Latest News

Sparta Capital Sends Letter to Board of Directors of Wood Group

LONDON, April 16, 2024 /PRNewswire/ — The full text of the letter follows:

Sparta Capital Management Ltd

1 Knightsbridge Green

London SW1X 7QA

John Wood Group PLC

15 Justice Mill Lane

Aberdeen AB11 6EQ

Attn: Roy A Franklin, Chair; the Board of Directors

Cc: Ken Gilmartin, Chief Executive Officer

15 April 2024

Dear Roy,

Thank you for the many opportunities you have given us to continue our discussions.

As you know, we have been a significant investor in Wood Group since early 2022, and like many of your shareholders we are frustrated by the continued underperformance of the shares. We are now one year on from the lapsed bid process with Apollo and 17 months since you announced your strategy refresh. Despite the many operational achievements that you have recorded since then, your shares languish at 130p – 140p, which, with the exception of just one occasion in the last five years, are the all-time lows for the shares.

In the context of this, we believe that the Board must be realistic on how it can best achieve fair value for shareholders; if the UK public markets are unwilling or unable to engage in Wood’s story, we believe you should undertake a strategic review and actively seek alternative solutions. We note, for example, the recent successful attempts by corporates to move their primary listing away from markets which they have determined do not recognise the true worth of their businesses. In particular, the US, where Wood’s peers Jacobs and KBR trade, and where you have significant operational and executive presence, would seem a logical potential listing venue. Equally, we have been pleased to see a significant up-tick in M&A activity in Q1 2024, and financing markets which appear to be supportive of public to private transactions.

We have spoken to many of your existing investors, and there is widespread agreement that something must be done to address the poor share price performance. As such, we urge you to conduct a strategic review with an open mind as to the best way to achieve fair value for shareholders. If you conclude that shareholder value will be maximised through a sale of the company, we encourage you to engage with any suitable bidders who may emerge during this process.

Operational Achievements

It is clear that you have made considerable progress as a business since the beginning of 2022. The sale of the Built Environment division, completed in September 2022, was transformative and made possible, a comprehensive and long overdue root & branch restructuring of the business. You appointed Ken Gilmartin in June 2022 to lead this process. We believe Ken is a talented executive who has very quickly implemented the right strategy for Wood. At the November 2022 CMD, Ken and the refreshed executive leadership team set out a clear vision and roadmap:

- Growth – returning the business to sustainable growth “ahead of” a market estimated to grow at 5%

- Derisking – moving the business away from risky lumpsum turnkey contracts

- Profitability – addressing central costs and improving operating margins

- Operating Cash – generating substantial operating cash

- Legacy Liabilities – retiring legacy liabilities

- Free Cash Flow – generating sustainable free cash flow

Against this list of objectives, we note the following very significant successes, with more to follow:

- Growth – in its first full year since the strategy refresh the business grew EBITDA some 11%(*) and has guided to 2024 EBITDA growth towards the upper end of its medium-term target and for 2025 EBITDA growth to exceed its medium-term target of mid to high single digit percentage growth annually(1)

- Derisking – lumpsum turnkey contracts now represent only a negligible portion of the total revenue, versus 16% in FY 2021(1)

- Profitability – after a year of investment in 2023 with margins flat on 2022 as guided, margins are now expected to expand significantly as the business continues to grow, shifts towards higher margin consulting projects and benefits from cost savings initiatives(1). As a consequence, analysts estimate that EBITDA margins will expand to 7.5% and 8.1% for 2024 and 2025 respectively(2) from 7.2% in 2023

- Operating Cash – over 2023 the company generated a dramatic positive inflection in operating cash, generating $194m of operating cash for the year, versus an outflow of $66m in 2022(1). The company is on course to achieve a further improvements, with operating cashflow set to grow to $355m(2) by 2025 according to consensus estimates

- Legacy Liabilities – the company has retired some $145m(3) of legacy obligations in 2023, with the final amount of $70m(4) being retired in H1 of 2024.

