4 trillion |

-8 % |

+3 % |

Euroclear’s assets under custody reached a record €40 trillion, growing for the eighth quarter in a row, thanks to solid stock exchange performances coupled with robust results in fixed income.

Despite the usual summer slowdown, settlement volumes hit a new high due to sustained activity since the beginning of the year.

Funds depot is boosted by the success of ETFs, combined with the positive evolution of the stock valuations, and breaks its all-time record level close to €3.4 trillion.

The Collateral Highway’s outstanding continues to increase and is now very close to the early 2022 peak.

Business milestones

Reshaping traditional financial services

Euroclear made significant progress in its journey to become a digital, data-enabled Financial Market Infrastructure by welcoming the first Digital Native Note (DNN) issued by the Asian Infrastructure Investment Bank on its Digital Securities Issuance (D-SI) platform. This marks the first digital issuance in USD for Euroclear and the first such issuance by an Asia-based issuer on its platform. Euroclear’s DSI service enables the issuance, distribution and settlement of fully digital international securities on Distributed Ledger Technology (DLT).

In the related digital securities space, Euroclear, alongside Digital Asset and The World Gold Council, has successfully completed a groundbreaking pilot to tokenise gold, Gilts and Eurobonds for collateral management. This initiative showcases how DLT can revolutionise collateral mobility, enhance liquidity and boost transactional efficiency.

Furthermore, with the support of Paris Europlace, Euroclear has brought together a group of French banks around its D-SI platform and Banque de France’s DL3S platform for Central Bank Digital Currency (CBDC). As a result, these financial institutions will issue the first Digital Native Note (DNN) under French Law and settle it in CBDC.

Advancing the funds business

In October 2024, Euroclear acquired a strategic stake in Marketnode, a Singapore-based digital market infrastructure operator. By joining forces with Marketnode and its existing shareholders – the Singapore Exchange (SGX Group), Temasek and HSBC – Euroclear will contribute to establish a key market infrastructure in Asia-Pacific designed to simplify the management of fund flows and reduce settlement times by using new technology. This first strategic investment in Asia reinforces the region’s importance to Euroclear’s positioning and business growth.

In line with its commitment to make private markets more accessible to a wider range, Euroclear announced a pioneer collaboration with BlackRock. Both companies join forces to expand the distribution of BlackRock’s private market funds via Euroclear’s FundsPlace. With a global reach serving over 2,500 clients across the globe, FundsPlace is well-equipped to extend BlackRock’s diverse range of private market funds to an even broader array of investors.

Simplification of Euroclear’s group structure

On 1 October 2024, Euroclear completed the previously announced simplification of its group structure. Two out of the four financial holding companies of the Euroclear group, Euroclear AG and Euroclear Investments SA/NV, were successively merged into Euroclear Holding SA/NV, the ultimate parent entity of the Euroclear group.

This simplification of the corporate structure results in a significant reduction of complexity both in terms of governance and financial administration, while keeping direct participations in regulated entities at the level of Euroclear SA/NV. This merger also streamlines and accelerates the dividend upstreaming process.

A call for unlocking scale and competitiveness in Europe’s markets

As a trusted market infrastructure having contributed to the integration of European and global markets over decades, Euroclear is committed to advance the European Capital Markets Union. To instigate a meaningful dialogue with all involved stakeholders, Euroclear published a thought leadership paper on the European capital markets highlighting, key challenges, real opportunities and the critical need to improve integration and competitiveness, specifically in the post-trade sector.

To read the full paper, go to https://www.euroclear.com/content/dam/euroclear/news%20&%20insights/Format/Whitepapers-Reports/Whitepaper-Unlocking-Europe-capital-markets.pdf

Supporting academic research on sustainable finance

In line with its ambition to advancing the understanding of sustainable finance, Euroclear announced its sponsorship of a new Chair in Sustainable Finance at the Solvay Brussels School of Economics and Management of the Université Libre de Bruxelles (ULB). Professor Dr Guntram Wolff will be the first holder of this newly created Chair, which will contribute to the creation of knowledge on sustainable finance, executive training as well as teaching.

Russian sanctions impacts

Financial impacts of the Russian assets

- The Russian sanctions continue to have a significant impact on Euroclear’s earnings.

- Interest earnings related to Russian assets, which are subject to Belgian corporate tax, generated €1.27 billion tax revenue.

- Following the implementation of the EU windfall contribution regulation applicable to the Central Bank of Russia’s (CBR) assets dating from 15 February 2024 onwards, Euroclear provisioned €2.9 billion as windfall contribution for the first nine months of 2024.

