Fintech

How finance brands can drive the ROI with content creators

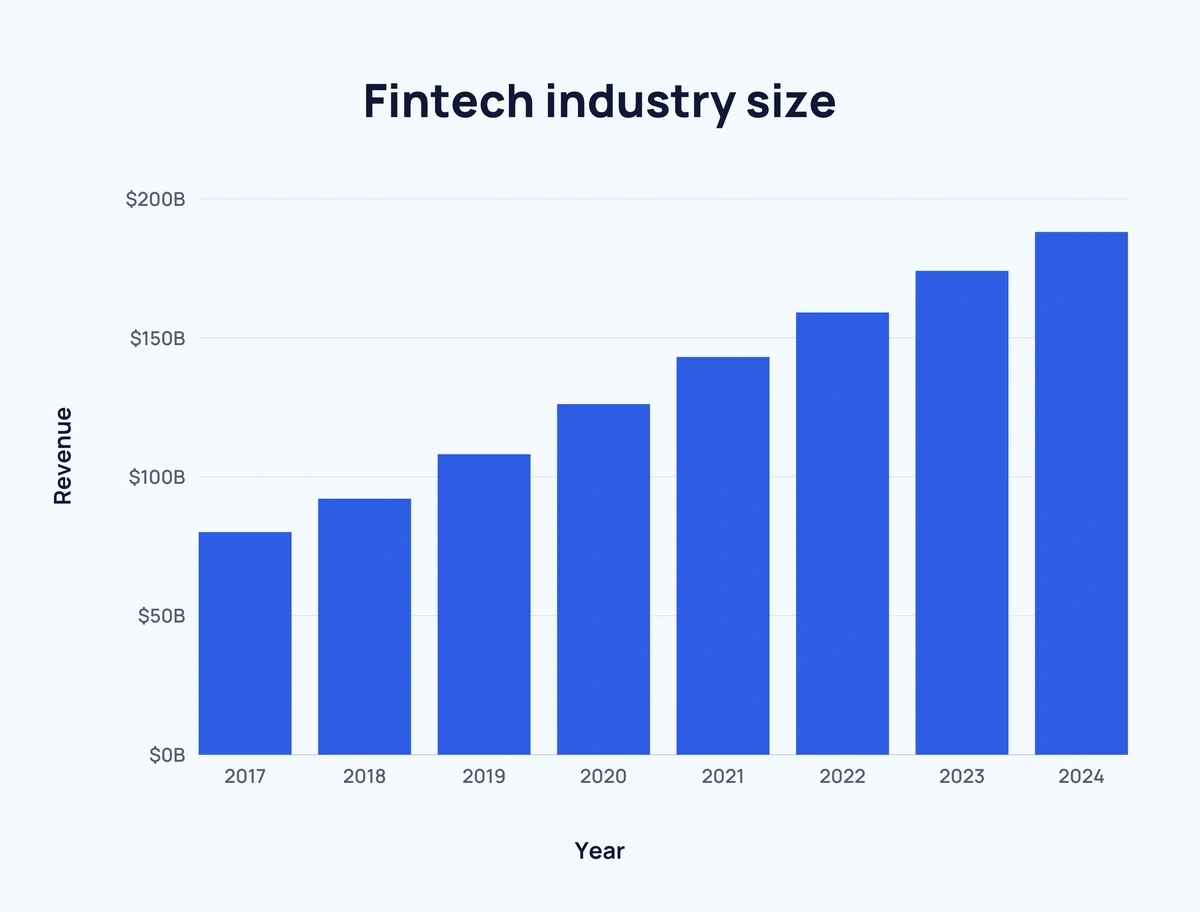

The FinTech industry is highly competitive. In 2017, global FinTech industry revenue was approximately $90.5 billion, and it has grown by over 100% by the end of 2023.

Finance brands are constantly seeking innovative ways to connect with their target audiences, as a result, their marketing channels have also changed. The once-traditional financial sector, often associated with formal advertising, such as billboards, TV commercials, and print advertisements, now commonly uses influencer marketing.

Today, trust in traditional advertising methods has weakened, and consumers now are turning to sources they perceive as authentic and relatable. Influencer marketing, with its ability to build trust and credibility, has become a common strategy for finance brands aiming to enhance their ROI and their engagement with audiences. At the same time, 67% of brands are increasing their influencer marketing budgets that also proves the effectiveness of this channel.

The rise of influencer marketing in finance

Influencers’ recommendations are highly effective, with 92% of consumers trusting influencers more than traditional advertising channels. Social media platforms have further amplified the impact of influencer marketing, allowing influencers to engage directly with their audiences and foster trust within niche finance communities.

Influencer marketing is commonly used by such companies as Binomo, Olymp Trade, Ego, Klarna, Exness, Pay Senger, Capital.com, and many more. If you are interested to see the example of a strategy, here is how Famesters helped FxPro drive 18K+ installations and more than 18M views.

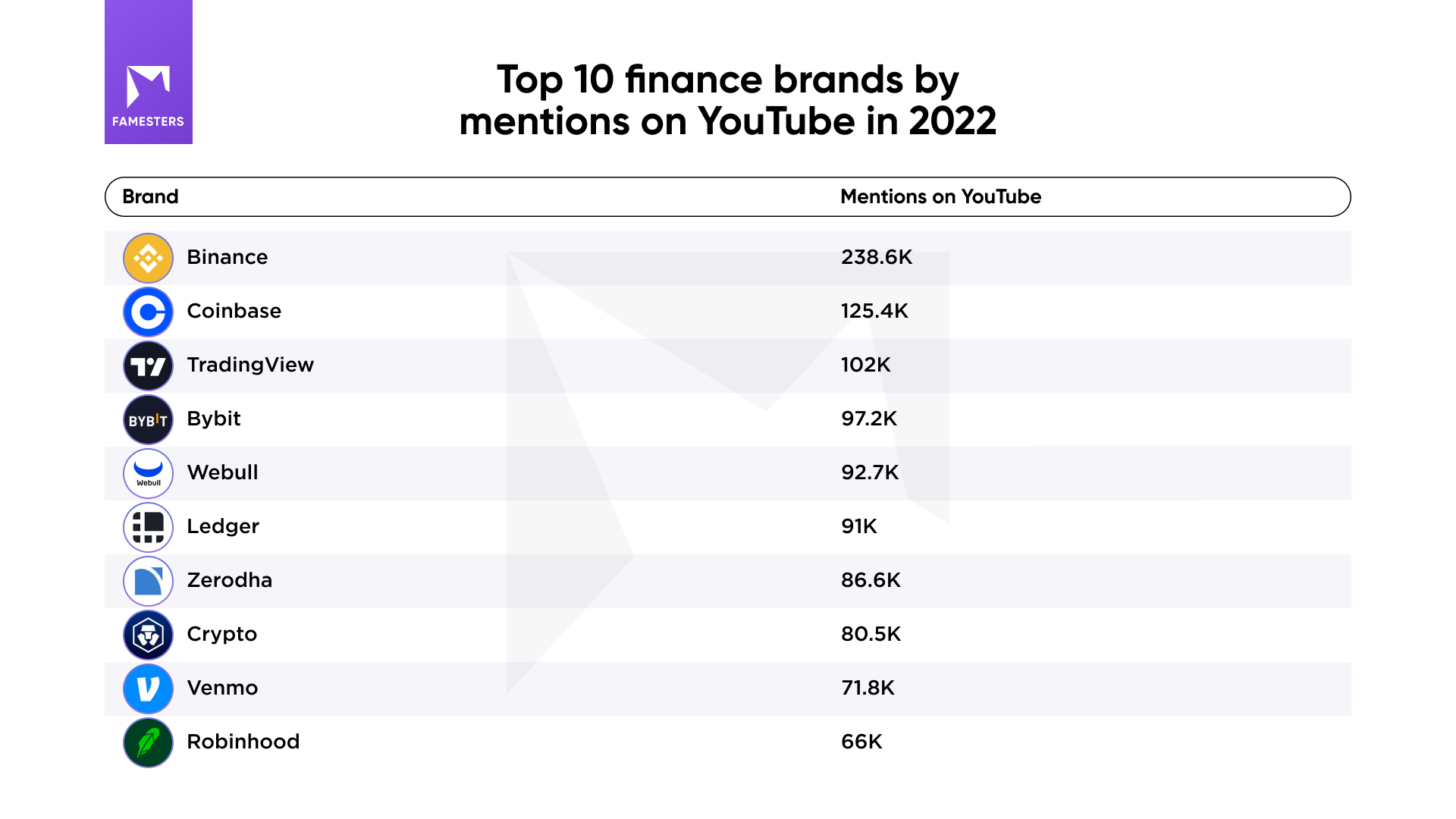

Trading services, especially those strongly connected with cryptocurrencies, get the largest influencer marketing budgets among finance brands. According to Famesters, in 2022 Binance was the top-mentioned finance brand on YouTube.

