Fintech PR

Euroclear achieves robust third quarter results

BRUSSELS, Oct. 31, 2024 /PRNewswire/ — Results for the first nine months of 2024

Highlights

Euroclear’s business income and interest earnings reached record levels

- Underlying operating income increased by 6% to reach €2.18 billion. Net profit increased by 8% to €890 million.

- Underlying business income is up by 5% to €1,302 million, driven by record levels in settlement and safe keeping activities, with assets under custody crossing the €40 trillion mark for the first time ever. In Q3 2024, business income increased by 8% compared to Q3 2023, driven by strong performance especially in the Eurobonds & European assets and funds business.

- Underlying interest income continues to increase, up 9% to €882 million in the context of sustained high interest rates environment and gradual policy rate cuts.

Pace of cost growth continues to slow

- After a step-up in investment in digital capabilities, workforce and IT infrastructure in 2023, the growth of underlying operating expenses slowed to 3% for the first nine months of 2024.

- In Q3 2024, underlying costs decreased by 1.5% compared to Q3 2023, reflecting Euroclear’s continued focus on cost mitigation and non-recurrence of specific items.

- As a result, the business income operating margin improved to 24.7% for the first nine months of 2024.

Strong shareholder return and capital position

- Underlying earnings per share increased by 8% to €283 in line with continued increase in net profit.

- Euroclear group retains a very strong capital position, comfortably above regulatory requirements with an underlying Common Equity Tier 1 capital ratio slightly below 60%[1].

Russian sanctioned assets

- Following the implementation of the EU windfall contribution regulation, Euroclear provisioned €2.9 billion as windfall contribution for the first nine months of 2024, of which a first tranche of €1.55 billion for H1 2024 was paid to the European Fund for Ukraine in July 2024.

- Gradual rate cuts have led to a decline in interest income related to the Central Bank of Russia’s assets in Q3 2024 with the outlook for future interest earnings dependent on policymaking decisions.

- The impacts of the Russian sanctions are detailed in the last section of this press release.

|

Euroclear Holding |

||||||||

|

(€ m) |

YTD Q3 23 |

Russian sanctions impacts |

YTD Q3 23 underlying |

YTD Q3 24 |

Russian sanctions impacts after Windfall Contribution |

YTD Q3 24 underlying |

Underlying |

|

|

Operating income |

5,052 |

2,996 |

2,056 |

4,424 |

2,240 |

2,184 |

128 |

6 % |

|

Business income |

1,226 |

-18 |

1,243 |

1,282 |

-20 |

1,302 |

59 |

5 % |

|

Interest, banking & other income |

3,826 |

3,013 |

813 |

6,030 |

5,148 |

882 |

69 |

9 % |

|

Windfall contribution |

-2,888 |

-2,888 |

0 |

0 |

||||

|

Operating expenses |

-991 |

-34 |

-956 |

-1,049 |

-68 |

-981 |

-24 |

-3 % |

|

Operating profit before Impairment |

4,061 |

2,961 |

1,100 |

3,375 |

2,172 |

1,203 |

103 |

9 % |

|

Impairment |

0 |

0 |

0 |

-5 |

0 |

-5 |

-5 |

|

|

Pre tax profit |

4,061 |

2,961 |

1,100 |

3,370 |

2,172 |

1,198 |

98 |

9 % |

|

Tax |

-1,018 |

-740 |

-278 |

-1,573 |

-1,265 |

-308 |

-30 |

-11 % |

|

Net profit |

3,043 |

2,221 |

822 |

1,797 |

907 |

890 |

68 |

8 % |

|

EPS |

966.8 |

261.2 |

570.9 |

282.9 |

||||

|

Business income operating margin |

19.2 % |

23.1 % |

24.7 % |

|||||

|

EBITDA margin (EBITDA/oper.income) |

82.0 % |

57.5 % |

59.1 % |

|||||

Valerie Urbain, Chief Executive Officer of Euroclear, commented:

“We are maintaining our trajectory of strong financial results and excellent performance, with our settlement and safe keeping activities reaching once again record levels. We remain focused on the execution of our strategy and delivering outstanding service to our customers, while continuing to invest to support our long-term growth.