In total, some $362m(5) of liabilities faced by the group at the time of the CMD in 2022, equivalent to approximately 1/3rd of the group’s current market capitalisation, have been permanently retired - Free Cash Flow – as guided at the time of the CMD, the business is on course to generate material free cash flow in 2025

We note that as an engineering consultant, Wood benefits from the structural growth drivers of carbon emission reductions and energy security. Revenues for 2024 are backstopped by an order book of $6.3bn(1) and an increasing proportion of Wood’s revenues are linked to Carbon Emissions – at the last report date, the percentage of work encompassing “green” initiatives was 22% FY 2023 revenue, up from 20% just one year ago, while the current pipeline is now 43% exposed to sustainable solutions(1).

Relative Valuation & Performance

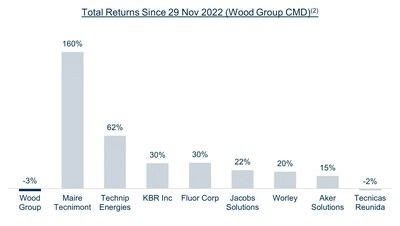

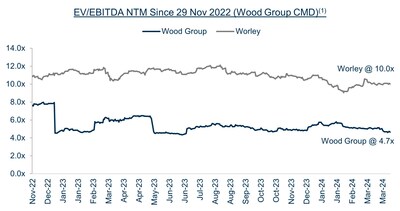

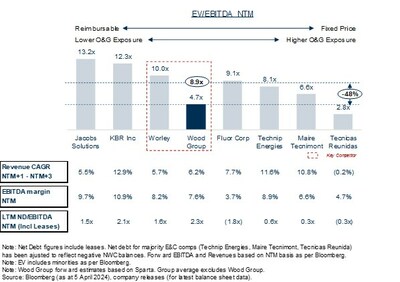

In spite of these many achievements, Wood’s share price has languished, and the company remains the lowliest valued company in the sector. Wood trades at 1/3rd(6) of the multiple of the comparable, higher quality peers like Worley (often cited as your key competitor and the business most like Wood), Jacobs and KBR and a 48%(6) discount to the sector average and with only Tecnicas Reunidas trading cheaper, which given that according to consensus numbers, it is ex-growth with close to half the margins, this is would appear to be a low bar.

- Wood’s share price has languished since the CMD

- Wood has delivered the lowest total return of its peers, including its former OFS peers

- The discount in valuation against Wood’s closest peer globally, Worley, remains stubbornly wide

- Wood remains at an unwarranted discount to its listed peers, including its former OFS peers

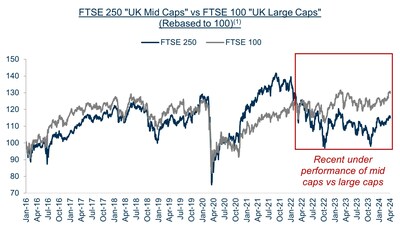

UK Mid-cap Curse

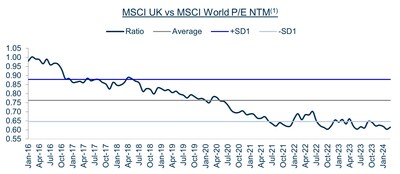

We accept and acknowledge that part of this underperformance and lack of shareholder engagement in the equity story is beyond your control. As can clearly be seen in the graphs below, UK mid-caps have chronically underperformed global equities in recent years. The first chart shows that the UK has materially de-rated against world equities, with a forward PE multiple now sitting at just 0.6x that of the MSCI World index, down from parity in 2016. Equally, within the UK, the second chart and recent past in particular (highlighted in red), shows that UK mid-caps have underperformed UK large-caps in the time since Covid, unfortunately coinciding with your strategic re-launch.

Whatever the reasons for this market-wide underperformance, as a transformation story with history of poor execution, you are a “show-me” story and, as such, will feel the full effect of this apparent indifference from public markets. We urge you to be realistic that these dynamics will not shift anytime soon when assessing how best to serve shareholders in the near term.

In Summary

You are delivering operationally, yet your shares trade at the all-time lows. In the context of the Apollo bid process, you described their approaches of 200p to 230p as proposals which “significantly undervalued the repositioned Group’s prospects.”(1). We don’t doubt that, fundamentally, Wood is worth significantly more than where it is currently trading in the public markets and indeed more than those offers. However, if there is no realistic prospect of achieving that value steady state in the public markets, then this is a moot point.