Choosing the right influencers

Selecting the right influencers is key to the success of influencer marketing campaigns in any business sector, and it is especially crucial for the finance sector due to its specificity. To find the right influencers with authentic audiences, you have to spend time and resources. But if aligned with a creative strategy, such publications can pay off greatly: brands can earn around $5.78 for every dollar spent on influencer marketing. Here are some key considerations to pay attention on:

- Alignment with brand values. This ensures that the influencer’s content will reflect the brand’s mission, maintaining consistency in messaging.

- Target audience compatibility. Effective influencer marketing hinges on reaching the right audience. Finance brands should thoroughly analyze an influencer’s follower demographics to ensure they match the intended target audience. For instance, promoting credit cards to young adults may require influencers with a predominantly youthful and financially active audience.

- Domain expertise. In the world of finance, domain expertise is a significant asset. Influencers who demonstrate a deep understanding of financial matters and can communicate complex topics in a clear and accurate manner are considered to be the best choice to cooperate with.

Not all financial products are best promoted by financial influencers. For instance, if you’re marketing a banking product designed for children, it’s more effective to collaborate with influencers who are able to reach the parents of potential users. Similarly, for B2B financial products like business bank accounts, it makes more sense to partner with influencers who cater to entrepreneurs rather than those focused on personal finance or budgeting advice.

- Engagement and trustworthiness. High engagement rates, authentic interactions, and a track record of trust-building are indicators of an influencer’s effectiveness in conveying messages and recommendations (that are crucial for finance brands). Besides, the FinTech creators market is full of fraud and scam, this is why it is worth taking time and ensuring the quality of potential partners.

Ask for a screencast of the creator’s statistics instead of a screenshot if you have doubts; a trustworthy creator would provide it, and if the statistics are fake, the influencer will likely refuse.

- Content quality. FinTech brands should assess an influencer’s content quality and relevance to ensure it aligns with their campaign goals. Consistency in producing valuable, informative, and engaging content is key.

You can analyze around 10-15 of the latest videos on the channel, review the comments, and ensure that they have not been purchased from a shady website. For example, when you come across comments such as “Yes sir,” “Great video,” “Thanks!”, “Love you man!”, “Quality content,” etc., they should raise red flags, as these are most likely bot-generated comments.

- Past collaborations and reputation. Examine an influencer’s past collaborations and reputation. For instance, if a FinTech company partners with an influencer known for promoting risky investment schemes in the past, or associated with controversial practices, it could harm the brand’s credibility and integrity.

Besides choosing the right creators for your campaign it is also crucial to craft a well-thought brief – a clear communication tool that helps convey your app or platform’s value. Provide influencers with guidelines on your brand message, goals, budget, and content expectations, including tone of voice and key messages. Trust influencers to communicate naturally while ensuring essential ad points are covered.

Influencer fraud risks and how to reduce them

Influencer fraud is actually decreasing year by year as more tools to detect it appear and improve. But still, 64% of companies name influencer fraud an issue that worries them. And yes, there are significant risks that can be divided into two major categories: distorted ROI and brand reputation risks.

Distorted ROI:

- Brands engage with influencers expecting benefits like enhanced brand recognition, sales boosts, or greater audience interaction. However, influencer fraud distorts these projections.

- Investments in influencers who have artificial followers or engagement don’t deliver tangible outcomes, resulting in a reduced ROI.

Brand reputation risks:

- In the finance market where authenticity is highly valued by consumers, the discovery of deceit by an influencer connected to a brand can breed doubt, not only about the influencer but also about the brand itself. This association can damage the brand’s reputation and weaken trust with its audience.

Influencer fraud in the FinTech sector doesn’t just affect individual campaigns; it threatens the integrity of influencer marketing as a whole. In an industry built on trust and precision, deceptive practices have far-reaching consequences, making vigilance and informed decision-making imperative for FinTech brands.

To avoid fraudulent influencers and reduce risks, finance brands should prioritize vetting influencers. To do so, brands can:

- Review content history, engagement rates, and alignment with brand values.

- Look for genuine audience interaction and content that resonates with your brand’s message.

- Engage directly with influencers to grasp their audience’s age, gender, and location.

- Seek personal stories of audience interactions, indicating authentic connections.

Here are some FinTech brands’ self-audit tips:

- Engagement analysis. Check the ratio of followers to engagement; low engagement with high followers is a warning sign.

- Audience location. Be wary of influencers with most followers from regions irrelevant to their supposed base.

- Content evaluation. Genuine influencers mix sponsored and organic content, showing true interest in their niche.

- Feedback checks. Seek testimonials from other brands or agencies.

- Consistency. Authentic influencers show regular posting and engagement patterns.

And last but not least: for brands venturing into influencer marketing, especially in sectors like FinTech where trust and credibility are essential, the importance of formalizing collaborations through contracts cannot be overstated. Contracts serve as a foundational safeguard against influencer fraud, clearly delineating expectations, deliverables, and terms of engagement. This formal agreement helps to ensure that both parties are accountable and that the influencer’s following and engagement metrics are authentic and aligned with the brand’s objectives. Contracts also provide legal recourse in the event of misrepresentation or non-compliance, significantly reducing the risk of financial loss and reputational damage.

A well-structured contract is not just a formal requirement; it is a strategic tool in mitigating the risks associated with influencer fraud, ensuring transparency, and maintaining the integrity of the brand’s marketing efforts.

Conclusion

You can see that the success of influencer marketing in the FinTech sector hinges on a strategic and analytical approach. Its key aspects include:

- Selective influencer engagement. Choosing influencers with a deep understanding of financial products and alignment with brand values is crucial for effective audience engagement.

- ROI and risk management. It’s vital to employ robust analytics for assessing influencer authenticity to mitigate risks to ROI and brand reputation.

- Audience and content analysis. Detailed examination of the influencer’s audience demographics and content relevance is essential for ensuring alignment with the brand’s target market.

- Adaptive strategies. Staying adaptive to the evolving digital marketing trends and consumer behaviors in the fast-paced FinTech industry is key.

Effectively navigating these elements can significantly enhance ROI and market positioning for FinTech brands in an industry that values innovation and trust.

Fintech

Fintech Pulse: Your Daily Industry Brief – April 22, 2025 (Fiserv, Circle, Braviant, ANNA Money & Shaype, Yubi)

In today’s rapidly evolving financial technology landscape, incumbents and challengers alike are pushing the boundaries of what’s possible—from regional expansion and payments network advancements to credit infrastructure innovations and AI‑powered super apps. Here’s your concise yet comprehensive op‑ed–style rundown of the day’s most impactful developments.