We believe digital assets offer significant benefits and our teams have continued to innovate to advance their adoption across geographies and asset classes. After two successful issuances, Euroclear now welcomed the first issuance in USD by an Asia-based issuer on its Digital Securities Issuance (D-SI) platform. Euroclear took part in a groundbreaking pilot project to tokenise gold, Gilts and Eurobonds for collateral management and completed the dress rehearsal of its trial for Eurosystem wholesale Central Bank Digital Currency (CBDC) exploratory work. Finally, Euroclear joined forces with Singapore-based Marketnode to help establish a key market infrastructure in Asia-Pacific designed to simplify the management of fund flows and reduce settlement times by using Distributed Ledger Technology (DLT).

As a group with European roots, Euroclear reiterated its commitment to supporting the European Capital Markets Union. With Europe entering a new political cycle, Euroclear presented a detailed memorandum on the competitiveness in Europe’s markets and engaged with key stakeholders to chart the course for enhanced market development and integration in Europe. I firmly believe that by attracting more issuers and investors, by removing barriers to efficiency, competition and integration and by supporting innovation, European capital markets can become more liquid, resilient and competitive.”

Business performance

The key operating metrics (end of period unless stated otherwise) demonstrate an excellent business performance during the period.

|

Q3 2023 |

Q3 2024 |

YoY evolution |

3-year CAGR |

|

|

Assets under custody |

€37 trillion |

€40 trillion |

+9 % |

+3 % |

|

Number of transactions |

224 million |

243 million |

+9 % |

+4 % |

|

Turnover |

€813 trillion |

€850 trillion |

+5 % |

+5 % |

|

Fund assets under custody |

€3 trillion |

€3.4 trillion |

+14 % |

+6 % |

|

Collateral Highway |

€1.67 trillion |

€1.9 trillion |

+14 % |

+2 % |

|

Underlying cash deposits (average) |

€24.3 trillion |

€22.4 trillion |

-8 % |

+3 % |

Euroclear’s assets under custody reached a record €40 trillion, growing for the eighth quarter in a row, thanks to solid stock exchange performances coupled with robust results in fixed income.

Despite the usual summer slowdown, settlement volumes hit a new high due to sustained activity since the beginning of the year.

Funds depot is boosted by the success of ETFs, combined with the positive evolution of the stock valuations, and breaks its all-time record level close to €3.4 trillion.

The Collateral Highway’s outstanding continues to increase and is now very close to the early 2022 peak.

Business milestones

Reshaping traditional financial services

Euroclear made significant progress in its journey to become a digital, data-enabled Financial Market Infrastructure by welcoming the first Digital Native Note (DNN) issued by the Asian Infrastructure Investment Bank on its Digital Securities Issuance (D-SI) platform. This marks the first digital issuance in USD for Euroclear and the first such issuance by an Asia-based issuer on its platform. Euroclear’s DSI service enables the issuance, distribution and settlement of fully digital international securities on Distributed Ledger Technology (DLT).

In the related digital securities space, Euroclear, alongside Digital Asset and The World Gold Council, has successfully completed a groundbreaking pilot to tokenise gold, Gilts and Eurobonds for collateral management. This initiative showcases how DLT can revolutionise collateral mobility, enhance liquidity and boost transactional efficiency.

Furthermore, with the support of Paris Europlace, Euroclear has brought together a group of French banks around its D-SI platform and Banque de France’s DL3S platform for Central Bank Digital Currency (CBDC). As a result, these financial institutions will issue the first Digital Native Note (DNN) under French Law and settle it in CBDC.

Advancing the funds business

In October 2024, Euroclear acquired a strategic stake in Marketnode, a Singapore-based digital market infrastructure operator. By joining forces with Marketnode and its existing shareholders – the Singapore Exchange (SGX Group), Temasek and HSBC – Euroclear will contribute to establish a key market infrastructure in Asia-Pacific designed to simplify the management of fund flows and reduce settlement times by using new technology. This first strategic investment in Asia reinforces the region’s importance to Euroclear’s positioning and business growth.

In line with its commitment to make private markets more accessible to a wider range, Euroclear announced a pioneer collaboration with BlackRock. Both companies join forces to expand the distribution of BlackRock’s private market funds via Euroclear’s FundsPlace. With a global reach serving over 2,500 clients across the globe, FundsPlace is well-equipped to extend BlackRock’s diverse range of private market funds to an even broader array of investors.