When we look at the behaviour of your core holders at the time of the previous approach, we note that institutional holders sold millions of shares at an average price of 214p(2) – their actions speaking louder perhaps than any assurances of their belief in the fundamental value they may have offered at the time. This trading pattern suggests that, at the time of the offer, shareholders accepted, out of brutal pragmatism, that realising 200p+ today, was a better course than hoping for a multiple of that price, at some point in the future.

You have given the UK public markets 17 months to recognise the value creation possible in a 36 month turn-around plan. The disconnect between intrinsic value and the value assigned by the market has never been wider. We believe that it is time to recognise that the next chapter of Wood’s journey could be best supported by different owners, and we urge you to undertake a strategic review and explore the best way to maximise shareholder value, including a sale of the company.

We have sent this letter to you first, but we have also chosen to make this letter public so that the debate can be open and transparent, and we encourage other shareholders to make their views known to you.

We look forward to continuing our discussions.

Best wishes,

Franck Tuil, CIO

Sparta Capital Management Ltd

About Sparta Capital

Sparta Capital is a multi-strategy investment fund launched in 2021 investing globally in a broad range of public and private securities, across both equity and credit markets. Our investment process relies on intensively researching the fundamentals of our targeted companies and identifying investment opportunities where, for a variety of clearly identifiable reasons, we believe a disconnect exists between the price of the securities in question and their underlying value – in short, we look for mispriced, catalyst-driven, investment opportunities.

Core to our investment process is the belief that constructive engagement with the companies in which we invest is not only our duty as responsible investors, but a highly effective way to drive value creation for the mutual benefit of shareholders and companies alike. We believe that the evolution of stock market dynamics of the past several years, has created increasingly stark disconnects between share price performance and investment fundamentals and our philosophy is to work with the companies that we invest in to address this.

Media Contacts

Greenbrook

Rob White / Michael Russell

[email protected]

+44 207 952 2000

Sparta Capital Management Limited (“Sparta”) is authorised and regulated by the Financial Conduct Authority of the United Kingdom (the “FCA”). This presentation is made by Sparta to John Wood group PLC (“Wood”) in Sparta’s capacity as an investor in Wood and not as part of an advisory or other professional service to Wood or any other person. Sparta is not advising the recipients of this presentation and will not be held responsible for providing them with the regulatory protections under the FCA rules. The presentation is based on information which we consider to be reliable but we make no representation or warranty, express or implied, as to its accuracy, reliability or completeness. Sparta is a Private Limited Company registered in England and Wales, Company No: 11178462. Registered Office: 1 Knightsbridge Green, London SW1X 7QA.

This document is not an offer to, or solicitation of, any potential clients or investors for the provision by Sparta of investment management, advisory or any other comparable or related services. No statement in this overview is or should be construed as investment, legal, or tax advice, nor is any statement an offer to sell, or a solicitation of an offer to buy, any security or other instrument, or an offer to arrange any transaction, or to enter into legal relations.

No representation is made as to the accuracy or completeness of any information contained herein, and the recipient accepts all risk in relying on this information for any purpose whatsoever. Without prejudice to the foregoing, any views expressed herein are the opinions of Sparta as of the date on which this document has been prepared and are subject to change at any time without notice. Sparta does not undertake to update this information. Any forward-looking statements herein are inherently subject to material business, economic and competitive risks and uncertainties, many of which are beyond our control. In addition, these forward-looking statements are subject to assumptions with respect to future business strategies and decisions that are subject to change.

[1] Source: Company financial reports. (*) Refers to constant FX reported figures.

[2] Source: Sparta-compiled consensus based on Research Analysts who have updated their model post FY 23 results. Based on company defined OCF: Adj. EBITDA – cash adj. JV elements – Provisions – Others – NWC.

[3] Source: Company CMD presentation: summation of expected exceptional cash outflow FY 23 – 25

[4] Source: Company FY 23 Results Presentation ($120m including $50m simplification programme costs).

[5] Source: Company FY 23, FY 22 and H1 22 Results Presentation: includes $145m settled in FY 23 and $217m settled in H2 22 ($319m – $102m).