1. Fiserv Plants Its Flag in the Heartland

Overview: Milwaukee‑based Fiserv has officially confirmed that it will invest $125 million to renovate two buildings on Aspiria campus in Overland Park, Kansas, establishing a 2,000‑employee regional headquarters by March 2030. The new hub, dubbed “Project Turtle,” will transform 427,000 sq ft of former Sprint space into a strategic fintech nexus.

Source: KSHB 41 Kansas City News

Analysis & Opinion:

-

Strategic Geography: Kansas City’s burgeoning tech talent pool and central U.S. location make Aspiria an ideal crossroads for Fiserv’s expansion, signaling that regional cost structures and quality‐of‐life factors are increasingly drawing fintech giants away from coastal hubs.

-

Talent & Economics: Pledging an average salary of $125,000, Fiserv’s commitment underscores the fierce competition for skilled technologists outside traditional metros. Local incentives—property tax rebates and clawback provisions—reflect how states are sharpening their playbooks to attract large fintech employers.

-

Implications for Fintech Clusters: As Fiserv’s new campus joins other high‑tech projects (e.g., Panasonic EV batteries in De Soto), the Kansas City area is rapidly becoming a Midwest fintech cluster, offering a blueprint for similar “second‑tier” cities vying for innovation dollars.

2. Circle Unveils a Global Payments Network on Stablecoins

Overview: Circle Internet Group announced the Circle Payments Network (CPN), a platform leveraging regulated stablecoins (USDC, EURC) to facilitate 24/7 real‑time settlement of cross‑border payments for banks, neo‑banks, and payment service providers. Governance partners include Santander, Deutsche Bank, Société Générale, and Standard Chartered.

Source: Press Release Hub

Analysis & Opinion:

-

Cross‑Border Friction Points: With traditional remittances still averaging >6% fees and multi‑day settlement times, CPN’s programmable rails promise to undercut correspondent‑bank fees and compliance bottlenecks, particularly in emerging markets.

-

Institutional Trust & Compliance: By imposing strict AML/CFT, licensing, and cybersecurity prerequisites, Circle addresses one of the biggest barriers to stablecoin adoption among regulated institutions—namely, the fear of regulatory backlash.

-

Developer Ecosystem: The modular API architecture invites third‑party integrations, foreshadowing an “app store” of financial workflows. This opens new revenue streams for Circle and positions CPN as a foundational layer for decentralized finance (DeFi) interoperability among legacy institutions.

3. Braviant Charts a New Course for Financial Access

Overview: Braviant Holdings, marking its 10th anniversary in consumer credit innovation, has unveiled a multi‑pronged strategy to deepen partnerships with investors, lenders, vendors, and service providers, aiming to broaden access to alternative credit for the underbanked.

Source: PR Newswire

Analysis & Opinion:

-

Underbanked Market Focus: With the FDIC estimating 51.1 million underbanked U.S. adults and 33% of consumers sporting non‑prime credit scores, Braviant’s data‑driven underwriting and digital borrowing experience could finally bridge gaps left by traditional scoring models.

-

Strategic Alliances: By courting a wider circle of financial service providers, Braviant looks to embed its analytics engine into partner workflows—transitioning from a standalone lender to a B2B2C platform.

-

Sustainable Growth vs. Regulatory Scrutiny: As regulatory bodies intensify oversight of alternative lenders, transparency in Braviant’s innovative analytics will be as crucial as technological prowess in securing long‑term viability.

4. ANNA Money & Shaype Launch Australia’s First AI‑Powered Finance “Super App”

Overview: UK‑based ANNA Money, in partnership with embedded finance provider Shaype, has rolled out the first AI‑driven “business finance super app” tailored for Australian Pty Ltd companies. The platform consolidates banking, tax (IAS/BAS) prep, expense tracking, company formation, and corporate cards into a single interface.

Source: IBS Intelligence, PR Newswire

Analysis & Opinion:

-

End of Fragmented Workflows: SMEs have long cobbled together disparate tools—accounting software, bank portals, expense apps—resulting in data silos. ANNA’s unified approach can slash admin time and elevate financial visibility.

-

AI‑Driven Decisioning: Real‑time transaction categorization and predictive cash‑flow insights give business owners a 24/7 financial co‑pilot, potentially reducing reliance on external advisors for routine tasks.

-

Embedded Finance Leapfrog: By leveraging Shaype’s infrastructure, ANNA bypasses lengthy integrations, showcasing how embedded finance partnerships accelerate time‑to‑market for super apps.

5. Yubi & Cockroach Labs Power Next‑Gen Credit Infrastructure

Overview: India’s leading lending‑tech platform Yubi has integrated CockroachDB to scale tenfold, unify its product suite, and support global expansion—while maintaining cloud neutrality.

Source: PR Newswire

Analysis & Opinion:

-

Scalability & Resilience: CockroachDB’s geo‑partitioning and horizontal scaling ensure Yubi can handle surges in transaction volumes without downtime—a critical factor for mission‑critical credit processes.

-

Compliance & Data Locality: As Yubi enters new jurisdictions, CockroachDB’s data‑locality controls help meet regional data‑sovereignty laws, reducing compliance risks for cross‑border lenders.

-

Strategic Infrastructure Decisions: This partnership signals a broader industry shift toward cloud‑neutral, distributed databases—prioritizing flexibility over vendor lock‑in and aligning with the multi‑cloud strategies of enterprise fintechs.

The Takeaway: A Fintech Mosaic in Motion

Today’s briefs underscore three core themes shaping 2025’s fintech narrative:

-

Geographic Diversification: Fiserv’s move to Kansas and ANNA’s Australian launch illustrate that fintech growth is no longer siloed in legacy tech hubs.

-

Programmable Money & Real‑Time Rails: Circle’s CPN and stablecoin rails are accelerating cross‑border flows, foreshadowing an era where money movement is as frictionless as email.

-

Infrastructure & Data Strategy: From Braviant’s analytics to Yubi’s database overhaul, fintech leaders are doubling down on scalable, compliant, and intelligent back‑end systems to support rapid innovation.

As the industry matures, success will hinge not just on sleek front‑ends but on robust infrastructure, strategic partnerships, and regulatory foresight. Keep watching this space—tomorrow’s Pulse will bring you fresh insights.

The post Fintech Pulse: Your Daily Industry Brief – April 22, 2025 (Fiserv, Circle, Braviant, ANNA Money & Shaype, Yubi) appeared first on News, Events, Advertising Options.

Fintech

Fintech Pulse: Your Daily Industry Brief – April 16, 2025 – Featuring RWA Inc and Wolters Kluwer

In the rapidly evolving world of financial technology, the pace of innovation never ceases to amaze. Every day, new developments, strategic moves, regulatory experiments, and executive reshuffles shape the future of finance. Welcome to Fintech Pulse: Your Daily Industry Brief – April 16, 2025, an op-ed-style briefing designed to cut through the clutter and deliver insightful analysis on today’s most critical fintech news. In this comprehensive report, we delve deeply into the major headlines making waves throughout the fintech ecosystem, from bold investment moves and international market dynamics to strategic executive appointments and breakthrough innovations in regulatory technology.

Drawing on insights from leading financial sources—Yahoo Finance, The Nation Thailand, Globe NewsWire, ThePaypers, and BusinessWire—we analyze what these developments mean for fintech stakeholders, investors, and innovators alike. Prepare for a detailed exploration that not only summarizes the news but also offers opinion-driven commentary to help you understand emerging trends and anticipate future disruptions in the landscape of finance.

I. The Fintech Stock Surge: A Portfolio Transformation

A. Overview of the Market Shift

The fintech segment of the stock market has seen an unprecedented wave of investor enthusiasm as top fintech stocks continue to attract considerable portfolio attention. Industry leaders have been rallying amid an environment of favorable market dynamics and technological breakthroughs, with investors increasingly pinning their hopes on the next wave of disruptive innovations. In today’s ever-competitive market, building a resilient portfolio means not only identifying stable market leaders but also recognizing emerging players willing to challenge established norms.