Simplification of Euroclear’s group structure

On 1 October 2024, Euroclear completed the previously announced simplification of its group structure. Two out of the four financial holding companies of the Euroclear group, Euroclear AG and Euroclear Investments SA/NV, were successively merged into Euroclear Holding SA/NV, the ultimate parent entity of the Euroclear group.

This simplification of the corporate structure results in a significant reduction of complexity both in terms of governance and financial administration, while keeping direct participations in regulated entities at the level of Euroclear SA/NV. This merger also streamlines and accelerates the dividend upstreaming process.

A call for unlocking scale and competitiveness in Europe’s markets

As a trusted market infrastructure having contributed to the integration of European and global markets over decades, Euroclear is committed to advance the European Capital Markets Union. To instigate a meaningful dialogue with all involved stakeholders, Euroclear published a thought leadership paper on the European capital markets highlighting, key challenges, real opportunities and the critical need to improve integration and competitiveness, specifically in the post-trade sector.

To read the full paper, go to https://www.euroclear.com/content/dam/euroclear/news%20&%20insights/Format/Whitepapers-Reports/Whitepaper-Unlocking-Europe-capital-markets.pdf

Supporting academic research on sustainable finance

In line with its ambition to advancing the understanding of sustainable finance, Euroclear announced its sponsorship of a new Chair in Sustainable Finance at the Solvay Brussels School of Economics and Management of the Université Libre de Bruxelles (ULB). Professor Dr Guntram Wolff will be the first holder of this newly created Chair, which will contribute to the creation of knowledge on sustainable finance, executive training as well as teaching.

Russian sanctions impacts

Financial impacts of the Russian assets

- The Russian sanctions continue to have a significant impact on Euroclear’s earnings.

- Interest earnings related to Russian assets, which are subject to Belgian corporate tax, generated €1.27 billion tax revenue.

- Following the implementation of the EU windfall contribution regulation applicable to the Central Bank of Russia’s (CBR) assets dating from 15 February 2024 onwards, Euroclear provisioned €2.9 billion as windfall contribution for the first nine months of 2024.

- Euroclear made a first payment for H1 2024 of approx. €1.55 billion to the European Fund for Ukraine in July 2024.

- The sanctions and Russian countermeasures resulted in direct costs of €68 million and a loss of business income of €20 million.

- Gradual rate cuts have led to a decline in interest income related to the Central Bank of Russia’s assets in Q3 2024 (see quarterly evolution in the table below) with the outlook for future interest earnings dependent on policymaking decisions. As a reference, an interest rate cut of 0.25% in Euro would have a potential impact of €51 million on the windfall contribution on quarterly basis.

|

Russian sanctions |

o/w CBR as of 15 Feb. |

CBR Q1 2024 as of 15 Feb. |

CBR Q2 2024 |

CBR Q3 2024 |

o/w Other Russia |

||||

|

Operating income |

2,240 |

1,000 |

191 |

407 |

402 |

1,240 |

|||

|

Business income |

-20 |

0 |

0 |

0 |

0 |

-20 |

|||

|

Interest, banking & other income |

5,148 |

3,888 |

746 |

1,577 |

1,565 |

1,260 |

|||

|

Windfall contribution provision |

-2,888 |

-2,888 |

-554 |

-1,170 |

-1,163 |

||||

|

Operating expenses |

-68 |

-16 |

-3 |

-7 |

-6 |

-52 |

|||

|

Operating profit before Impairment |

2,172 |

984 |

188 |

400 |

396 |

1,188 |

|||

|

Tax |

-1,265 |

-968 |

-185 |

-393 |

-390 |

-297 |

|||

|

Net profit |

907 |

16 |

3 |

7 |

6 |

891 |

|||

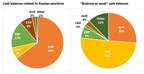

Update on Russian sanctions and countermeasures

Russia’s invasion of Ukraine in February 2022 resulted in market-wide application of international sanctions. Euroclear considers the application of international sanctions as a key obligation. Therefore, well established processes are in place which have allowed the group to implement the sanctions while maintaining our normal course of business.

As a result of the sanctions, blocked coupon payments and redemptions owed to sanctioned entities continue to accumulate on Euroclear Bank’s balance sheet. At the end of September 2024, Euroclear Bank’s balance sheet totalled €216 billion, of which €176 billion relate to sanctioned Russian assets.