[6] Source: Based on Bloomberg EV/EBITDA NTM. Sector includes Jacobs Solutions, KBR, Worley, Fluor Corp, Technip Energies, Maire Tecnimont, Tecnicas Reunidas.

[1] Source: Bloomberg as of 5th April 2024.

2 Source: Bloomberg as of 5th April 2024. Assumes that any dividends are reinvested into the security.

[1] Source: Bloomberg as of 5th April 2024.

[1] Source: Bloomberg as of 5th April 2024.

[1] Source: Company Press Release 22 February 2023.

[2] Source: Based on best efforts compilation of Form 8.3 data, focusing only institutional investors and their shares sold. Daily Bloomberg VWAP used as an approximation of price of shares sold.

Photo – https://mma.prnewswire.com/media/2387745/Sparta_Capital_Management_Ltd.jpg

Photo – https://mma.prnewswire.com/media/2387746/Sparta_Capital_Management_Ltd.jpg

Photo – https://mma.prnewswire.com/media/2387747/Sparta_Capital_Management_Ltd.jpg

Photo – https://mma.prnewswire.com/media/2387748/Sparta_Capital_Management_Ltd.jpg

Photo – https://mma.prnewswire.com/media/2387749/Sparta_Capital_Management_Ltd.jpg

Photo – https://mma.prnewswire.com/media/2387750/Sparta_Capital_Management_Ltd.jpg

![]() View original content to download multimedia:https://www.prnewswire.co.uk/news-releases/sparta-capital-sends-letter-to-board-of-directors-of-wood-group-302117261.html

View original content to download multimedia:https://www.prnewswire.co.uk/news-releases/sparta-capital-sends-letter-to-board-of-directors-of-wood-group-302117261.html

Latest News

COCA Celebrates Q2 2024 with Record-Breaking Milestones and New Launches

HONG KONG, Aug. 7, 2024 /PRNewswire/ — COCA, a pioneering force in the crypto wallet and financial services industry, has achieved several remarkable milestones in Q2 2024. Thanks to the steadfast support of its user community, COCA has launched new features, expanded its partnerships, and garnered prestigious accolades, further solidifying its position as a leader in the crypto space.

Launch of Physical Cards

COCA has introduced its highly anticipated physical cards, which are now available globally and compatible with Apple Pay and Google Pay. These cards allow users to make transactions with ease, earning cashback rewards on their purchases. This significant launch marks a step forward in integrating crypto with everyday financial activities, enhancing user convenience and financial flexibility.

Wallet Growth Milestone

The company has reached a significant milestone with 510,000 active wallets, reflecting a 102% growth quarter-on-quarter. This surge in active wallets highlights the increasing trust and adoption of COCA’s platform, as more users join the COCA community to manage their crypto assets securely and efficiently.

Transaction Volume Surge

In Q2 2024, COCA processed over USD 450,000 in transactions through its platform, demonstrating the robust usage and popularity of its financial services. This impressive transaction volume underscores COCA’s commitment to providing smooth and efficient crypto payment solutions.

Integration with Revolut

COCA has made it easier for users to fund their wallets by integrating with Revolut. This new feature allows seamless loading of crypto assets, enhancing the overall user experience and accessibility of COCA’s services.

Award Recognition

COCA has been honoured with the “Best Startup” award in the Financial Revolution category at CONF3RENCE & BLOCKCHANCE 2024. This award is a testament to COCA’s innovative approach and significant impact on the future of finance, recognizing its efforts in driving forward the digital financial ecosystem.

New Strategic Partnerships

COCA has formed strategic partnerships with industry leaders such as Wirex Pay and GoMining. These collaborations aim to provide users with enhanced rewards and a superior overall experience. The partnerships signify COCA’s dedication to expanding its ecosystem and delivering greater value to its users.

Welcoming Pavel Matveev

COCA is excited to announce the addition of Pavel Matveev, Founder of Wirex, to its team as a Strategy and Product Advisor. Pavel’s extensive experience and visionary approach are expected to drive COCA’s strategic initiatives and product development, contributing to the company’s continued growth and innovation.

