Latest News

New World Captures A Historic Moment: Elias Theodorou to Release NFT on Fight Night vs. Bryan Baker

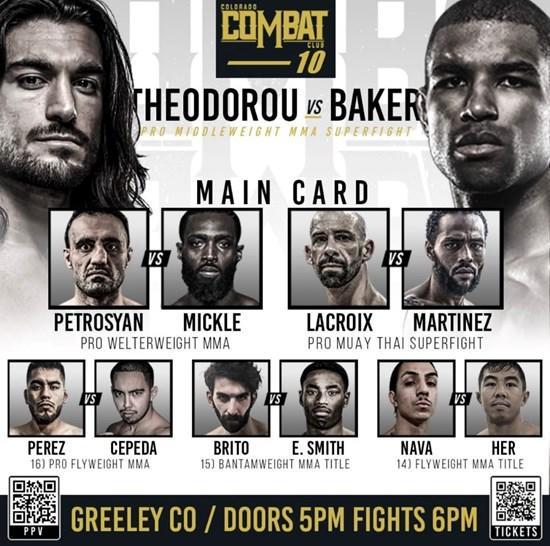

Toronto, Ontario–(Newsfile Corp. – December 15, 2021) – Graph Blockchain Inc. (CSE: GBLC) (OTC Pink: REGRF) (FSE: RT5A) (“Graph“) or (the “Company“) is pleased to announce that its wholly owned subsidiary New World Inc. will be launching Elias Theodorou‘s NFT on December 18th, the day he is set to face Bryan Baker (18-5) in the main event of CCC 10. Committed to fighting the stigma of medical cannabis in athletics, this is a historic first, as the Canadian will become the first professional athlete to compete on American soil with a Therapeutic Use Exemption for medical cannabis.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/107253

Powered by WPeMatico

Latest News

What’s Next for UK Challenger Banks, According to Auriemma Group

LONDON, May 21, 2024 /PRNewswire/ — The 1990s saw the emergence of the first wave of Challenger Banks in the UK – including Virgin Direct (1995), Sainsbury’s Bank (1997) and Tesco Personal Finance (1997). Their intention was to take on the established big banking players. However, as time has passed, they have moved in unintended directions. Auriemma Group has been monitoring this space for years, and provides strategic insights and advisory services to help clients navigate market dynamics and regulatory changes.

With the recent purchase of Tesco Bank by Barclays, the imminent purchase of Virgin Money by Nationwide, and the ongoing process for Sainsbury’s Bank to identify an appropriate exit route for its full suite of banking products, the established banking players have taken control of the core original Challenger banks. The ownership of M&S Bank as a wholly-owned subsidiary of HSBC (since 2004) can be added to this list.

Increased regulation—including interchange restrictions, higher capital requirements, the cost of capital, the cost of rewards, and economic turbulence—has made it too challenging for these entities to operate independently. What might this mean for the more recent Challenger banks?

The newer wave of Challenger banks, including Monzo, Starling, and Revolut have taken a very different approach to differentiate themselves from the mainstream. Whilst the 1990s wave focused on leveraging established brand names and existing distribution channels, the more recent wave has emphasized innovation, technology and a digital-first approach.

Slick, digital sign-up processes have attracted significant customer volumes for these players (Monzo with more than 7 million customers, Starling with 3.6 million, and Revolut with over 30 million globally). However, profitability remains a challenge for many.

“If the mainstream players feel they need to compete more directly, there are three possible approaches to consider,” says Simon Cottenham, Head of International Partnerships at Auriemma. “Spin-off their own digital banks to compete head-on with the Challenger banks, invest in the digital approaches and apply these to their mainstream products, or ultimately look to invest in or buy-out a Challenger bank and bring their capabilities in-house.”

The future of Challenger banks is murky at best. It remains to be seen if the new wave will be able to compete in the long-term with their largest competitors, or ultimately be absorbed by the high street banks like the original Challengers.

About Auriemma Group

For 40 years, Auriemma’s mission has been to empower clients with authoritative data and actionable insights. Our team comprises recognised experts in four primary areas: operational effectiveness, consumer research, co-brand partnerships and corporate finance. Our business intelligence and advisory services give clients access to the data, expertise and tools they need to navigate an increasingly complex environment and maximise their performance. Auriemma serves the consumer financial services ecosystem from our offices in London and New York City. For more information, visit us at www.auriemma.group or contact Simon Cottenham at [email protected].