In line with Euroclear’s risk appetite and policies and as expected by the EU Capital Requirements Regulation, Euroclear’s cash balances are re-invested to minimise risk and capital requirements. In the first nine months of 2024, interest arising on cash balances from Russian-sanctioned assets was approximately €5.15 billion. Such interest earnings are driven by the prevailing interest rates and the amount of cash balances that Euroclear is required to invest. Subject to Belgian corporate tax, these earnings generated €1.27 billion tax revenue for the Belgian State. As such, future earnings will be influenced by the evolving interest rate environment.

Effective 15 February 2024, the EU Council adopted a Regulation requiring Central Securities Depositories (CSDs) holding reserves and assets of the Central Bank of Russia with a total value of more than €1 million to apply specific rules in relation to the cash balances accumulating due to restrictive measures. These CSDs, such as Euroclear Bank, should account for and manage such extraordinary cash balances separately from their other activities, should keep separate the net profit generated and should not dispose of these ensuing net profits (e.g. in the form of dividends to shareholders).

In May 2024, the European Commission has adopted a new regulation about a windfall contribution applicable to CSDs holding Russian Central Bank assets with a total value of more than €1 million. The profits generated by the reinvestment of these sanctioned amounts dating from 15 February 2024 onwards are required to be contributed to the European Fund for Ukraine. Consequently, Euroclear made a first payment of approx. €1.55 billion to the European Fund for Ukraine in July 2024.

Euroclear continues to act prudently and to strengthen its capital by retaining the remainder of the Russian sanction related profits as a buffer against current and future risks. Euroclear is focused on minimising potential legal, financial, and operational risks that may arise for itself and its clients, while complying with its obligations.

As a direct consequence of the sanctions and countermeasures, Euroclear faces multiple proceedings in Russian courts. Since Russia considers international sanctions against public order, Russian claimants initiated legal proceedings aiming mainly to access assets blocked in Euroclear Bank’s books, by claiming an equivalent amount in Russian Ruble and enforcing their claim in Russia. Despite all legal actions taken by Euroclear and the considerable resources mobilised, the probability of unfavourable rulings in Russian courts is high since Russia does not recognise the international sanctions.

Euroclear Bank and Euroclear Investments are the two group issuing entities. The summary income statements and financial positions at Q3 2024 for both entities are shown below.

|

Figures in Million of EUR |

|||||||

|

Euroclear Bank Income Statement (BE GAAP) |

Q3 2024 |

Q3 2023 |

Variance |

||||

|

Net interest income |

3,130.5 |

3,803.8 |

-673.2 |

||||

|

Net fee and commission income |

841.5 |

815.7 |

25.8 |

||||

|

Other income |

-4.6 |

20.9 |

-25.5 |

||||

|

Total operating income |

3,967.5 |

4,640.3 |

-672.9 |

||||

|

Administrative expenses |

-710.2 |

-612.5 |

-97.7 |

||||

|

Operating profit before impairment and taxation |

3,257.3 |

4,027.9 |

-770.6 |

||||

|

Result for the period |

1,709.5 |

3,013.6 |

-1,304.0 |

||||

|

Euroclear Bank Statement of Financial Position |

|||||||

|

Shareholders’ equity |

7,745.3 |

5,615.7 |

2,129.7 |

||||

|

Debt securities issued and funds borrowed (incl.subordinated debt) |

3,876.2 |

4,846.0 |

-969.8 |

||||

|

Total assets |

215,916.9 |

164,481.0 |

51,435.9 |

||||

The drop in Q3 2024 figures compared to Q3 2023 reflects the booking of the windfall contribution related to the Central Bank of Russia’s (CBR) assets dating from 15 February 2024.

|

Euroclear Investments Income Statement (BE GAAP) |

Q3 2024 |

Q3 2023 |

Variance |

|||||||

|

Dividend |

706.7 |

395.5 |

311.3 |

|||||||

|

Net gains/(losses) on financial assets & liabilities |

18.8 |

10.5 |

8.3 |

|||||||

|

Other income |

-0.1 |

-0.2 |

0.1 |

|||||||

|

Total operating income |

725.4 |

405.8 |

319.6 |

|||||||

|

Administrative expenses |

-1.6 |

-0.8 |

-0.8 |

|||||||

|

Operating profit before impairment and taxation |

723.8 |

405.0 |

318.8 |

|||||||

|

Result for the period |

719.3 |

402.4 |

316.9 |

|||||||

|

Euroclear Investments Statement of Financial Position |

||||||||||

|

Shareholders’ equity |

443.8 |

696.7 |

-253.0 |

|||||||

|

Debt securities issued and funds borrowed |

1,656.9 |

1,656.2 |

0.7 |

|||||||

|

Total assets |

2,100.8 |

2,354.5 |

-253.7 |

|||||||

The evolution of Q3 2024 figures compared to Q3 2023 reflects the increase in intragroup dividend.