Season 2 Point System Launch

Season 2 of COCA’s popular point system has launched, offering users the opportunity to earn points through various activities, including trades, referrals, holding assets, and spending with COCA cards. With a prize pool of USDT 3500 and 5 Wirex Pay Nodes, this season promises exciting rewards and increased user engagement. The season ends on August 9th, so users are encouraged to participate actively.

NFT Giveaway

In a special giveaway, COCA distributed 1000 GoMining NFTs to lucky users. These NFTs provide unique benefits, including enhanced mining capabilities and exclusive digital collectibles, adding significant value to the user experience.

For further details on COCA’s Q2 achievements and upcoming initiatives, visit the company’s blog.

Website: coca.xyz

COCA continues to redefine the crypto experience with its innovative solutions, seamless integrations, and user-focused approach. The company’s recent milestones and future plans highlight its commitment to leading the way in the digital financial landscape.

About COCA

COCA is a next-generation crypto super app designed to simplify and secure the crypto experience for users worldwide. With innovations in security, usability, and integration, COCA is at the forefront of the digital asset revolution. For more information, visit coca.xyz.

Photo – https://mma.prnewswire.com/media/2477245/COCA_Q2_2024.jpg

Logo – https://mma.prnewswire.com/media/2338075/4848605/COCA_Logo.jpg

![]() View original content:https://www.prnewswire.co.uk/news-releases/coca-celebrates-q2-2024-with-record-breaking-milestones-and-new-launches-302216619.html

View original content:https://www.prnewswire.co.uk/news-releases/coca-celebrates-q2-2024-with-record-breaking-milestones-and-new-launches-302216619.html

Latest News

Stake and Earn with KuCoin’s Innovative GemPool Platform

VICTORIA, Seychelles, Aug. 7, 2024 /PRNewswire/ — KuCoin, a leading global cryptocurrency exchange, is excited to announce the launch of GemPool, its innovative new platform that allows users to acquire token airdrops as a reward for staking their crypto assets. This unique product is designed to provide early access to emerging crypto projects while offering rewards for their existing holdings at zero cost. By staking respective tokens in separate pools, users can farm new tokens and gain a foothold in the latest developments within the cryptocurrency market.

GemPool also offers flexible staking terms, allowing users to stake and un-stake their assets anytime within the designated period without lock-up restrictions. This flexibility ensures that users can manage their assets according to their preferences and market conditions. Additionally, GemPool provides zero-cost rewards, enabling users to earn tokens while holding their existing cryptocurrencies. By staking their tokens, users contribute to the growth of promising new projects, supporting innovation and development within the crypto space. With completion of tasks offered, users are eligible to earn multiplier bonus and receive more rewards.

Users can participate by staking KCS, USDT, or other specified assets in designated pools. The rewards are earned according to the respective yields of the pools, ensuring a fair and exciting experience for all users.

For more information on how to participate and the benefits of GemPool, please visit the KuCoin GemPool page.

About KuCoin

Launched in September 2017, KuCoin is a leading cryptocurrency exchange with its operational headquarters in Seychelles. As a user-oriented platform with a focus on inclusiveness and community engagement. It offers over 900 digital assets across Spot trading, Margin trading, P2P Fiat trading, Futures trading, and Staking to its 34 million users in more than 200 countries and regions. KuCoin ranks as one of the top 6 crypto exchanges. KuCoin was acclaimed as “One of the Best Crypto Apps & Exchanges of June 2024” by Forbes Advisor and has been included as one of the top 50 companies in the “2024 Hurun Global Unicorn List”. Learn more at https://www.kucoin.com/.

Logo – https://mma.prnewswire.com/media/2356857/KuCoin_Horizontal_Green_LOGO_Logo.jpg

![]() View original content:https://www.prnewswire.co.uk/news-releases/stake-and-earn-with-kucoins-innovative-gempool-platform-302216471.html

View original content:https://www.prnewswire.co.uk/news-releases/stake-and-earn-with-kucoins-innovative-gempool-platform-302216471.html

Latest News

Trust Wallet Launches Gamified Education Platform and Loyalty Program to Enhance and Reward Web3 Learning

DUBAI, UAE, Aug. 7, 2024 /PRNewswire/ — Trust Wallet, the world’s leading self-custody Web3 wallet and Web3 gateway trusted by over 130 million users, has launched Trust Wallet Quests, a gamified education platform within the Trust Wallet mobile app which encourages users to earn points while exploring and learning about Web3.

