Fintech

Voice Recognition Market to hit US$ 10 billion by 2028, Says Global Market Insights Inc.

The voice recognition market is expected to surpass USD 10 billion by 2028, as reported in a research study by Global Market Insights Inc. The market growth can be attributed to the emergence of fintech technology and innovations in banking processes along with digitization.

The cloud-based voice recognition market is expanding owing to its several benefits such as high speed, scalability, IT security, and 24/7 services. These solutions can be remotely customized to transcribe domain-specific terms and rare words by providing hints and boost the transcription accuracy in different languages. The cloud-based deployment model enables the users to access APIs for different use cases such as dictation, short commands, captioning, and subtitles. The market players are undertaking strategic mergers & acquisitions to offer high-quality solutions to the customers. For instance, in April 2021, Microsoft Corporation acquired Nuance Communications, Inc., an AI-based voice recognition solutions provider to boost cloud healthcare business. This allows to offer better patient-physician interactions in person or in the telemedicine appointments.

Request for a sample of this research report @ https://www.gminsights.com/request-sample/detail/1572

The in-flight voice recognition technology helps aircraft pilots to decrease their workload by automating various device operations based on commands. It provides flight crews with access to frequent commands; this enables them to efficiently manage various operations. Continuous technological advancements in the aerospace industry coupled with the focus on improving flight safety provide impetus to the voice recognition market. The voice recognition system allows pilots to save time while obtaining Air Traffic Control (ATC) commands, thereby allowing them to concentrate completely on flying efficiently & safely. Voice recognition systems provide improved situational awareness by identifying, capturing, and presenting ATC communications relevant to the aircraft’s operation for review or replay.

The developing consumer electronics industry in North America is augmenting the voice recognition market growth. Increasing disposable incomes of consumers in North America are boosting the sale of consumer electronic devices. According to Statistics Canada, disposable incomes of the lowest-income households grew to 3.0% and 3.3%, respectively, in the first two quarters of 2021 while that of the highest-income households decreased by 6.4% and then increased by 3.9% over the same period. Growth in disposable incomes indicates the additional spending power of the consumer in the country. Individuals are increasingly spending on advanced smartphones and tablets equipped with voice recognition technology to enable convenient user authentications. Voice recognition solutions help to identify a person, thereby providing enhanced security to sensitive data.

Some of the major findings of the voice recognition market report are:

- Stringent government polices to improve data security will positively impact the voice recognition market growth. For instance, the General Data Protection Regulation (GDPR) enhances data management across every sector including healthcare and BFSI to improve the data protection & privacy of individuals across Europe. Voice recognition is a safe authentication technology that identifies a person while protecting sensitive data.

- Technological advancements, such as Artificial intelligence (AI) and Natural Language Processing (NLP), are prompting various sectors to replace their existing authentication systems with voice-based biometrics to enhance user identity verifications. In response to the increased demand from various end-use verticals, numerous market players are integrating this innovative technology into their voice recognition systems. For instance, Aculab PLC employs Artificial Neural Networks (ANNs) and analytical signal processing technologies to offer real-time frictionless & universal authentications.

- The increasing introduction of consumer electronic devices that uses voice recognition to protect data stored in device and various applications supports the market growth. Global population is increasing the use of voice interactions with digital assistants such as Siri & Alexa, smartphones, and smart home devices to streamline various tasks.

- The growing demand for voice recognition solutions in healthcare sectors is providing impetus to the market. Medical voice recognition software minimizes typing errors and automates spellcheck in real time. It decreases the cost of transcription, offers end-to-end security, and imports records directly into an electronic health record (EHR).