Euroclear group is the financial industry’s trusted provider of post trade services. Guided by its purpose, Euroclear innovates to bring safety, efficiency, and connections to financial markets for sustainable economic growth. Euroclear provides settlement and custody of domestic and cross-border securities for bonds, equities and derivatives, and investment funds. As a proven, resilient capital market infrastructure, Euroclear is committed to delivering risk-mitigation, automation, and efficiency at scale for its global client franchise. The Euroclear group comprises Euroclear Bank, the International and Irish CSD, as well as Euroclear Belgium, Euroclear Finland, Euroclear France, Euroclear Nederland, Euroclear Sweden and Euroclear UK & International.

1 Post deduction of dividend relating to 2023 earnings, including Sept. 2024 YTD profit and based on estimated underlying RWA of around EUR 7.4bn. Assuming a 60% dividend pay-out on the Sept. 2024 profit, the CET1 ratio would be 52%.

Pascal Brabant / [email protected] / +32 475 78 36 62

Photo – https://mma.prnewswire.com/media/2545302/Annexes.jpg

Logo – https://mma.prnewswire.com/media/2064818/Euroclear_logo.jpg

![]() View original content:https://www.prnewswire.co.uk/news-releases/euroclear-achieves-robust-third-quarter-results-302292240.html

View original content:https://www.prnewswire.co.uk/news-releases/euroclear-achieves-robust-third-quarter-results-302292240.html

Fintech PR

Redefining Financial Frontiers: Nucleus Software Celebrates 30 Years with Synapse 2024 in Singapore

SINGAPORE, Nov. 23, 2024 /PRNewswire/ — The thriving India–Singapore partnership in banking and technology reached a new milestone as Nucleus Software celebrated 30 years of transformative innovation at Synapse 2024, held in Singapore. The event underscored the company’s role in redefining financial services across Southeast Asia (SEA) and the globe, bringing together leaders in finance and technology to explore a shared vision for the future of banking.

Synapse 2024 celebrated 30 years of Nucleus Software’s leadership in driving transformative change across Singapore and Southeast Asia’s financial ecosystem. The event also shone a spotlight on the Global Finance & Technology Network (GFTN), an initiative supported by the Monetary Authority of Singapore (MAS) to champion responsible technology adoption. The event highlighted the deepening synergies between India and Singapore, driven by their shared commitment to innovation, cross-border collaboration, and financial inclusion. As the financial services sector undergoes rapid evolution with advancements in artificial intelligence, blockchain, and digital banking, these partnerships are setting the stage for a more connected, resilient, and inclusive global ecosystem.

Vishnu R. Dusad, Co-founder and Managing Director of Nucleus Software, reflected on the milestone: “For over 30 years, we’ve had the privilege of aligning our journey with Singapore’s ascent as a global financial powerhouse. Back in 1994, when we chose to go East instead of West, it was a bold and emotional decision—guided by our belief in Singapore as a hub for innovation and collaboration. We saw then what remains true today: Singapore is at the heart of the global financial landscape, a place where new ideas take root, and partnerships thrive.”

The event brought together a distinguished array of participants, highlighting the transformative potential of India–Singapore collaboration. Mr. Piyush Gupta, CEO of DBS Group and the Guest of Honor, set the tone for the event with his opening remarks, emphasizing the transformative role of big tech in reimagining scalable, customer-centric financial services in the digital age.