- Euroclear made a first payment for H1 2024 of approx. €1.55 billion to the European Fund for Ukraine in July 2024.

- The sanctions and Russian countermeasures resulted in direct costs of €68 million and a loss of business income of €20 million.

- Gradual rate cuts have led to a decline in interest income related to the Central Bank of Russia’s assets in Q3 2024 (see quarterly evolution in the table below) with the outlook for future interest earnings dependent on policymaking decisions. As a reference, an interest rate cut of 0.25% in Euro would have a potential impact of €51 million on the windfall contribution on quarterly basis.

|

Russian sanctions |

o/w CBR as of 15 Feb. |

CBR Q1 2024 as of 15 Feb. |

CBR Q2 2024 |

CBR Q3 2024 |

o/w Other Russia |

||||

|

Operating income |

2,240 |

1,000 |

191 |

407 |

402 |

1,240 |

|||

|

Business income |

-20 |

0 |

0 |

0 |

0 |

-20 |

|||

|

Interest, banking & other income |

5,148 |

3,888 |

746 |

1,577 |

1,565 |

1,260 |

|||

|

Windfall contribution provision |

-2,888 |

-2,888 |

-554 |

-1,170 |

-1,163 |

||||

|

Operating expenses |

-68 |

-16 |

-3 |

-7 |

-6 |

-52 |

|||

|

Operating profit before Impairment |

2,172 |

984 |

188 |

400 |

396 |

1,188 |

|||

|

Tax |

-1,265 |

-968 |

-185 |

-393 |

-390 |

-297 |

|||

|

Net profit |

907 |

16 |

3 |

7 |

6 |

891 |

|||

Update on Russian sanctions and countermeasures

Russia’s invasion of Ukraine in February 2022 resulted in market-wide application of international sanctions. Euroclear considers the application of international sanctions as a key obligation. Therefore, well established processes are in place which have allowed the group to implement the sanctions while maintaining our normal course of business.

As a result of the sanctions, blocked coupon payments and redemptions owed to sanctioned entities continue to accumulate on Euroclear Bank’s balance sheet. At the end of September 2024, Euroclear Bank’s balance sheet totalled €216 billion, of which €176 billion relate to sanctioned Russian assets.

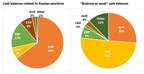

In line with Euroclear’s risk appetite and policies and as expected by the EU Capital Requirements Regulation, Euroclear’s cash balances are re-invested to minimise risk and capital requirements. In the first nine months of 2024, interest arising on cash balances from Russian-sanctioned assets was approximately €5.15 billion. Such interest earnings are driven by the prevailing interest rates and the amount of cash balances that Euroclear is required to invest. Subject to Belgian corporate tax, these earnings generated €1.27 billion tax revenue for the Belgian State. As such, future earnings will be influenced by the evolving interest rate environment.

Effective 15 February 2024, the EU Council adopted a Regulation requiring Central Securities Depositories (CSDs) holding reserves and assets of the Central Bank of Russia with a total value of more than €1 million to apply specific rules in relation to the cash balances accumulating due to restrictive measures. These CSDs, such as Euroclear Bank, should account for and manage such extraordinary cash balances separately from their other activities, should keep separate the net profit generated and should not dispose of these ensuing net profits (e.g. in the form of dividends to shareholders).

In May 2024, the European Commission has adopted a new regulation about a windfall contribution applicable to CSDs holding Russian Central Bank assets with a total value of more than €1 million. The profits generated by the reinvestment of these sanctioned amounts dating from 15 February 2024 onwards are required to be contributed to the European Fund for Ukraine. Consequently, Euroclear made a first payment of approx. €1.55 billion to the European Fund for Ukraine in July 2024.

Euroclear continues to act prudently and to strengthen its capital by retaining the remainder of the Russian sanction related profits as a buffer against current and future risks. Euroclear is focused on minimising potential legal, financial, and operational risks that may arise for itself and its clients, while complying with its obligations.

As a direct consequence of the sanctions and countermeasures, Euroclear faces multiple proceedings in Russian courts. Since Russia considers international sanctions against public order, Russian claimants initiated legal proceedings aiming mainly to access assets blocked in Euroclear Bank’s books, by claiming an equivalent amount in Russian Ruble and enforcing their claim in Russia. Despite all legal actions taken by Euroclear and the considerable resources mobilised, the probability of unfavourable rulings in Russian courts is high since Russia does not recognise the international sanctions.