View original content:https://www.prnewswire.co.uk/news-releases/whats-next-for-uk-challenger-banks-according-to-auriemma-group-302151733.html

Latest News

Apex Group names Ken Fullerton as new global head of operational transformation

The post Apex Group names Ken Fullerton as new global head of operational transformation appeared first on HIPTHER Alerts.

Latest News

Lockton Caribbean & Central America launches region’s first dedicated Food, Agriculture & Beverage insurance broking practice

MIAMI, May 21, 2024 /PRNewswire/ — Lockton Caribbean & Central America (CCA) announced today the launch of CCA FAB, the insurance broking industry’s first Food, Agriculture & Beverage practice focusing exclusively on the region.

The new Food, Agriculture & Beverage practice within Lockton CCA — the Miami-based wholesale insurance and reinsurance operation focused on the region, within Lockton’s Latin America and Caribbean Insurance Services Series (LACIS) — will deliver tailor-made insurance solutions to companies at all points along the value chain of the food, agriculture and beverage industries. Among other potential offerings, these include bespoke liability insurance and contract review, crop insurance, stock throughput solutions, product liability and recall insurance, reputational damage insurance, and financial and professional coverages.

Lockton CCA has historically served many high-profile local and global food, agriculture and beverage companies with exposures within the region, including food distribution companies, distilleries, breweries, and soft drink manufacturers, on behalf of local independent brokers and insurers. The new CCA FAB practice, working as a wholesaler, will deliver new and innovative solutions designed for the food, agriculture, and beverage industry to these brokers and insurers to better serve their clients.

Lockton named Simon Arden and Mario Martinez as co-leaders of CCA FAB. They will jointly report to Julian Pratt, CEO of Lockton CCA, and Tony Matta, President of CCA. Arden and Martinez, insurance industry veterans with history and experience in the Caribbean and Central America, will work closely with Lockton’s global Food, Agriculture & Beverage practices in both London and the United States to help food, agriculture and beverage industry companies effectively manage their risk.

“As the food, agriculture, and beverage sector in the Caribbean and Central America grows and evolves, businesses need tailored advice from brokers who understand the industry and the region,” Arden said. “Lockton CCA is excited to help deliver outside-the-box thinking and problem-solving to help industry participants manage their most critical operational, financial, and reputational risks and build competitively priced and responsive insurance programs.”

About Lockton

What makes Lockton stand apart is also what makes us better: independence. Lockton’s private ownership empowers its 11,500+ Associates doing business in over 140 countries to focus solely on clients’ risk, insurance and people needs. With expertise that reaches around the globe, Lockton delivers the deep understanding needed to accomplish remarkable results. For more information, visit www.lockton.com.

Logo – https://mma.prnewswire.com/media/2342384/Lockton_70_mm_Black_Logo.jpg

![]() View original content:https://www.prnewswire.co.uk/news-releases/lockton-caribbean–central-america-launches-regions-first-dedicated-food-agriculture–beverage-insurance-broking-practice-302151577.html

View original content:https://www.prnewswire.co.uk/news-releases/lockton-caribbean–central-america-launches-regions-first-dedicated-food-agriculture–beverage-insurance-broking-practice-302151577.html

-

Latest News6 days ago

Unleash a Wave of Opportunities this May with Bybit

-

Latest News6 days ago

What Does Nuvei’s Go-Private Deal Portend for FinTechs?

-

Latest News6 days ago

B Lab UK research reveals UK public back change to company law to put people, the planet and profit on more equal footing

-

Latest News5 days ago

Cayman Enterprise City Publishes Socio-Economic Impact Assessment by Economist and Leading Advisor on the Caribbean, Marla Dukharan

-

Latest News6 days ago

Bankart migrates payment processing to Diebold Nixdorf’s Vynamic Transaction Middleware

-

Latest News4 days ago

Early Detection Breakthrough: Biotech Companies Lead the Way in Pancreatic Cancer Treatment

-

Latest News5 days ago

SANY Heavy Industry Reports 2023 Earnings: Overseas Revenue Soars to 60% of Core Business Amid Market Pressures, Signaling Strong Global Expansion

-

Latest News5 days ago

Embracing the AI Era: IMF Highlights Massive Potential for Global Workforce AI Innovation