Following his address, key speakers enriched the discussions with their insights. Mr. Sopnendu Mohanty, Chief Fintech Officer at the Monetary Authority of Singapore and Group CEO-Designate of The Global Finance & Technology Network (GFTN), underlined the importance of fostering responsible technology adoption and building inclusive financial ecosystems. Mr. Vinod Rai, globally respected public policy expert, Distinguished Visiting Research Fellow at the National University of Singapore, and former Comptroller and Auditor General of India, shared his perspectives on governance and policy frameworks in financial systems. Mr. S.M. Acharya, Chairman of Nucleus Software and former Defence Secretary of India, offered a visionary outlook on leveraging technology to modernize and secure banking frameworks. Finally, Mr. Pieter Franken, Co-founder and Director of GFTN (Japan), a global FinTech pioneer and deep tech innovator, discussed the future of decentralized finance and its implications for the financial sector.

The event showcased the transformative role of technology in global financial systems, emphasizing innovations that set benchmarks for scalability and inclusivity. Panelists discussed the importance of localized solutions, the challenges of cross-border integration, and leveraging dual business models to optimize capital and foster public participation. The dialogue highlighted the need for common standards, unified frameworks like APIs, and collaborative efforts to accelerate financial inclusion and drive global connectivity in the digital age.

For 30 years, Nucleus Software has consistently introduced advanced lending and banking solutions that support financial institutions’ evolving needs in Singapore and South East Asia. Driven by lean development methodologies like Acceptance Test-Driven Development (ATDD) and Continuous Integration/Continuous Delivery (CICD), Nucleus Software continues to push boundaries in efficient, flexible, and secure financial technology.

Photo: https://mma.prnewswire.com/media/2565374/Synapse_2024.jpg

Logo: https://mma.prnewswire.com/media/2565373/Nucleus_Software_Logo.jpg

![]() View original content to download multimedia:https://www.prnewswire.co.uk/news-releases/redefining-financial-frontiers-nucleus-software-celebrates-30-years-with-synapse-2024-in-singapore-302314485.html

View original content to download multimedia:https://www.prnewswire.co.uk/news-releases/redefining-financial-frontiers-nucleus-software-celebrates-30-years-with-synapse-2024-in-singapore-302314485.html

Fintech PR

ROYAL CANADIAN MINT REPORTS PROFITS AND PERFORMANCE FOR Q3 2024

OTTAWA, ON, Nov. 22, 2024 /PRNewswire/ — The Royal Canadian Mint (the “Mint”) announces its financial results for the third quarter of 2024 that provide insight into its activities, the markets influencing its businesses and its expectations for the next 12 months.

“As the markets continue to change, the Mint is proving its ability to seize on new opportunities thanks to its diversified structure and flexible business strategy” said Marie Lemay, President and CEO of the Royal Canadian Mint.

The financial results should be read in conjunction with the Mint’s annual report available at www.mint.ca . All monetary amounts are expressed in Canadian dollars, unless otherwise indicated.

Financial and Operational Highlights

- The financial results for the third quarter of 2024 were ahead of target and higher than 2023 levels. Higher gold market pricing and foreign circulation volumes combined with lower fixed costs were the main drivers for the quarter over quarter increase. These increases were partially offset by lower than expected bullion volumes from the continued soft demand in the global bullion market. The Mint expects to meet its financial goals for 2024, as set out in its 2024-2028 Corporate Plan, the Mint’s Leadership team continues to actively monitor its status.

- Consolidated revenue decreased to $252.7 million in 2024 (2023 – $360.6 million).

Revenue from the Precious Metals business decreased to $217.6 million in 2024

(2023 – $328.4 million):- Gold bullion volumes decreased 38% quarter over quarter to 106.1 thousand ounces (2023 – 170.1 thousand ounces) while silver bullion volumes decreased 20% to 2.7 million ounces (2023 – 3.4 million ounces).

- Gold and silver market prices increased quarter over quarter by 27% and 23%, respectively.

- Sales of numismatic products decreased 12% quarter over quarter mainly due to the high demand in 2023 for the Queen Elizabeth II’s Reign products.

- Revenue from the Circulation business increased to $35.1 million in 2024

(2023 – $32.2 million):- Revenue from the Foreign Circulation business increased 77% quarter over quarter, a reflection of higher volumes produced and shipped in 2024 as compared to 2023.

- Revenue from Canadian coin circulation products and services decreased 12% quarter over quarter as fewer coins were required to replenish inventories, combined with lower program fees in accordance with the memorandum of understanding with the Department of Finance.

- Overall, operating expenses decreased 27% quarter over quarter to $28.3 million (2023 – $36.0 million) mainly due to planned reductions in consulting and workforce expenses.