Request for customization of this research report at https://www.gminsights.com/roc/1572

Partial chapters of report table of contents (TOC):

Chapter 2 Executive Summary

2.1 Voice recognition industry 360º synopsis, 2018 – 2028

2.1.1 Business trends

2.1.2 Regional trends

2.1.3 Deployment model trends

2.1.4 Technology trends

2.1.5 End-use trends

Chapter 3 Voice Recognition Industry Insights

3.1 Introduction

3.2 Impact of COVID-19 outbreak

3.3 Industry ecosystem analysis

3.4 Technology & innovation landscape

3.5 Patent analysis

3.6 Regulatory landscape

3.7 Industry impact forces

3.7.1 Growth drivers

3.7.1.1 Rise in adoption of voice biometrics for enhancing identity and security among various industry verticals

3.7.1.2 Increasing adoption of the AI-based voice recognition systems

3.7.1.3 Stringent government regulations drive the need for secure authentication technologies in healthcare sector

3.7.1.4 Need to prevent unauthorized access to IT facilities and other security-sensitive areas

3.7.1.5 Growing popularity of mobile payments using voice recognition software

3.7.1.6 Proliferation of smart consumer electronics devices in Asia Pacific

3.7.1.7 Development of voice-enabled in-car infotainment systems in Europe and the U

3.7.2 Industry pitfalls & challenges

3.7.2.1 Data security & privacy concerns

3.7.2.2 High cost of implementation

3.8 Growth potential analysis

3.9 Porter’s analysis

3.10 PESTEL analysis

About Global Market Insights

Global Market Insights Inc., headquartered in Delaware, U.S., is a global market research and consulting service provider; offering syndicated and custom research reports along with growth consulting services. Our business intelligence and industry research reports offer clients with penetrative insights and actionable market data specially designed and presented to aid strategic decision making. These exhaustive reports are designed via a proprietary research methodology and are available for key industries such as chemicals, advanced materials, technology, renewable energy and biotechnology.

Fintech

How to identify authenticity in crypto influencer channels

Modern brands stake on influencer marketing, with 76% of users making a purchase after seeing a product on social media.The cryptocurrency industry is no exception to this trend. However, promoting crypto products through influencer marketing can be particularly challenging. Crypto influencers pose a significant risk to a brand’s reputation and ROI due to rampant scams. Approximately 80% of channels provide fake statistics, including followers counts and engagement metrics. Additionally, this niche is characterized by high CPMs, which can increase the risk of financial loss for brands.

In this article Nadia Bubennnikova, Head of agency Famesters, will explore the most important things to look for in crypto channels to find the perfect match for influencer marketing collaborations.

-

Comments

There are several levels related to this point.

LEVEL 1

Analyze approximately 10 of the channel’s latest videos, looking through the comments to ensure they are not purchased from dubious sources. For example, such comments as “Yes sir, great video!”; “Thanks!”; “Love you man!”; “Quality content”, and others most certainly are bot-generated and should be avoided.

Just to compare:

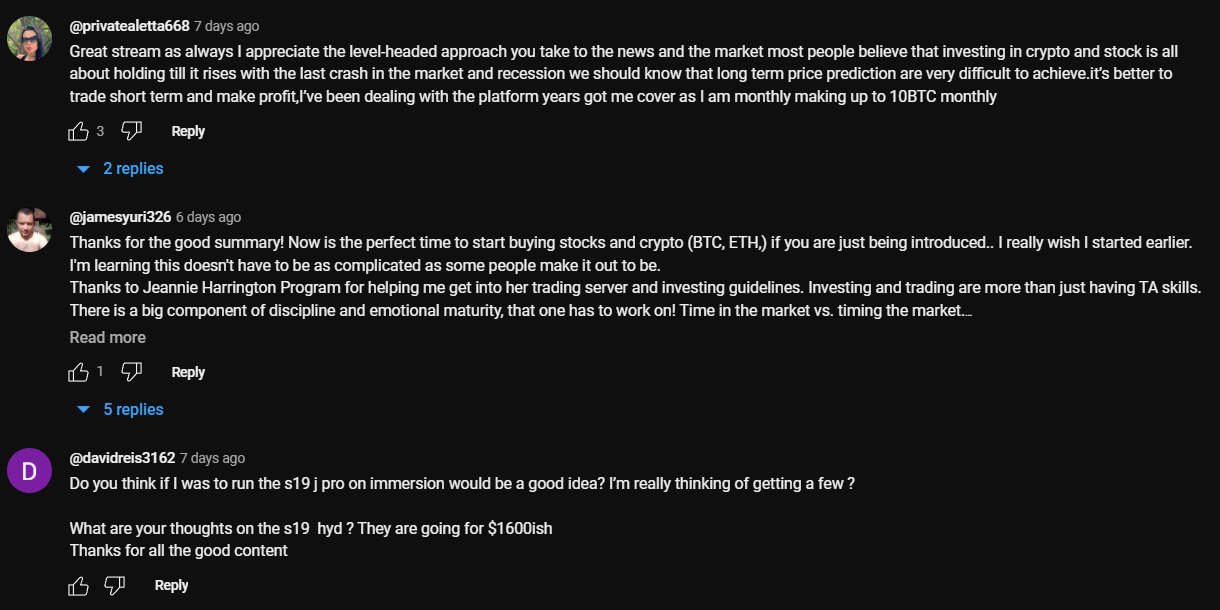

LEVEL 2

Don’t rush to conclude that you’ve discovered the perfect crypto channel just because you’ve come across some logical comments that align with the video’s topic. This may seem controversial, but it’s important to dive deeper. When you encounter a channel with logical comments, ensure that they are unique and not duplicated under the description box. Some creators are smarter than just buying comments from the first link that Google shows you when you search “buy YouTube comments”. They generate topics, provide multiple examples, or upload lists of examples, all produced by AI. You can either manually review the comments or use a script to parse all the YouTube comments into an Excel file. Then, add a formula to highlight any duplicates.

LEVEL 3

It is also a must to check the names of the profiles that leave the comments: most of the bot-generated comments are easy to track: they will all have the usernames made of random symbols and numbers, random first and last name combinations, “Habibi”, etc. No profile pictures on all comments is also a red flag.

LEVEL 4

Another important factor to consider when assessing comment authenticity is the posting date. If all the comments were posted on the same day, it’s likely that the traffic was purchased.

2. Average views number per video

This is indeed one of the key metrics to consider when selecting an influencer for collaboration, regardless of the product type. What specific factors should we focus on?

First & foremost: the views dynamics on the channel. The most desirable type of YouTube channel in terms of views is one that maintains stable viewership across all of its videos. This stability serves as proof of an active and loyal audience genuinely interested in the creator’s content, unlike channels where views vary significantly from one video to another.

Many unauthentic crypto channels not only buy YouTube comments but also invest in increasing video views to create the impression of stability. So, what exactly should we look at in terms of views? Firstly, calculate the average number of views based on the ten latest videos. Then, compare this figure to the views of the most recent videos posted within the past week. If you notice that these new videos have nearly the same number of views as those posted a month or two ago, it’s a clear red flag. Typically, a YouTube channel experiences lower views on new videos, with the number increasing organically each day as the audience engages with the content. If you see a video posted just three days ago already garnering 30k views, matching the total views of older videos, it’s a sign of fraudulent traffic purchased to create the illusion of view stability.