Users can engage in task-based challenges ranging from quizzes to complex problem-solving scenarios composed of various DeFi and Web3 activities, all designed to deepen their understanding of blockchain technology and decentralized applications (dApps), and expose them to exciting opportunities within Web3. As an incentive, users will earn Trust Points, a loyalty-based points system designed to reward user activity within the Trust Wallet mobile app. With Trust Points, users can earn rewards upon the completion of specific tasks, making Web3 more rewarding and fun.

In the future, Trust Points will offer additional gamification features, such as unlocking achievements, badges, and levels. This interactive approach not only boosts individual learning but also contributes to broader community education and adoption of decentralized technologies, making Trust Wallet Quests a dynamic and exciting way to reward loyal users and engage with communities in Web3.

On the motive for launching Trust Wallet Quests, Eowyn Chen, CEO of Trust Wallet, stated: “The complex technology and fast-paced industry can be intimidating for both new and seasoned users. The introduction of Quests on Trust Wallet further solidifies our commitment to making it easier for millions to navigate Web3, aligning perfectly with our mission to build a seamless Web3 hub and open ecosystem for all.”

Nate Zou, Head of Product at Trust Wallet, highlighted what to expect from Trust Points and Trust Wallet Quests: “Trust Points and Quests are just the first iteration of a much-needed reward system for our community. Within 2024, we have plans to build on this, combining rewards with many of our other web3 product offerings. Overall, we envision this points system not only changing how users engage with Trust Wallet, but also encouraging more collaboration between Trust Wallet, our users and other web3 ecosystem players.”

Trust Wallet Quests and Trust Points are now available on both Android and iOS versions of Trust Wallet’s mobile app. Download here: https://short.trustwallet.com/TrustWalletQuests

About Trust Wallet

Trust Wallet is the self-custody, multi-chain Web3 wallet and Web3 gateway for people who want to fully own, control, and leverage the power of their digital assets. From beginners to experienced users, Trust Wallet makes it easier, safer, and convenient for millions of people around the world to experience Web3, access dApps securely, store and manage their crypto and NFTs, buy, sell, and stake crypto to earn rewards, all in one place and without limits.

Photo – https://mma.prnewswire.com/media/2475264/image.jpg

Logo – https://mma.prnewswire.com/media/2475420/Trust_Wallet_Core_Logo_Blue_Logo.jpg

![]() View original content:https://www.prnewswire.co.uk/news-releases/trust-wallet-launches-gamified-education-platform-and-loyalty-program-to-enhance-and-reward-web3-learning-302215130.html

View original content:https://www.prnewswire.co.uk/news-releases/trust-wallet-launches-gamified-education-platform-and-loyalty-program-to-enhance-and-reward-web3-learning-302215130.html

-

Fintech3 days ago

Fintech3 days agoFintech Pulse: Industry Updates, Innovations, and Strategic Moves

-

Fintech2 days ago

Fintech2 days agoFintech Pulse: Daily Industry Brief – A Dive into Today’s Emerging Trends and Innovations

-

Fintech PR7 days ago

Fintech PR7 days agoLaunch of Al Faisal Al Baladi Holding

-

Fintech PR3 days ago

Fintech PR3 days agoROLLER Releases 2025 Attractions Industry Benchmark Report, Unveiling Key Trends and Revenue Strategies

-

Fintech PR2 days ago

Fintech PR2 days agoTAILG Represents the Industry at COP29, Advancing South-South Cooperation with Low-Carbon Solutions

-

Fintech5 days ago

Fintech5 days agoFintech Pulse: Navigating Expansion, Innovation, and Sustainability

-

Fintech4 days ago

Fintech4 days agoFintech Pulse: Milestones, Partnerships, and Transformations in Fintech

-

Fintech PR2 days ago

Fintech PR2 days agoCritical Metals Surge Opens Prime Opportunity for Mining Investors