Consolidated results and financial performance

(in millions)

|

13 weeks ended |

39 weeks ended |

|||||||||||

|

Change |

Change |

|||||||||||

|

September |

September |

$ |

% |

September |

September 30, 2023 |

$ |

% |

|||||

|

Revenue |

$ |

252.7 |

$ 360.6 |

(107.9) |

(30) |

$ 861.2 |

$ 1,841.8 |

(980.6) |

(53) |

|||

|

Profit (loss) for the period |

$ |

5.7 |

$ (5.8) |

11.5 |

(198) |

$ 24.1 |

$ 15.0 |

9.1 |

61 |

|||

|

Profit (loss) before |

$ |

1.4 |

$ (8.7) |

10.1 |

(116) |

$ 12.3 |

$ 23.4 |

(11.1) |

(47) |

|||

|

Profit (loss) before |

0.6 % |

(2.4) % |

1.4 % |

1.3 % |

||||||||

|

(1) Profit (loss) before income tax and other items is a non-GAAP financial measure. A reconciliation from profit for the period to profit before income tax and other items is included on page 13 of the Mint’s 2024 Third Quarter Report. |

|

(2) Profit (loss) before income tax and other items margin is a non-GAAP financial measure and its calculation is based on profit before income tax and other items. |

|

As at |

||||||||||

|

September 28, 2024 |

December 31, 2023 |

$ Change |

% Change |

|||||||

|

Cash |

$ |

58.4 |

$ |

59.8 |

(1.4) |

(2) |

||||

|

Inventories |

$ |

71.5 |

$ |

68.8 |

2.7 |

4 |

||||

|

Capital assets |

$ |

174.2 |

$ |

173.0 |

1.2 |

1 |

||||

|

Total assets |

$ |

376.8 |

$ |

380.4 |

(3.6) |

(1) |

||||

|

Working capital |

$ |

99.2 |

$ |

97.8 |

1.4 |

1 |

||||

As part of its enterprise risk management program, the Mint continues to actively monitor its global supply chain and logistics networks in support of its continued operations. Despite its best efforts, the Mint expects changes in the macro-economic environment and other external events around the globe to continue to impact its performance in 2024. The Mint continues to mitigate potential risks as they arise through its enterprise risk management process.

To read more of the Mint’s Third Quarter Report for 2024, please visit www.mint.ca.

About the Royal Canadian Mint

The Royal Canadian Mint is the Crown corporation responsible for the minting and distribution of Canada’s circulation coins. The Mint is one of the largest and most versatile mints in the world, producing award-winning collector coins, market-leading bullion products, as well as Canada’s prestigious military and civilian honours. As an established London and COMEX Good Delivery refiner, the Mint also offers a full spectrum of best-in-class gold and silver refining services. As an organization that strives to take better care of the environment, to cultivate safe and inclusive workplaces and to make a positive impact on the communities where it operates, the Mint integrates environmental, social and governance practices in every aspect of its operations.

For more information on the Mint, its products and services, visit www.mint.ca. Follow the Mint on LinkedIn, Facebook and Instagram.

FORWARD LOOKING STATEMENTS AND NON-GAAP FINANCIAL MEASURES

This Earnings Release contains non-GAAP financial measures that are clearly denoted where presented. Non-GAAP financial measures are not standardized under International Financial Reporting Standards (IFRS) and might not be comparable to similar financial measures disclosed by other corporations reporting under IFRS.

This Earnings Release contains forward-looking statements that reflect management’s expectations regarding the Mint’s objectives, plans, strategies, future growth, results of operations, performance, and business prospects and opportunities. Forward-looking statements are typically identified by words or phrases such as “plans”, “anticipates”, “expects”, “believes”, “estimates”, “intends”, and other similar expressions. These forward-looking statements are not facts, but only estimates regarding expected growth, results of operations, performance, business prospects and opportunities (assumptions). While management considers these assumptions to be reasonable based on available information, they may prove to be incorrect. These estimates of future results are subject to a number of risks, uncertainties and other factors that could cause actual results to differ materially from what the Mint expects. These risks, uncertainties and other factors include, but are not limited to, those risks and uncertainties set forth in the Risks to Performance section of the Management Discussion and Analysis in the Mint’s 2023 annual report, as well as in Note 9 – Financial Instruments and Financial Risk Management to the Mint’s Audited Consolidated Financial Statements for the year ended December 31, 2023. The forward-looking statements included in this Earnings Release are made only as of November 20, 2024 and the Mint does not undertake to publicly update these statements to reflect new information, future events or changes in circumstances or for any other reason after this date.