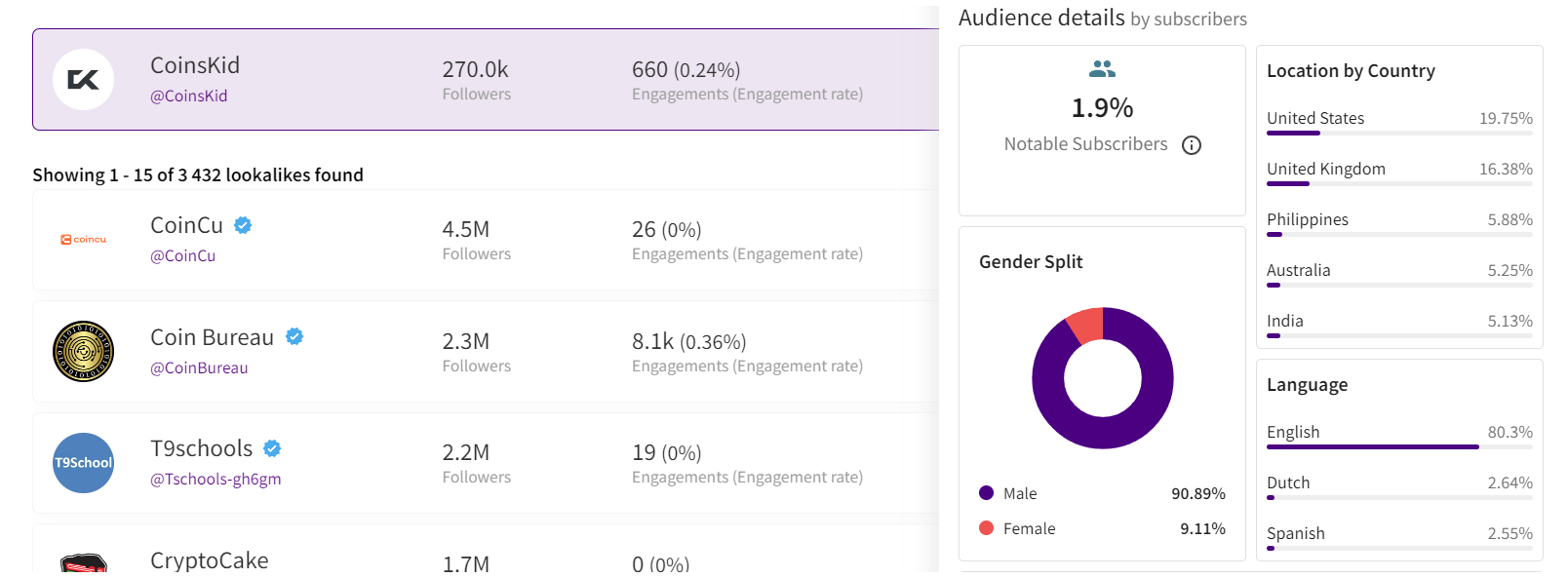

3. Influencer’s channel statistics

The primary statistics of interest are region and demographic split, and sometimes the device types of the viewers.

LEVEL 1

When reviewing the shared statistics, the first step is to request a video screencast instead of a simple screenshot. This is because it takes more time to organically edit a video than a screenshot, making it harder to manipulate the statistics. If the creator refuses, step two (if only screenshots are provided) is to download them and check the file’s properties on your computer. Look for details such as whether it was created with Adobe Photoshop or the color profile, typically Adobe RGB, to determine if the screenshot has been edited.

LEVEL 2

After confirming the authenticity of the stats screenshot, it’s crucial to analyze the data. For instance, if you’re examining a channel conducted in Spanish with all videos filmed in the same language, it would raise concerns to find a significant audience from countries like India or Turkey. This discrepancy, where the audience doesn’t align with regions known for speaking the language, is a red flag.

If we’re considering an English-language crypto channel, it typically suggests an international audience, as English’s global use for quality educational content on niche topics like crypto. However, certain considerations apply. For instance, if an English-speaking channel shows a significant percentage of Polish viewers (15% to 30%) without any mention of the Polish language, it could indicate fake followers and views. However, if the channel’s creator is Polish, occasionally posts videos in Polish alongside English, and receives Polish comments, it’s important not to rush to conclusions.

Example of statistics

Example of statistics

Wrapping up

These are the main factors to consider when selecting an influencer to promote your crypto product. Once you’ve launched the campaign, there are also some markers to show which creators did bring the authentic traffic and which used some tools to create the illusion of an active and engaged audience. While this may seem obvious, it’s still worth mentioning. After the video is posted, allow 5-7 days for it to accumulate a basic number of views, then check performance metrics such as views, clicks, click-through rate (CTR), signups, and conversion rate (CR) from clicks to signups.

If you overlooked some red flags when selecting crypto channels for your launch, you might find the following outcomes: channels with high views numbers and high CTRs, demonstrating the real interest of the audience, yet with remarkably low conversion rates. In the worst-case scenario, you might witness thousands of clicks resulting in zero to just a few signups. While this might suggest technical issues in other industries, in crypto campaigns it indicates that the creator engaged in the campaign not only bought fake views and comments but also link clicks. And this happens more often than you may realize.

Summing up, choosing the right crypto creator to promote your product is indeed a tricky job that requires a lot of resources to be put into the search process.

Author

Nadia Bubennikova, Head of agency at Famesters

Fintech

Central banks and the FinTech sector unite to change global payments space

The BIS, along with seven leading central banks and a cohort of private financial firms, has embarked on an ambitious venture known as Project Agorá.