Yahoo Finance recently highlighted a significant trend where key fintech stocks have managed to enhance their portfolio positions, providing a beacon of opportunity amid uncertainty. The meticulous combination of robust business models and innovative tech strategies has attracted capital from both institutional and retail investors. This portfolio strengthening points to renewed confidence in fintech companies that are pushing the boundaries of digital payments, blockchain technology, and data analytics within financial services.

Source: Yahoo Finance

B. Detailed Analysis and SEO Insights

From an investment perspective, the surge in fintech stocks underscores several critical SEO keywords that every fintech enthusiast and investor should note—“digital payments,” “blockchain innovation,” “financial technology,” and “market disruption.” As investors seek out companies that not only promise growth but also drive technological transformations, integrating content around these keywords becomes essential. This strategy ensures that industry thought leaders and market analysts are well-informed about evolving trends in automated risk management, contactless payments, and next-generation financial solutions.

Investors are now more than ever paying attention to companies that adopt agile investment approaches, adapting to global economic challenges and rapid regulatory changes. These companies are capitalizing on a post-pandemic world that demands resilient and adaptive business models, where capital flow and technological innovation go hand in hand. Reflecting on this shift, it becomes clear that the market’s renewed appetite for fintech is a response to long-term structural changes in global finance—a transformation that digital-first companies are uniquely positioned to lead.

C. Opinion-Driven Commentary

As an industry observer, one cannot help but admire the remarkable growth trajectories of fintech stocks. This momentum isn’t fleeting; it symbolizes a deeper market shift where technology and finance converge to create truly transformational business models. The integration of robust algorithms, AI-driven decision-making, and seamless digital interfaces are not just enhancing user experiences—they are revolutionizing how money is managed, invested, and safeguarded. The evolving strategies witnessed in these portfolio shifts have reinforced the notion that today’s fintech innovations are the foundation for tomorrow’s financial stability and prosperity.

II. Fintech Developments in Southeast Asia: A Glimpse into the Thai Banking Sector

A. Contextualizing the Thai Fintech Landscape

In the heart of Southeast Asia, Thailand is emerging as a pivotal market for fintech innovations. The region’s dynamic economy, blended with an increasing appetite for digital transformation, is creating fertile ground for fintech disruption. A recent development reported by The Nation Thailand paints a picture of a country in the midst of a transformative journey—a journey that bridges traditional banking with contemporary digital solutions.

The article from The Nation highlights how Thailand’s regulatory bodies and financial institutions are converging around strategies that integrate digital banking with traditional financial services. These measures aim to stimulate economic growth, enhance customer accessibility, and secure the region’s position on the global fintech map.

Source: The Nation Thailand

B. In-Depth Analysis and Market Trends

Thailand’s fintech revolution is underpinned by several critical factors: a young, tech-savvy population, increasing internet penetration, and a supportive regulatory environment. These factors come together to form a robust ecosystem where innovative startups and established banks can collaborate and experiment with new technologies. Prominent trends that emerge from this narrative include the advent of mobile banking, digital wallets, and AI-driven customer service solutions. Each of these aspects not only resonates with local markets but also carries the potential for global scalability.

From an SEO perspective, keywords such as “digital banking,” “mobile payments,” “fintech startups,” and “Southeast Asia fintech” are paramount. This content strategically underscores the importance of region-specific trends and highlights local success stories that carry a universal appeal. As regulators and financial institutions lean into innovation, the balance between risk management and customer-centric innovations becomes a fine line, requiring judicious oversight and forward-thinking policies.

C. Reflective Commentary

What’s striking about the Thai fintech scenario is the seamless blend of tradition and innovation—a narrative that defies simple categorization. As Thailand redefines its approach to banking and finance, it serves as a powerful reminder that regulatory foresight and innovation can coalesce to redefine market boundaries. For investors and consumers alike, the evolution witnessed in Thailand’s financial sector isn’t just about technology; it’s about rethinking how accessible, secure, and efficient financial services can be made for everyone. The progressive transformation in this region could well serve as a blueprint for other emerging markets eager to ride the wave of digital transformation.

III. Leadership Reinvented: RWA Inc Appoints Fintech Trailblazer Shaunt Sarkissian

A. The Strategic Executive Appointment

In a groundbreaking move, RWA Inc has appointed the renowned fintech executive and entrepreneur Shaunt Sarkissian to its Board of Directors. This appointment marks a significant turning point in RWA Inc’s strategy, signaling the company’s commitment to leveraging industry expertise and visionary leadership as it navigates the complexities of a competitive financial landscape.

The Globe NewsWire release on this appointment offered a detailed look at Sarkissian’s credentials, underscoring his extensive background in fintech innovation, startup mentorship, and digital transformation initiatives. His track record boasts achievements in driving change across multiple facets of the financial ecosystem—ranging from enhancing operational efficiencies to fostering groundbreaking technological integrations. Sarkissian’s appointment is a testament to RWA Inc’s ambition of staying ahead of emerging trends and establishing itself as a leader in the fintech space.

Source: Globe NewsWire

B. Strategic Implications and SEO Keywords

This executive appointment illuminates critical themes that resonate strongly within the fintech industry: leadership, strategic reinvention, innovation management, and digital transformation. For content strategists and market analysts, incorporating keywords such as “executive leadership,” “fintech innovation,” “digital transformation,” and “board appointment” is indispensable. These elements help in shaping a narrative that is not only informative but also optimized for search engines in a highly competitive digital media landscape.

Beyond the immediate leadership impact, this move symbolizes a broader industry shift where companies increasingly value the role of visionary leaders in navigating complex regulatory landscapes and fostering sustainable growth. Investors will likely view this appointment as an affirmation of RWA Inc’s commitment to excellence, positioning the company well to capitalize on the evolving demands of the financial market.

C. Reflective Op-Ed Perspective

From an op-ed standpoint, the appointment of Shaunt Sarkissian can be interpreted as a harbinger of change. In an era where financial institutions are rapidly reinventing themselves, strategic leadership becomes the linchpin of competitive advantage. Sarkissian’s deep expertise in fintech, paired with his proven ability to spearhead innovation, positions him as a transformative figure capable of guiding RWA Inc through uncharted territory. This move should be viewed not merely as a routine appointment but as a bold statement about the company’s future direction. It signals a proactive embrace of change and an acknowledgment that leadership, innovation, and strategic foresight are interdependent components of success in today’s fast-paced digital economy.

IV. Regulatory Sandbox and Innovation: RBI’s On-Tap Initiative

A. Unpacking the Regulatory Sandbox Evolution

Central banks across the globe are increasingly adopting innovative regulatory frameworks to facilitate fintech growth, and India’s Reserve Bank of India (RBI) is at the forefront of this movement. In a recent article by ThePaypers, the RBI’s support for fintech innovation through its “On-Tap Regulatory Sandbox” was detailed as a significant initiative aimed at balancing the need for innovation with robust risk management practices.

By establishing a controlled environment where fintech start-ups can test their products and services without the immediate burden of full regulatory compliance, the RBI is championing an ecosystem that nurtures experimentation while safeguarding consumer interests. This strategic move has considerable implications for both fintech innovators and regulatory bodies alike.

Source: ThePaypers

B. In-Depth Sector Analysis

The concept of a regulatory sandbox is not new; however, the RBI’s “On-Tap” iteration represents a critical evolution. It allows for real-time experimentation and iterative feedback, facilitating a dynamic interaction between regulators and innovators. This initiative is particularly significant in light of the global digital transformation trends where regulatory agility is essential to keep pace with the innovations that continuously redefine the financial landscape.