For more information, please contact: Alex Reeves, Senior Manager, Public Affairs, Tel: (613) 884-6370, [email protected]

View original content:https://www.prnewswire.co.uk/news-releases/royal-canadian-mint-reports-profits-and-performance-for-q3-2024-302314428.html

Fintech PR

OIVE and ViniPortugal celebrate closing of joint campaign that reached 100 million consumers

MADRID and PORTO, Portugal, Nov. 22, 2024 /PRNewswire/ — For three years, A Shared Passion showed European consumers the quality and unparalleled versatility of Iberian wines. The program reached over 100 million consumers with advertising in airports, train stations, press trips, digital content, and other actions with opinion leaders.

The wine interprofessionals of Spain (OIVE) and Portugal (ViniPortugal) celebrated the closing of their ambitious joint campaign A Shared Passion with flagship events in Madrid and Porto. The closing event in Spain took place in Madrid’s iconic Calle Alcalá, while in Portugal, the World of Wine (WOW) in Porto was the perfect setting to present the achievements of the international collaboration. Both ceremonies were very well received by the press and the wine sector, highlighting the impact of the promotional actions that reached more than 79.2 million travelers in key transport infrastructures.

The campaign included 22 study trips, taking 150 specialized journalists to explore the world of wine in both countries and generating publications that reached nearly 15 million European consumers.

On social media, the A Shared Passion profile on Instagram exceeded 15,000 followers, consolidating its presence in the digital sphere. In addition, exclusive activities such as workshops and VIP dinners contributed significantly to this initiative’s global impact.

The final events were honored by the presence of opinion leaders, such as Masters of Wine Pedro Ballesteros and Dirceu Vianna Júnior, who moderated round tables with the presidents of OIVE, Fernando Ezquerro, and ViniPortugal, Frederico Falcão. The conference concluded with masterclasses that highlighted Spain and Portugal’s extraordinary oenological diversity, reinforcing the relevance of the sector in the economic, social, and environmental sustainability of both countries.

With funding from the European Union, A Shared Passion highlighted not only the quality and authenticity of Iberian wines but also their strategic role in the sustainable development of numerous municipalities. This initiative underlines the passion with which Spanish and Portuguese wines are made, reflecting their rich traditions and commitment to the future.

For more information: www.asharedpassion.com

Video: https://mma.prnewswire.com/media/2565600/ViniPortugal_and_OIVE.mp4

![]() View original content to download multimedia:https://www.prnewswire.co.uk/news-releases/oive-and-viniportugal-celebrate-closing-of-joint-campaign-that-reached-100-million-consumers-302314339.html

View original content to download multimedia:https://www.prnewswire.co.uk/news-releases/oive-and-viniportugal-celebrate-closing-of-joint-campaign-that-reached-100-million-consumers-302314339.html

-

Fintech3 days ago

Fintech3 days agoFintech Pulse: Industry Updates, Innovations, and Strategic Moves

-

Fintech2 days ago

Fintech2 days agoFintech Pulse: Daily Industry Brief – A Dive into Today’s Emerging Trends and Innovations

-

Fintech PR3 days ago

Fintech PR3 days agoROLLER Releases 2025 Attractions Industry Benchmark Report, Unveiling Key Trends and Revenue Strategies

-

Fintech PR2 days ago

Fintech PR2 days agoTAILG Represents the Industry at COP29, Advancing South-South Cooperation with Low-Carbon Solutions

-

Fintech5 days ago

Fintech5 days agoFintech Pulse: Navigating Expansion, Innovation, and Sustainability

-

Fintech4 days ago

Fintech4 days agoFintech Pulse: Milestones, Partnerships, and Transformations in Fintech

-

Fintech PR2 days ago

Fintech PR2 days agoCritical Metals Surge Opens Prime Opportunity for Mining Investors

-

Fintech PR3 days ago

Fintech PR3 days agoThe CfC St. Moritz Announces New Speakers from BlackRock, Binance, Bpifrance, Temasek, PayPal, and More for Upcoming 2025 Conference