Euroclear Bank and Euroclear Investments are the two group issuing entities. The summary income statements and financial positions at Q3 2024 for both entities are shown below.

|

Figures in Million of EUR |

|||||||

|

Euroclear Bank Income Statement (BE GAAP) |

Q3 2024 |

Q3 2023 |

Variance |

||||

|

Net interest income |

3,130.5 |

3,803.8 |

-673.2 |

||||

|

Net fee and commission income |

841.5 |

815.7 |

25.8 |

||||

|

Other income |

-4.6 |

20.9 |

-25.5 |

||||

|

Total operating income |

3,967.5 |

4,640.3 |

-672.9 |

||||

|

Administrative expenses |

-710.2 |

-612.5 |

-97.7 |

||||

|

Operating profit before impairment and taxation |

3,257.3 |

4,027.9 |

-770.6 |

||||

|

Result for the period |

1,709.5 |

3,013.6 |

-1,304.0 |

||||

|

Euroclear Bank Statement of Financial Position |

|||||||

|

Shareholders’ equity |

7,745.3 |

5,615.7 |

2,129.7 |

||||

|

Debt securities issued and funds borrowed (incl.subordinated debt) |

3,876.2 |

4,846.0 |

-969.8 |

||||

|

Total assets |

215,916.9 |

164,481.0 |

51,435.9 |

||||

The drop in Q3 2024 figures compared to Q3 2023 reflects the booking of the windfall contribution related to the Central Bank of Russia’s (CBR) assets dating from 15 February 2024.

|

Euroclear Investments Income Statement (BE GAAP) |

Q3 2024 |

Q3 2023 |

Variance |

|||||||

|

Dividend |

706.7 |

395.5 |

311.3 |

|||||||

|

Net gains/(losses) on financial assets & liabilities |

18.8 |

10.5 |

8.3 |

|||||||

|

Other income |

-0.1 |

-0.2 |

0.1 |

|||||||

|

Total operating income |

725.4 |

405.8 |

319.6 |

|||||||

|

Administrative expenses |

-1.6 |

-0.8 |

-0.8 |

|||||||

|

Operating profit before impairment and taxation |

723.8 |

405.0 |

318.8 |

|||||||

|

Result for the period |

719.3 |

402.4 |

316.9 |

|||||||

|

Euroclear Investments Statement of Financial Position |

||||||||||

|

Shareholders’ equity |

443.8 |

696.7 |

-253.0 |

|||||||

|

Debt securities issued and funds borrowed |

1,656.9 |

1,656.2 |

0.7 |

|||||||

|

Total assets |

2,100.8 |

2,354.5 |

-253.7 |

|||||||

The evolution of Q3 2024 figures compared to Q3 2023 reflects the increase in intragroup dividend.

Euroclear group is the financial industry’s trusted provider of post trade services. Guided by its purpose, Euroclear innovates to bring safety, efficiency, and connections to financial markets for sustainable economic growth. Euroclear provides settlement and custody of domestic and cross-border securities for bonds, equities and derivatives, and investment funds. As a proven, resilient capital market infrastructure, Euroclear is committed to delivering risk-mitigation, automation, and efficiency at scale for its global client franchise. The Euroclear group comprises Euroclear Bank, the International and Irish CSD, as well as Euroclear Belgium, Euroclear Finland, Euroclear France, Euroclear Nederland, Euroclear Sweden and Euroclear UK & International.

1 Post deduction of dividend relating to 2023 earnings, including Sept. 2024 YTD profit and based on estimated underlying RWA of around EUR 7.4bn. Assuming a 60% dividend pay-out on the Sept. 2024 profit, the CET1 ratio would be 52%.

Pascal Brabant / [email protected] / +32 475 78 36 62

Photo – https://mma.prnewswire.com/media/2545302/Annexes.jpg

Logo – https://mma.prnewswire.com/media/2064818/Euroclear_logo.jpg

![]() View original content:https://www.prnewswire.co.uk/news-releases/euroclear-achieves-robust-third-quarter-results-302292240.html

View original content:https://www.prnewswire.co.uk/news-releases/euroclear-achieves-robust-third-quarter-results-302292240.html

Fintech PR

Xinhua Silk Road: Conference on deepening financial openness and co-op in Northeast Asia held in NE. China’s Shenyang

BEIJING, Dec. 27, 2024 /PRNewswire/ — The 2nd Northeast Asia Finance Conference and 2024 “Revitalizing Liaoning with Finance” Excellent Cases Release kicked off on Tuesday in Shenyang, capital of northeast China’s Liaoning Province, aiming to further deepen financial openness and cooperation in the Northeast Asian region and advance construction of a regional financial center.