Key SEO keywords such as “regulatory sandbox,” “RBI fintech initiative,” “innovation in fintech,” and “regulatory innovation” are especially important for driving organic search traffic. Investors and fintech startups often search for insights on how regulatory changes might affect their strategic planning, operational risk management, and market entry strategies. By understanding the RBI’s progressive move, stakeholders can better align their initiatives with regulatory expectations, thereby mitigating risks while fostering innovation.

C. Opinion-Driven Analysis

The RBI’s new initiative is a commendable and necessary step in the ongoing debate about regulation versus innovation. In an era characterized by digital rapidity, regulators cannot afford to be passive. The “On-Tap Regulatory Sandbox” embodies a forward-thinking approach that underscores the necessity of a dialogue between innovators and regulators. This initiative not only promotes competitive advantage for fintech startups but also ensures that consumer protection remains paramount—a delicate balance that is crucial for sustainable growth in the fintech space. Ultimately, the RBI’s efforts reflect a broader global trend: the recognition that regulatory frameworks must evolve in tandem with technological advancements.

V. Celebrating Innovation: Wolters Kluwer Wins FinTech Breakthrough Award

A. The Award and Its Significance

In another momentous development within the fintech landscape, Wolters Kluwer has been recognized with the prestigious FinTech Breakthrough Award for its outstanding achievements in regulatory change management innovation. Announced via BusinessWire, this accolade underscores Wolters Kluwer’s commitment to harnessing technology to streamline compliance processes, mitigate regulatory risks, and foster transparency in financial operations.

The award is a celebration of innovation and strategic excellence, highlighting how technology is reshaping regulatory frameworks in ways that enhance operational efficiency, reduce administrative burdens, and ultimately benefit the entire financial ecosystem.

Source: BusinessWire

B. Detailed Breakdown of the Innovation Process

Wolters Kluwer’s pioneering approach in regulatory change management involves leveraging advanced data analytics, AI-enabled tools, and automation to provide real-time insights and reduce compliance risks. In an increasingly complex regulatory environment, the ability to adapt swiftly to changing rules and standards is a competitive advantage. This achievement is emblematic of the company’s long-standing commitment to innovation, positioning it as a trusted partner for organizations navigating the treacherous waters of regulatory compliance.

For SEO practitioners, integrating keywords such as “regulatory change management,” “fintech innovation,” “compliance technology,” and “award-winning fintech” can significantly enhance content visibility. These keywords not only encapsulate the core achievements of Wolters Kluwer but also serve as critical search terms for industry professionals seeking insight into cutting-edge solutions that address regulatory challenges.

C. Reflective Commentary on Industry Implications

From an op-ed perspective, the recognition of Wolters Kluwer is more than just an accolade—it represents a transformative shift in how the industry approaches regulatory challenges. In today’s world, where financial institutions are burdened with ever-evolving regulatory requirements, innovation in compliance technology is not just beneficial—it is absolutely essential. Wolters Kluwer’s triumph is a clarion call for all market participants: adaptability and forward-thinking innovation are the keys to thriving in a dynamic financial landscape. In an industry where the pace of change is relentless, awards such as these remind us that excellence is achieved not by standing still, but by continuously evolving.

VI. Integrating Diverse Perspectives: The Broader Implications of Today’s News

A. Interconnected Trends in Fintech Innovation

The series of developments discussed in this briefing—from portfolio enhancements and regional digital transformations to strategic leadership moves, regulatory innovations, and award-winning breakthroughs—are interconnected threads in the intricate tapestry of fintech. Together, these narratives illuminate several prevailing themes:

-

Resilience and Adaptation: Fintech companies are not only surviving but thriving amid economic uncertainties by pivoting their strategies and investing in transformative technologies.

-

Regulatory Evolution: Regulatory bodies worldwide are embracing innovation with initiatives like regulatory sandboxes, thereby fostering an environment where both consumer protection and business growth can coexist.

-

Strategic Leadership: Executive appointments and visionary leadership are playing an increasingly pivotal role in steering companies through digital disruptions and regulatory challenges.

-

Technological Empowerment: Breakthrough innovations in data analytics, artificial intelligence, and automation are redefining operational efficiencies in risk management and regulatory compliance.

-

Global Collaboration: From Southeast Asia to Western markets, cross-border knowledge sharing and strategic investments are accelerating innovation and consolidating fintech’s position on the global stage.

B. SEO Implications for Fintech Content Creators

In the digital age, the art of content creation is inseparable from the science of SEO. As we dissect these trends, it is imperative for content creators, bloggers, and industry analysts to integrate robust SEO practices in their digital strategies. Keywords such as “fintech innovation,” “digital transformation,” “financial technology news,” and “regulatory technology” are essential to capture the attention of both search engines and target audiences. By aligning content with trending industry terms and providing comprehensive, research-backed insights, creators can ensure that their narratives resonate widely and drive traffic to their platforms.

Moreover, with the dynamic interplay between fintech and regulatory landscapes, updating content regularly is critical. This involves continuous monitoring of industry developments, refreshing keywords as trends evolve, and offering fresh perspectives on emerging topics. The integration of thoughtful commentary, in-depth analysis, and real-world examples further solidifies a brand’s reputation as an industry thought leader.

C. Reflective Insights: A Balanced Market Perspective

From an industry observer’s standpoint, today’s fintech news is a mirror reflecting both the immense potential and the palpable challenges of our time. The convergence of rapid technological advancements, strategic leadership, and innovative regulatory approaches creates a landscape where opportunities abound—provided that market participants are agile, informed, and forward-thinking. These developments remind us that the future of finance is not written in isolation; it is a symphony of diverse voices working in concert to redefine what is possible in the digital age.

VII. Detailed Case Studies and Future Projections

A. Case Study 1: Portfolio Diversification and Investor Confidence

Let us consider a detailed case study on the impact of portfolio diversification among top fintech stocks. As highlighted earlier, the shift noted by Yahoo Finance reflects a deliberate strategy by investors to mitigate risks by broadening their exposure to multiple facets of fintech innovation. The companies involved are not only pursuing aggressive growth strategies but also investing in technologies that enhance operational efficiency and customer experiences.

In this context, portfolio diversification emerges as a key driver of market resilience. Investors are increasingly understanding that the success of fintech is not dictated by a single company’s performance, but rather by the synergistic evolution of an entire ecosystem. This comprehensive strategy ensures that even if one segment encounters turbulence, others can counterbalance the adverse effects, leading to more stable, long-term growth.

B. Case Study 2: Regulatory Sandboxes in Action

Drawing insights from the RBI’s regulatory sandbox initiative offers another profound case study. By providing a controlled environment for fintech startups to test their products, regulators are fostering a culture of experimentation without sacrificing the safeguards that protect end users. This model of governance could be a game-changer across multiple markets, setting a benchmark for how innovation can be encouraged without compromising on oversight.

As fintech startups navigate the regulatory maze, the sandbox model allows for iterative improvements—a lesson in proactive risk management and adaptive governance. It also provides regulators with invaluable data that can inform broader policy changes, ensuring that the evolution of technology is matched by equally progressive regulatory frameworks.

C. Future Projections and Strategic Recommendations

Looking forward, several future projections are evident from today’s news:

-

Acceleration of Digital Banking: With Southeast Asia at the forefront of digital banking innovations, we expect accelerated adoption of mobile payments, AI-driven customer interfaces, and blockchain-powered security solutions.

-

Enhanced Regulatory Frameworks: Global regulators will likely expand on the sandbox model, fostering environments where experimentation and compliance go hand-in-hand.

-

Increased Strategic Leadership Appointments: As companies face more complex market conditions, the trend of appointing visionary leaders like Shaunt Sarkissian will grow, ensuring that strategic decisions remain ahead of market disruptions.

-

Broadening of Innovation Awards: Celebrations like the Wolters Kluwer FinTech Breakthrough Award will pave the way for similar recognitions, encouraging companies to invest heavily in technologies that streamline regulatory compliance and drive operational excellence.