Named after the Greek word for “marketplace,” this initiative stands at the forefront of exploring the potential of tokenisation to significantly enhance the operational efficiency of the monetary system worldwide.

Central to this pioneering project are the Bank of France (on behalf of the Eurosystem), the Bank of Japan, the Bank of Korea, the Bank of Mexico, the Swiss National Bank, the Bank of England, and the Federal Reserve Bank of New York. These institutions have joined forces under the banner of Project Agorá, in partnership with an extensive assembly of private financial entities convened by the Institute of International Finance (IIF).

At the heart of Project Agorá is the pursuit of integrating tokenised commercial bank deposits with tokenised wholesale central bank money within a unified, public-private programmable financial platform. By harnessing the advanced capabilities of smart contracts and programmability, the project aspires to unlock new transactional possibilities that were previously infeasible or impractical, thereby fostering novel opportunities that could benefit businesses and consumers alike.

The collaborative effort seeks to address and surmount a variety of structural inefficiencies that currently plague cross-border payments. These challenges include disparate legal, regulatory, and technical standards; varying operating hours and time zones; and the heightened complexity associated with conducting financial integrity checks (such as anti-money laundering and customer verification procedures), which are often redundantly executed across multiple stages of a single transaction due to the involvement of several intermediaries.

As a beacon of experimental and exploratory projects, the BIS Innovation Hub is committed to delivering public goods to the global central banking community through initiatives like Project Agorá. In line with this mission, the BIS will soon issue a call for expressions of interest from private financial institutions eager to contribute to this ground-breaking project. The IIF will facilitate the involvement of private sector participants, extending an invitation to regulated financial institutions representing each of the seven aforementioned currencies to partake in this transformative endeavour.

Source: fintech.globa

The post Central banks and the FinTech sector unite to change global payments space appeared first on HIPTHER Alerts.

Fintech

TD Bank inks multi-year strategic partnership with Google Cloud

TD Bank has inked a multi-year deal with Google Cloud as it looks to streamline the development and deployment of new products and services.

The deal will see the Canadian banking group integrate the vendor’s cloud services into a wider portion of its technology solutions portfolio, a move which TD expects will enable it “to respond quickly to changing customer expectations by rolling out new features, updates, or entirely new financial products at an accelerated pace”.

This marks an expansion of the already established relationship between TD Bank and Google Cloud after the group previously adopted the vendor’s Google Kubernetes Engine (GKE) for TD Securities Automated Trading (TDSAT), the Chicago-based subsidiary of its investment banking unit, TD Securities.

TDSAT uses GKE for process automation and quantitative modelling across fixed income markets, resulting in the development of a “data-driven research platform” capable of processing large research workloads in trading.

Dan Bosman, SVP and CIO of TD Securities, claims the infrastructure has so far supported TDSAT with “compute-intensive quantitative analysis” while expanding the subsidiary’s “trading volumes and portfolio size”.

TD’s new partnership with Google Cloud will see the group attempt to replicate the same level of success across its entire portfolio.

Source: fintechfutures.com

The post TD Bank inks multi-year strategic partnership with Google Cloud appeared first on HIPTHER Alerts.

-

Latest News6 days ago

China remains stabilizing force for global economic growth

-

Latest News5 days ago

Kylian Mbappé and Accor Forge Alliance to Empower Younger Generations

-

Latest News4 days ago

Martello Re announces closing of $1.3 billion capital raise consisting of $935 million in equity and a $360 million upsize of the Company’s credit facility

-

Latest News4 days ago

Market Dojo Celebrates Prestigious Inclusion in Ardent Partners 2024 Strategic Sourcing Technology Advisor

-

Latest News5 days ago

BioCatch completes best first half in company history, grows ARR by 43% YoY

-

Latest News5 days ago

COP28 President calls on all stakeholders to bring spirit of solidarity that delivered UAE Consensus to drive implementation and sustainable socio-economic development

-

Latest News2 days ago

Driving Innovation Forward: CFI Welcomes Seven-Time Formula 1™ World Champion Lewis Hamilton as new Global Brand Ambassador

-

Latest News4 days ago

TWSE Becomes the First Exchange to Receive ISO 14068-1 Carbon Neutrality Certificate