The main forum held a series of activities, including an opening ceremony, two round-table dialogues on “finance + biomedical industry” and “finance + cultural industry”, a symposium for foreign financial institutions, a seminar on innovative development of financial clusters, a forum on development of technology and finance, a forum on industrial low-carbon transformation and financial innovation, as well as an enterprise project roadshow and industry-finance matchmaking event.

During the conference themed on “accelerating the construction of a regional financial center in Northeast Asia and creating a new highland for opening up”, excellent cases of revitalizing Liaoning through finance in 2024 were unveiled and the index for core areas of regional financial centers in northeast China was released.

The conference also held an unveiling ceremony for the upgrading of the Shenyang finance and trade development zone to a national-level development zone, and a launch ceremony of a platform for Shenyang industrial insights and decision analysis.

The conference was co-hosted by China Economic Information Service, Liaoning Branch of Xinhua News Agency, Shenhe District People’s Government, Shenyang local financial administration under guidance of Shenyang Municipal People’s Government and Liaoning local financial supervision and administration bureau.

Original link: https://en.imsilkroad.com/p/343777.html

Photo – https://mma.prnewswire.com/media/2588005/Liaoning_finance.jpg

![]() View original content:https://www.prnewswire.co.uk/news-releases/xinhua-silk-road-conference-on-deepening-financial-openness-and-co-op-in-northeast-asia-held-in-ne-chinas-shenyang-302339538.html

View original content:https://www.prnewswire.co.uk/news-releases/xinhua-silk-road-conference-on-deepening-financial-openness-and-co-op-in-northeast-asia-held-in-ne-chinas-shenyang-302339538.html

Fintech PR

BingX Introduces ALTCOIN Index Futures Trading: One Click, Countless Trends

VILNIUS, Lithuania, Dec. 27, 2024 /PRNewswire/ — BingX, a global leading cryptocurrency exchange, is excited to announce the launch of ALTCOIN Index, the first futures trading pair involving top altcoins. This innovative trading product offers users a one-click solution to efficiently track and trade major cryptocurrency trends with ease.

Traditionally used in stock markets, a futures index is a financial derivative that tracks the performance of a group of assets, such as stocks of commodities. These instruments were first introduced to simplify trading by allowing investors to speculate on or hedge against the collective movements of selected market sectors. Instead of purchasing individual stocks, traders are able to access broad market exposure in a single transaction, saving time and reducing costs.

In the cryptocurrency market, this new ALTCOIN/USDT futures trading pair works similarly by bundling the performance of the top mainstream cryptocurrencies by market capitalization, excluding Bitcoin (BTC) and stablecoins. The current index includes ETH, XRP, SOL, BNB, DOGE, ADA, TRX, AVAX, and SHIB. This approach is more efficient compared to buying individual cryptocurrencies or ETFs as this allows for direct speculation using tiered leverage options without the need to manage multiple positions, effectively diversifying trading risks associated with individual asset volatility.

Vivien Lin, Chief Product Officer of BingX, commented on the new offering: “By aggregating a range of leading cryptocurrencies into a single trading instrument, we’re giving users a practical and efficient way to better capture market trends. This index trading pair should help our less experienced users with their trading goals more easily, particularly when they are unsure which asset to trade and just want to trade major altcoins in general with leverage.”

BingX users can take advantage of tiered leverage options and competitive rates consistent with the platform’s perpetual futures terms, simplifying open order management and enhancing trading efficiency. The platform also ensures that the index composition remains current, with regular quarterly adjustments and temporary updates in response to market conditions.

About BingX

Founded in 2018, BingX is a leading crypto exchange, serving over 10 million users worldwide. BingX offers diversified products and services, including spot, derivatives, copy trading, and asset management – all designed for the evolving needs of users, from beginners to professionals. BingX is committed to providing a trustworthy platform that empowers users with innovative tools and features to elevate their trading proficiency. In 2024, BingX proudly became the official crypto exchange partner of Chelsea Football Club, marking an exciting debut in the world of sports.