For investors, fintech innovators, and policymakers, the road ahead is full of opportunities and challenges. It is incumbent on all players in the ecosystem to remain agile and collaborative, continuously refining their strategies to leverage both technological advances and progressive regulatory practices.

VIII. Opinion-Driven Round-Up: What This Means for the Future of Fintech

A. A Future Shaped by Strategic Innovation

In assessing the various threads that weave together today’s fintech narrative, one central theme stands out: the undeniable power of strategic innovation. Whether it is through bolstering stock portfolios, nurturing regional fintech ecosystems, making bold leadership appointments, or pioneering regulatory frameworks, the collective thrust is unmistakably forward-looking. Fintech is not merely a sector defined by transactions and technologies—it is a living, breathing organism that adapts, evolves, and inspires.

Today’s developments serve as markers of where we are and pointers to where we might be headed. The blend of art and science in finance—where quantitative analysis meets qualitative judgment—fuels not just investor confidence but also the broader societal adoption of digital-first financial models. The future of fintech, therefore, will be driven by a balanced symbiosis between technological innovation, strategic human capital, and enlightened regulatory oversight.

B. The Role of Opinion-Driven Journalism in Shaping Market Discourse

In an era saturated with data and rapid-fire news cycles, opinion-driven journalism plays a vital role in distilling complex information into actionable insights. By providing informed commentary alongside factual analysis, op-eds help bridge the gap between raw market data and the broader strategic context that investors and industry participants need to navigate effectively. This form of journalism not only informs but also educates, urging readers to question assumptions and explore the deeper implications of every headline.

Opinion pieces like this are essential tools for fostering a well-informed community. They prompt critical thinking, encourage a proactive approach to market trends, and inspire confidence in a future that, while uncertain, is brimming with potential.

C. Final Reflections and Call to Action

As we reach the conclusion of today’s comprehensive briefing, it is worth reflecting on the transformative journey that the fintech industry is undertaking. The stories discussed herein are more than fleeting news items—they represent fundamental shifts that will shape the financial landscape for years to come. This briefing is a call to action: for investors to diversify wisely, for innovators to push the boundaries of technology, and for regulators to craft policies that enhance both safety and competitiveness.

It is clear that the future of fintech is a tapestry of interwoven narratives—each contributing to an era defined by innovation, collaboration, and dynamic growth. As the fintech landscape continues to evolve, stakeholders across the board must embrace change, invest in smart strategies, and remain committed to a shared vision of financial empowerment.

IX. In-Depth Segment Analysis: Key Takeaways and Strategic Insights

A. Investment Strategies in a Dynamic Market

With fintech stocks demonstrating a clear upward trajectory, the emerging investment strategies are increasingly focused on long-term value creation. Investors are not simply chasing short-term gains; they are looking to build diversified portfolios that can weather the inevitable volatility of emerging technologies and regulatory shifts. This approach is rooted in the understanding that successful fintech investments require patience, insight, and a willingness to adapt to the fluid market dynamics—a philosophy that resonates throughout every aspect of today’s financial discourse.

B. Regulatory Initiatives: Balancing Innovation with Oversight

At a time when regulatory changes can either stifle innovation or act as a catalyst for growth, the measured approach of bodies such as the RBI is a testament to what is possible when regulators and innovators work in tandem. The “On-Tap Regulatory Sandbox” and similar initiatives provide a blueprint for how sectors can thrive under adaptive governance, ensuring that rapid innovation does not come at the expense of consumer protection or systemic stability.

C. Leadership and Executive Vision: Steering the Ship Amid Stormy Seas

The fintech world, much like any emerging industry, is driven by visionary leadership. The strategic appointment of industry luminaries, such as Shaunt Sarkissian at RWA Inc, underscores the importance of strong, innovative leadership that understands both market dynamics and technological trends. Visionary leaders are the navigators in tumultuous times, providing the strategic direction needed to harness opportunities and mitigate risks effectively.

D. Celebrating Excellence in Innovation

Awards and recognitions, like the FinTech Breakthrough Award conferred upon Wolters Kluwer, are more than symbols of achievement—they are benchmarks that set high standards for innovation across the industry. Such accolades encourage companies to strive for excellence and continuously improve on their technological capabilities, ensuring that the fintech sector remains dynamic and future-ready.

X. Concluding Thoughts and The Road Ahead

A. A Synopsis of Today’s Highlights

As we wrap up this detailed op-ed, it is essential to summarize the key highlights:

-

Stock Market Resilience: Top fintech stocks are experiencing robust portfolio enhancements, reflecting strong investor confidence amid rapid technological changes.

-

Regional Innovation: Thailand’s fintech landscape is undergoing significant transformation, marking the integration of traditional banking with cutting-edge digital solutions.

-

Leadership Shifts: RWA Inc’s appointment of Shaunt Sarkissian is a strategic move with far-reaching implications for future growth and market positioning.

-

Regulatory Advancements: The RBI’s innovative sandbox initiative is setting a new benchmark for balancing innovation with regulatory oversight, fostering a safe yet progressive market environment.

-

Industry Recognition: Wolters Kluwer’s FinTech Breakthrough Award highlights how technological advancements in regulatory change management can drive industry-wide transformations.

B. Embracing the Future of Fintech

Every development discussed today is a building block in the grand narrative of fintech’s evolution. The fusion of advanced technology, visionary leadership, and adaptive regulation is not only rewriting the rules of finance but also democratizing access to financial services for millions around the globe. As we look to the future, the imperative for investors, regulators, and innovators is clear: embrace change, seek out collaboration, and remain vigilant in the pursuit of excellence.

C. A Call for Continued Engagement

For every stakeholder in the financial ecosystem, staying informed and responsive to these shifts is paramount. Whether you are an investor refining your portfolio, an entrepreneur driving the next wave of fintech innovation, or a policymaker shaping regulatory futures, the insights shared in this briefing provide a roadmap to harnessing the vast potential that fintech offers. The journey ahead is complex and challenging, but with strategic foresight and relentless innovation, the financial landscape is poised to transform in unimaginable ways.

D. Final Remarks

In conclusion, today’s comprehensive review of fintech news is more than a snapshot of industry happenings—it is a profound commentary on the forces redefining the nature of finance. The progress made in consolidating portfolios, redefining regional banking paradigms, strategically appointing game-changing executives, implementing pioneering regulatory measures, and celebrating technological breakthroughs together chart a promising course for the future of financial innovation. As we move forward, let this op-ed serve as both a chronicle of today’s successes and a beacon for tomorrow’s possibilities.

XI. Supplementary Sections: Deep Dives and Strategic Implications

A. Deep Dive into Fintech Investment Strategies

Investors are increasingly turning their attention to fintech as an asset class that not only promises high returns but also drives systemic change. Emerging trends in artificial intelligence, big data analytics, and blockchain technology are catalyzing the emergence of new investment paradigms. When evaluating your fintech portfolio, consider diversifying across segments that highlight these transformative technologies. By strategically aligning with companies that are at the forefront of digital innovation, investors can safeguard against market fluctuations while tapping into exponential growth potentials.

B. Regulatory Innovation as a Catalyst for Growth

The evolution of regulatory frameworks, exemplified by initiatives like the RBI’s “On-Tap Regulatory Sandbox,” represents a paradigm shift in how financial oversight is conducted. Forward-thinking regulators are embracing new models that allow for controlled experimentation, which in turn accelerates innovation and encourages industry players to develop more resilient business models. The insights gained from these sandbox environments will undoubtedly shape future regulatory policies, making this a critical area for continued observation and analysis.

