Latest News

LBank Exchange Will List LUNI on February 18, 2022

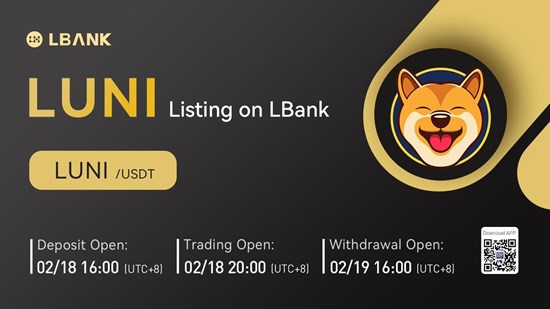

Internet City, Dubai–(Newsfile Corp. – February 16, 2022) – LBank Exchange, a global digital asset trading platform, will list LUNI on February 18, 2022. For all users of LBank Exchange, the LUNI/USDT trading pair will be officially available for trading at 20:00 (UTC+8) on February 18, 2022.

Figure 1: LBank Exchange Will List LUNI on February 18, 2022

Launched in 2019, Terra chain is a secure, decentralized and perspective modern network based in South Korea. To bring amusement and new features to Terra blockchain, a decentralized token named LUNI was created with core functions and utilities such as P2E games, LUNILAND metaverse integrated with NFTs, mobile application, staking and reward system, Terra based wallet and real events for the community.

The LUNI token will be listed on LBank Exchange at 20:00 (UTC+8) on February 18, 2022, to further expand its global reach and help it achieve its vision.

Introducing LUNI

LUNI is a decentralized token which brings benefits and entertainment on Terra Network. It is created to bring amusement and new features to Terra blockchain.

Terra chain is first created in 2018 and launched in 2019 as a secure, decentralized and perspective modern network based in South Korea. Prior to LUNI release, founders conducted thorough research and analyzed multiple independent chains such as ETH, BSC, SOL, ADA, NEAR and many more to estimate which one is the best platform to launch new token in November 2021. Terra won decisively.

The staking of LUNI is already available. Additionally, planned staking development phase 2 and phase 3 will integrate Genesis LUNI NFTs with staking system. In the coming future, LUNI will launch unique NFTs that are digitalized from handmade physical Balinese style LUNI related paintings, and upload them to Terra NFT marketplace. Mobile application with P2E games is planned to be developed, and LUNI wallet will be deployed as well. The team has already started working on the design of the unique metaverse called LUNILAND, which will be the first metaverse on Terra blockchain with virtual plots and integration with NFTs that will allow to generate passive income.

Last but not least, the rebranding of LUNI that the team has been working on is worth looking forward to, and its first effects will be visible before LUNI’s presentation in Dubai on World Blockchain Summit March, 2022.

About LUNI Token

The max supply of LUNI is 10 billion (i.e. 10,000,000,000), 60% of it is provided for public sale, 15% will be burned by removing them from TS and sending to a special Terra wallet which acts as a black hole, 10% is kept as a reserve for all marketing related actions, another 10% is provided for ecosystem reserve, and the rest 5% is allocated to team wallets.

The LUNI token will be listed on LBank Exchange at 20:00 (UTC+8) on February 18, 2022, investors who are interested in LUNI investment can easily buy and sell LUNI on LBank Exchange by then. The listing of LUNI on LBank Exchange will undoubtedly help it further expand its business and draw more attention in the market.

Learn More about LUNI Token:

Official Website: https://www.luniofficial.com

Telegram: https://t.me/LUNIonTerra

Twitter: https://twitter.com/LUNIonTerra

Discord: https://discord.gg/B8FA9fFHT9

About LBank Exchange

LBank Exchange, founded in 2015, is an innovative global trading platform for various crypto assets. LBank Exchange provides its users with safe crypto trading, specialized financial derivatives, and professional asset management services. It has become one of the most popular and trusted crypto trading platforms with over 6.4 million users from now more than 210 regions around the world.

Start Trading Now: lbank.info

Community & Social Media:

Telegram

Twitter

Facebook

Linkedin

Contact Details:

LBK Blockchain Co. Limited

LBank Exchange

[email protected]

PR Contact:

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/113973

Powered by WPeMatico

Latest News

PB Fintech slips 2% after over 8 million shares change hands via block deal

PB Fintech witnessed a 2% decline in its stock price, reaching Rs 1,313.65 per share, as approximately 8.4 million shares, equivalent to 1.86% of outstanding shares, were exchanged via block deals on the exchanges. By 9:44 AM, the volume surged to 9 million shares collectively on both exchanges, while PB Fintech’s stock price dipped by 0.56% to Rs 1,333 apiece, contrasting with a 0.22% decline in the S&P BSE Sensex.

Executive Share Sales

On May 16, PB Fintech announced that its Chairman and CEO, Yashish Dahiya, alongside Vice Chairman and Whole-time Director, Alok Bansal, intended to sell partial stakes in the company. Dahiya plans to sell up to 5.4 million equity shares, while Bansal aims to divest up to 2.97 million equity shares. Proceeds from the sale will be allocated primarily towards taxes on current and future ESOP exercises.

Following the sale, Dahiya will retain a 4.83% stake, while Bansal will hold a 1.63% stake in PB Fintech on a fully diluted basis. The company clarified that no further share sales are planned by the duo for at least one year.

Company Profile and Financial Performance

PB Fintech is actively involved in providing integrated online marketing and IT consulting services, primarily for the financial services industry, including insurance. The company operates Policybazaar, India’s largest digital insurance marketplace, and Paisabazaar, which offers lending-related services.