For more information please visit: https://bingx.com/

Photo – https://mma.prnewswire.com/media/2587929/IMG_0649.jpg

Logo – https://mma.prnewswire.com/media/2310183/BingX_logo_Logo.jpg

![]() View original content:https://www.prnewswire.co.uk/news-releases/bingx-introduces-altcoin-index-futures-trading-one-click-countless-trends-302339486.html

View original content:https://www.prnewswire.co.uk/news-releases/bingx-introduces-altcoin-index-futures-trading-one-click-countless-trends-302339486.html

Fintech PR

Nodepay Raises $7M Total Funding To Power AI Growth with Real-Time Data Infrastructure

SINGAPORE, Dec. 27, 2024 /PRNewswire/ — Nodepay, a decentralized AI platform transforming unused internet bandwidth into real-time data pipelines for AI training, today announced it has raised a second round of funding, bringing its total to $7 million.

The latest funding round welcomed new strategic investors IDG Capital ($23 Billion AUM), Mythos, Elevate Ventures, IBC, Optic Capital, Funders.VC, Matthew Tan (Etherscan founder) and Yusho Liu (CoinHako Co-founder & CEO) as notable angels. They join an impressive roster of previous backers that includes Animoca Brands, Mirana, OKX Ventures, JUMP Crypto, Tokenbay Capital and more.

Nodepay’s network taps into a global community of users running privacy-protected nodes. By sharing their spare internet bandwidth, these participants earn rewards for creating a real-time data source that improves AI inference with accurate, timely information—an approach known as Retrieval Augmented Generation (RAG).

Darren Nguyen, co-founder of Nodepay commented: “Our mission is to develop solutions that create tangible value for both AI developers and its end users. We give contributors a share in the AI ecosystem they help fundamentally build.”

Nodepay’s infrastructure platform integrates real-time data retrieval, a Web3-focused decentralized answer engine, reinforcement learning for more accurate model output, and gamified human verification. Together, these components combine to create a fair, collaborative, and innovative AI ecosystem.

Eric Le, investment director of IDG Capital, said, “The team at Nodepay is democratizing the AI economy by providing a platform that allows users to share directly in the value they create. We’re proud to support their vision of making AI more accessible and beneficial to all.”

With this funding, Nodepay will continue to commercialize its infrastructure to benefit both its community and partner AI labs. As it prepares to launch on Solana, Nodepay stands ready to lead the next era of decentralized AI development and training.

Already serving over 1.5 million active users worldwide, Nodepay continues to expand its reach, solidifying its role as a leader in the integration of AI and blockchain technology. Users can expect further updates and new announcements through their social channels and official website.

About Nodepay

Nodepay is a decentralized AI platform dedicated to democratizing AI training through real-time data retrieval. By turning idle internet bandwidth into a valuable resource, Nodepay fuels the next generation of AI models and stands at the forefront of AI decentralization.

Photo – https://mma.prnewswire.com/media/2587832/7M_Raised_Funds.jpg

Logo – https://mma.prnewswire.com/media/2587833/1080x1080_Black___Nodepay_2_Logo.jpg

![]() View original content:https://www.prnewswire.co.uk/news-releases/nodepay-raises-7m-total-funding-to-power-ai-growth-with-real-time-data-infrastructure-302339478.html

View original content:https://www.prnewswire.co.uk/news-releases/nodepay-raises-7m-total-funding-to-power-ai-growth-with-real-time-data-infrastructure-302339478.html

-

Fintech PR7 days ago

Fintech PR7 days agoAccording to Tickmill survey, 3 in 10 Britons in economic difficulty: Purchasing power down 41% since 2004

-

Fintech PR7 days ago

Fintech PR7 days agoPresident Emmerson Mnangagwa met this week with Zambia’s former Vice President and Special Envoy Enoch Kavindele to discuss SADC’s candidate for the AfDB

-

Fintech PR4 days ago

Fintech PR4 days agoGCL Energy Technology and Ant Digital Technologies Launch First Blockchain-Based RWA Project in Photovoltaic Industry

-

Fintech PR3 days ago

Fintech PR3 days ago2025 Will See Increased QR Code Payments but Payment Card IC ASPs Will Not Return to Pre-Covid Levels

-

Fintech PR3 days ago

Fintech PR3 days agoBybit Champions Web3 Innovation and Strengthens Ties with Asia’s Crypto Community at Taipei Blockchain Week

-

Fintech PR7 days ago

Fintech PR7 days agoStay Cyber Safe This Holiday Season: Heimdal’s Checklist for Business Security

-

Fintech PR7 days ago

Fintech PR7 days agoMedicilon Appoints Dr. Lilly Xu as Chief Technology Officer

-

Fintech PR4 days ago

Fintech PR4 days agoCKGSB Successfully Hosts 2024 MBA Professor Training Program for Western China