C. The Critical Role of Leadership in Navigating Digital Disruption

Leadership within the fintech realm is more than an administrative function—it is the strategic backbone of the industry’s transformation. The appointment of visionary figures like Shaunt Sarkissian signals a deeper shift toward a culture of innovation-driven governance. Effective leaders are expected to bridge the gap between technological potential and market realities, guiding their organizations through rapid changes with a balanced perspective that considers both opportunity and risk.

D. Industry Awards and Their Broader Impact

Recognition through awards such as the FinTech Breakthrough Award provides both validation and motivation for continuous improvement. Companies that earn such accolades are not only acknowledged for their current success but are also encouraged to maintain a forward-thinking approach to innovation and customer service. These awards set industry standards and offer a glimpse into where the future of fintech might be headed, underscoring the value of continuous innovation and strategic risk management.

XII. Final Reflections: Insights for the Modern Fintech Enthusiast

A. Synthesis of Core Themes

Today’s landscape is defined by the intersection of strategic investment, regulatory agility, visionary leadership, and technological prowess. These elements collectively highlight an industry in full metamorphosis—a sector that is rapidly abandoning its legacy constraints in favor of a bold, innovative future. The evolution of fintech is not just about money; it is about redefining human relationships with finance, fostering inclusion, and creating systems that are as secure as they are efficient.

B. A Vision for Tomorrow

The trends and news of today are harbingers of tomorrow’s financial ecosystem. A future where financial transactions are seamless, regulatory frameworks are adaptive, and leadership is visionary is rapidly materializing. The symbiotic relationship between technology and finance will continue to open up new avenues, challenge conventional wisdom, and drive the next chapter of global economic growth. In this context, every stakeholder must be proactive—investors must seek diversified opportunities, innovators must push beyond the known limits of technology, and regulators must evolve in tandem with industry progress.

C. A Strategic Imperative for Engagement

For enthusiasts, professionals, and policymakers alike, the future is intertwined with a need for continuous engagement. Whether through strategic investment, pioneering leadership, or dynamic regulatory adaptation, the collective mission is to harness the transformative power of fintech. The insights presented in this op-ed are not merely a recounting of events; they are a strategic guide designed to equip readers with the perspective required to navigate an evolving landscape.

D. Looking Ahead: The Final Word

As our detailed briefing draws to a close, it is clear that the fintech industry is on an irreversibly upward trajectory. The progress and innovations we see today are only the beginning of a journey that promises to reshape the global financial ecosystem. We invite our readers to stay engaged, remain inquisitive, and continue to explore the dynamic world of fintech. The future, after all, is defined by the bold steps taken today.

XIII. Comprehensive Recap and Strategic Action Points

A. Summary of Key News Items

-

Fintech Stock Portfolio Enhancements:

Leading fintech stocks have bolstered their market positions, presenting robust opportunities for diversified portfolios.

Source: Yahoo Finance -

Innovation in Thailand’s Fintech Sector:

Thailand’s dynamic integration of digital banking and traditional financial services underscores a regional trend that is setting new benchmarks for innovation.

Source: The Nation Thailand -

Strategic Leadership Appointment at RWA Inc:

The appointment of Shaunt Sarkissian marks a transformative shift towards innovation-driven governance in the fintech landscape.

Source: Globe NewsWire -

Regulatory Sandbox Initiative by RBI:

The RBI’s “On-Tap Regulatory Sandbox” paves the way for controlled fintech innovation while ensuring consumer protection and regulatory compliance.

Source: ThePaypers -

Wolters Kluwer’s Award-Winning Innovation:

Recognition of Wolters Kluwer’s breakthrough in regulatory change management highlights the critical role of technological innovation in risk management and compliance.

Source: BusinessWire

B. Strategic Recommendations for Stakeholders

-

For Investors:

Embrace portfolio diversification by integrating exposure to multiple fintech verticals, focusing on companies with solid fundamentals and innovative capabilities. -

For Fintech Companies:

Prioritize adaptive strategies that enhance customer experience and operational efficiency. Leverage emerging technologies such as AI and blockchain to remain competitive. -

For Regulators:

Continue fostering a climate that balances innovation with consumer protection. Explore and refine sandbox initiatives to support the rapidly evolving fintech ecosystem. -

For Industry Analysts and Content Creators:

Integrate SEO best practices by using relevant keywords, providing nuanced commentary, and ensuring timely updates on emerging trends.

C. Final Strategic Imperatives

The synthesis of these diverse yet connected narratives reinforces an essential truth: the future of finance hinges on our ability to adapt and innovate. By learning from today’s developments, stakeholders across the fintech spectrum can better position themselves to capture the opportunities that lie ahead.

XIV. Final Words: Navigating the Future of Fintech with Confidence

As we conclude this extensive industry brief, we are reminded that every news item, every strategic appointment, and every regulatory initiative is a stepping stone towards a more integrated, innovative, and inclusive financial future. Whether you are an investor, innovator, policymaker, or simply an enthusiast of financial technology, the insights and detailed analyses provided today are intended to inspire action and strategic thinking.

The transformative trends shaping fintech today will resonate for decades to come. By embracing a spirit of resilience, strategic foresight, and continuous engagement, we can collectively drive the evolution of finance into a domain that is as empowering as it is efficient. Thank you for joining us on this deep dive into the world of fintech, and here’s to a future defined by bold ideas and groundbreaking success.

The post Fintech Pulse: Your Daily Industry Brief – April 16, 2025 – Featuring RWA Inc and Wolters Kluwer appeared first on News, Events, Advertising Options.

Fintech

Fintech Pulse: Your Daily Industry Brief – April 15, 2025 – Featuring Meliuz, Marshmallow, Payfinia, Revolut

Discover the top fintech stories for April 15, 2025, including Méliuz’s Bitcoin strategy, Marshmallow’s new funding round, API innovation trends, Payfinia’s executive expansion, and a Revolut alumni launching a new venture. Get detailed insights, expert commentary, and opinion-driven analysis in today’s edition of Fintech Pulse: Your Daily Industry Brief.

Introduction: A Day of Bold Moves and Bigger Bets

Welcome to your April 15, 2025 edition of Fintech Pulse: Your Daily Industry Brief — your go-to source for industry-shaking developments, bold strategic pivots, and the quietly disruptive undercurrents shaping the future of financial services.

Today’s news round-up dives deep into a Brazilian fintech doubling down on Bitcoin, a UK-based insurtech startup raising fresh funds amid tough market conditions, and the accelerating trend of API-centric fintech architecture. We also look at Payfinia’s heavy-hitting executive hires and a stealthy talent migration from Revolut that hints at another fintech powerhouse in the making.

From Latin America’s crypto experimentations to Europe’s competitive insurtech landscape, and from digital banking’s tech arms race to the new elite shaping fintech’s next wave — today’s headlines are as much about evolution as they are about revolution.

Méliuz Goes All-In on Bitcoin: A Calculated Risk or Crypto Recklessness?

Source: Reuters

Brazil-based fintech Méliuz is making headlines with its newly proposed strategy to expand its Bitcoin reserves. This isn’t a fluke or a passing phase — this is a calculated move that plants Méliuz squarely in the camp of crypto-aligned fintechs seeking to build value beyond fiat.

Méliuz’s board has greenlit a proposal to integrate Bitcoin deeper into its treasury, turning what was once a fringe experiment into a core part of its financial strategy. The plan will go before shareholders on April 30, where it’s likely to pass unless something drastic shifts investor sentiment.

“Holding Bitcoin is no longer about speculation,” argues Méliuz CEO Israel Salmen. “It’s a hedge against systemic volatility and an enabler of decentralized value.”

— Source: Reuters

Let’s be clear: this isn’t just about Bitcoin. This is about trust, transparency, and long-term value preservation in an inflationary, volatile global economy. Méliuz’s move mirrors strategies seen in larger companies like MicroStrategy and even Tesla during their crypto flirtations. However, Méliuz’s size and geography make this bolder — and riskier.