In Q4FY24, PB Fintech reported a net profit of Rs 60.19 crore, marking a significant improvement from the Rs 9.34 crore loss in the corresponding period of the previous year. The company’s revenue from operations surged by 25.4% year-on-year to Rs 1,090 crore in Q4 FY24, compared to Rs 869 crore in Q4 FY23.

For the entire fiscal year, PB Fintech’s net profit stood at Rs 64 crore, contrasting with the Rs 488 crore loss in FY23. The company’s consolidated operating revenue rose by 34% year-on-year to Rs 3,437 crore.

Analyst Perspectives

Analysts at Nuvama Institutional Equities raised their FY25/26 Ebitda estimates significantly to accommodate higher growth and improved profitability. However, they maintained a ‘Reduce’ rating on the stock due to its rich valuation, revising their target price to Rs 1,160.

Keynote Capital downgraded PB Fintech’s stock to ‘Reduce’ from ‘Buy’, citing that most of the positives appear to be priced in. Despite acknowledging the company’s positive momentum and profitability, the brokerage believes that current market expectations may be overly optimistic.

PB Fintech continues to navigate its growth trajectory amidst strategic initiatives and evolving market dynamics, as reflected by varying analyst viewpoints.

Source: business-standard.com

The post PB Fintech slips 2% after over 8 million shares change hands via block deal appeared first on HIPTHER Alerts.

Latest News

US fintech Yendo secures $165m in mix of debt financing and equity

Yendo, a prominent fintech company based in the United States, has successfully secured $165 million in funding through a combination of debt financing and equity investment.

Funding Structure

The funding round comprised a mix of debt financing and equity infusion, highlighting investors’ confidence in Yendo’s growth prospects and business model. This significant financial injection underscores Yendo’s position as a key player in the fintech sector.

Investment Highlights

Yendo’s ability to attract such substantial investment underscores its appeal to investors. The company’s innovative approach and strategic positioning within the fintech landscape have positioned it for accelerated growth and market expansion.

Utilization of Funds

The newly raised capital will likely be deployed to fuel Yendo’s expansion initiatives, including product development, market expansion, and strategic acquisitions. The infusion of funds will provide Yendo with the financial resources needed to capitalize on emerging opportunities and consolidate its market position.

Market Impact

Yendo’s successful funding round is expected to have a positive impact on the broader fintech market, signaling investor confidence in the sector’s growth potential. The influx of capital into Yendo reflects the ongoing trend of significant investment activity within the fintech industry, driven by increasing demand for innovative financial solutions.

Source: fintechfutures.com

The post US fintech Yendo secures $165m in mix of debt financing and equity appeared first on HIPTHER Alerts.

Latest News

Commerce Bank goes live with instant payment service FedNow through Temenos Payments Hub

Commerce Bank, headquartered in Kansas City, USA, has recently activated the FedNow instant payments service as part of its ongoing modernization efforts.

Collaboration with Temenos

Commerce Bank has partnered with Temenos, a leading Swiss vendor, to enhance its real-time payment capabilities. This collaboration builds upon Commerce Bank’s previous deployment of Temenos’ core banking platform in 2022 and its adoption of the Infinity loan origination solution earlier this year.

Utilization of Temenos Payments Hub

Commerce Bank has opted for the Temenos Payments Hub to integrate the FedNow service seamlessly. According to Temenos, this choice aims to amalgamate advanced banking products with cutting-edge delivery methods.

Insight from David Roller

David Roller, CIO of Commerce Bank, views this selection as a strategic step in their modernization journey. He emphasizes the bank’s commitment to meeting the evolving expectations of its customers by leveraging the capabilities offered by the Temenos platform.

Features of the Platform

The Temenos Payments Hub, delivered via Software-as-a-Service (SaaS), offers a comprehensive suite of payment tools and frameworks. These include features like straight-through processing, automated exception handling, cloud security measures, intelligent routing, and customizable workflows.

Leveraging the US Model Bank

In addition to the Temenos Payments Hub, Commerce Bank has also leveraged Temenos’ US Model Bank. This collection of pre-configured banking processes is tailored to address the specific requirements of the US market, further enhancing Commerce Bank’s operational efficiency and customer service.

Source: fintechfutures.com

The post Commerce Bank goes live with instant payment service FedNow through Temenos Payments Hub appeared first on HIPTHER Alerts.

-

Latest News7 days ago

Sobha Developers bring to Singapore an Exclusive Dubai Property Showcase

-

Latest News5 days ago

Al Hassan Ghazi Ibrahim Shaker Co. announces a strong start to FY24, reporting a 12.09% YoY increase in net profit to reach SAR 32.25 million in Q1-FY24

-

Latest News7 days ago

South African fintech Lesaka snaps up Adumo in $86m deal

-

Latest News5 days ago

Major Korean pension fund invests in carbon solutions with Stafford Capital Partners

-

Latest News5 days ago

Newgen Recognized in the Gartner® Market Guide for Commercial Banking Cash Management and Trade Finance Solutions 2023 Report

-

Latest News5 days ago

Precisely Showcases Critical Role of Trusted Data in AI at the Gartner® Data & Analytics Summit in London

-

Latest News5 days ago

XREX Singapore Receives MAS Major Payment Institution Licence

-

Latest News5 days ago

One United Properties posts a consolidated turnover of 84.3 million euros and a gross profit of 37 million euros in the first three months of 2024