Brazil’s economic climate, marked by inflationary pressures and a tech-savvy population, makes it a fertile ground for crypto experimentation. But with crypto regulation in Latin America still a mixed bag, Méliuz is walking a high wire. One misstep, and the fallout could be swift. On the flip side, if crypto prices soar again, Méliuz could see returns that dwarf traditional asset classes.

Commentary:

This strategy signals a maturing fintech ecosystem in Brazil, where companies aren’t just playing catch-up but are instead crafting frontier strategies. While the jury’s out on whether Bitcoin is truly a “digital gold” or just volatile vaporware, Méliuz is betting on the former — and we’ll be watching closely to see if that bet pays off or backfires.

Marshmallow Raises £15 Million: The Resilient Rise of Insurtech

Source: Sifted

In a financial climate that’s tested even the hardiest of startups, UK-based insurtech Marshmallow has pulled off something rare — it’s raised £15 million to support its expansion strategy.

Founded by identical twins Alexander and Oliver Kent-Braham, Marshmallow has made a name for itself by offering car insurance to underserved communities, particularly immigrants, using data and AI to assess risk more fairly.

Now, with fresh capital on hand, the startup plans to continue its international expansion and broaden its product portfolio. This comes at a time when many fintechs are trimming fat, scaling back operations, and focusing on survival rather than growth.

“We’re building a different kind of insurance company — one that doesn’t penalize people for who they are,” said co-founder Alexander Kent-Braham.

— Source: Sifted

What makes this raise notable? It’s a Series B extension — not a new round — and Marshmallow is doing it without massive layoffs, without pivoting to profitability narratives, and without the usual desperation that has gripped post-2022 fintech fundraising.

Commentary:

Marshmallow’s win here underscores the power of mission-driven fintechs. Insurtech has been plagued with overpromising and underdelivering, but Marshmallow has stayed focused on user-centric outcomes and scalable technology. In a space bloated with VC cash and churn, Marshmallow is emerging as one of the few that could actually deliver sustainable returns.

The API Revolution: Fintechs Shift to Modular, Scalable Tech Stacks

Source: Yahoo Finance

APIs are not new. But in fintech, they are becoming the backbone of modern finance — not just for innovation, but for survival.

According to new reports, fintech companies are doubling down on API strategies to create scalable digital platforms, drive partnerships, and enable faster product rollouts. The trend is not just limited to startups; even mid-sized and larger institutions are embracing API-first infrastructure.

“Today’s fintechs are building Lego-block platforms — where everything is composable, adaptable, and modular,” said financial analyst Priya Menon.

— Source: Yahoo Finance

This modularity allows financial platforms to integrate with third-party services, launch new products faster, and create more seamless user experiences. Think of it as plug-and-play finance — the future of banking and payments.

Examples include:

-

Neobanks using third-party APIs for KYC/AML onboarding.

-

Lenders plugging into open banking APIs for credit assessments.

-

Wealthtech platforms integrating with robo-advisory engines on demand.

Commentary:

We are witnessing the Amazon Web Services moment for fintech. Just as AWS turned server infrastructure into a utility, APIs are doing the same for financial services. The winners of the next decade won’t be the ones with the most capital but the ones with the most composable, collaborative architecture.

Payfinia’s Power Play: Assembling a Dream Team of Fintech Heavyweights

Source: BusinessWire

In another move signaling growth ambitions, Payfinia, a rising player in the digital payments space, has announced a series of executive-level hires from across the fintech and traditional financial services industries.

New appointees include leaders from Stripe, Visa, and PayPal — a who’s who of payment royalty. This strategic hiring blitz is meant to turbocharge Payfinia’s expansion into North America and Asia-Pacific, with a focus on enterprise-grade payment infrastructure and B2B solutions.

“We’re not just building a company — we’re building an institution,” said Payfinia CEO Natalie Wexler.

— Source: BusinessWire

The new executives will be tasked with expanding partnerships, improving core payment technologies, and unlocking cross-border transaction capabilities. With global B2B payments projected to top $200 trillion by 2028, Payfinia is playing for keeps.

Commentary:

Talent is strategy. In the high-stakes world of fintech, executive leadership often makes or breaks a growth trajectory. Payfinia’s aggressive poaching of top-tier talent from incumbents shows it’s not content to nibble around the edges — it wants to be a category-defining company.

A Revolut Graduate Is Building a New Fintech Army

Source: eFinancialCareers

Nik Storonsky, Revolut’s enigmatic CEO, has a track record of cultivating aggressive, data-driven fintech leaders. Now, one of his star alumni is making moves, reportedly poaching key Revolut staffers to form a new stealth fintech.

While details are sparse, sources close to the matter suggest the new venture will focus on financial automation for SMEs, a long-underserved segment in digital banking. Ex-Revolut staff are being wooed with equity-heavy compensation packages and promises of building a “more humane” fintech.

“We learned how to scale ruthlessly at Revolut — now we want to build something with soul,” said a source familiar with the new venture.

— Source: eFinancialCareers

This kind of exodus isn’t new. PayPal begat the PayPal Mafia. Klarna has its alumni. Now, Revolut’s elite are planting the seeds of what could be the next breakout fintech startup.

Commentary:

Watch this space. These early movements have the fingerprints of something big. Revolut’s culture is intense and often controversial, but it produces builders. If this new venture can blend Revolut’s speed with a more balanced ethos, it could be one of 2025’s biggest stories.

Conclusion: From Crypto Treasuries to API Architectures — Fintech’s Future Is Now

Today’s fintech headlines make one thing abundantly clear: the industry is evolving faster than ever, driven by bold decisions, daring leaders, and next-gen tech stacks.

Méliuz’s Bitcoin move reflects a new wave of treasury management. Marshmallow’s funding round speaks to the endurance of purpose-driven fintechs. API modularity is shaping how fintechs build, not just what they build. Payfinia is making a power play through human capital, and Revolut’s alumni are hinting at the birth of another unicorn.

This isn’t just the daily news — it’s a snapshot of a sector in motion, flexing its muscles and preparing for its next metamorphosis.

Stay tuned. The future of finance is being written in real time — and you’re reading the first draft.

The post Fintech Pulse: Your Daily Industry Brief – April 15, 2025 – Featuring Meliuz, Marshmallow, Payfinia, Revolut appeared first on News, Events, Advertising Options.

-

Fintech PR4 days ago

Fintech PR4 days agoBybit’s CEO Meets with Vietnam’s Minister of Finance to Support Regulatory Sandbox and Strengthen Crypto Compliance

-

Fintech PR6 days ago

Fintech PR6 days agoDigital Oilfield Market is expected to generate a revenue of USD 38.09 Billion by 2031, Globally, at 5.31% CAGR: Verified Market Research®

-

Fintech PR5 days ago

Fintech PR5 days agoYarbo Secures $27M+ Series B Funding to Accelerate Global Growth, Innovation, and Ecosystem Expansion

-

Fintech PR5 days ago

Fintech PR5 days agoeCig Click Questions Impact of £10 Million Trading Standards Crackdown on Illicit Tobacco and Vaping Trade

-

Fintech PR6 days ago

Fintech PR6 days agoCognoa Advocates for Expanded Insurance Coverage of Canvas Dx as CDC Reports 1 in 31 Children Now Identified with Autism

-

Fintech7 days ago

Fintech7 days agoFintech Pulse: Your Daily Industry Brief – April 16, 2025 – Featuring RWA Inc and Wolters Kluwer

-

Fintech PR4 days ago

Fintech PR4 days ago“Shanghai Summer”: A Living Case of a Next-Generation Consumer Hub

-

Fintech PR6 days ago

Fintech PR6 days agoCard Payments Market to Reach $38,325.4 billion by 2027 in the short run and $56,379.3 billion by 2033 Globally, at 6.9% CAGR: Allied Market Research