Fintech

Letter to the Shareholders of Gambier Gold Corp. (“the Company”)

The Future of your Investment will be Determined by the Outcome of this Vote

Frastanz, Austria–(Newsfile Corp. – May 12, 2022) – Dear Fellow Shareholders of Gambier Gold Corp. (TSXV: GGAU) (the “Company”), Dear Fellow Gambier Shareholders,

Shareholders have not been told the full story and as you read further, you will find that in order for Gambier Gold Corp. (“Gambier” or the “Corporation“) to succeed, change is required. We, FruchtExpress Grabher GmbH & Co KG, significant shareholders of Gambier, have a passion for the Corporation to succeed, have the best interests of Shareholders in mind and want management of Gambier to deliver results. As significant shareholders, we hold approximately 8,750,000 common shares representing approximately 18.926% of Gambier’s issued and outstanding shares. Our interests are aligned with yours and we are motivated to maximize value for all.

The President and Chief Executive Officer, Michael Schuss, along with Chief Financial Officer, Geoff Balderson, have breached their fiduciary duties of loyalty and care which are owed by each director and officer to the Corporation and its shareholders under corporate law. Such behavior CANNOT continue and CANNOT remain hidden.

Key Highlights

In favour the of new Board of Directors and Management:

- We continue to actively engage with shareholders, key stakeholders and potential shareholders. Increasing shareholder support base to around 50%.

- Strengthening the team with the addition of two independent technical advisors, Bernie Kreft [Owner of a private prospect generator company and advisor of Kestrel Gold] and Robert Cameron [President & CEO at Commander Resources].

- Strengthening the team with the addition of a CFO, Mark T. Brown [Executive Chairman at Alianza Minerals Ltd and President of Pacific Opportunity Capital Ltd].

- We are in discussions with third parties about the addition of new projects to replace the loss of the Wicheeda property.

- Since our last News Release, we have continued to try and work with the existing Board, who continue to fail to address questions and concerns.

Reason for concern about current Board of Directors and Management:

- Failure to comply with British Columbia securities laws and regulations.

- Extremely poor communication with shareholders, including out of date website and presentation.

- Lack of accountability, blaming former geologists and directors on exploration results.

- The lack of News Release regarding the disposal of Wicheeda. We recognize this was mentioned on the MD&A; however, we believe it should have had a separate News Release.

- Geoff Balderson, current CFO of Gambier is involved in approximately twenty-five other publicly traded companies, has had multiple active ‘Cease Trade Orders’ against him for the failure to file financial statements.

Mr. Daniel Rodriguez, proposed Chief Executive Officer, commented, “I am grateful for this opportunity to be a part of the future of Gambier Gold. The company holds amazing exploration properties that warrant thorough attention. The shareholders of Gambier Gold, myself included, deserve the opportunity to have these properties explored. The current management has lacked transparency and accountability, blaming others for its failures, this I will not do. I am pleased to announce the addition of our proposed CFO, Mark Brown and technical advisors Bernie Kreft and Robert Cameron. This gives me confidence that we are moving in the right direction with strong support from the addition of more industry experts. To all shareholders of Gambier Gold please remember to vote the GREEN proxy in support of the future of Gambier.“

Unfortunately, the self interested and oppressive actions of the existing members of the Board of Directors of Gambier, have given us no other option but to stand up for the rights of Gambier shareholders and to propose the election of a new board of directors (the “Shareholder Nominees“) at the June 1, 2022 annual general meeting of shareholders of Gambier (the “Meeting“). We care deeply about seeing Gambier transitioned back into a properly functioning and transparently operated company with a board of directors that will act in the best interests of shareholders. You now have a choice and the opportunity to determine the next path forward for your investment in Gambier.

Once you read the information we are providing you and understand the full facts, we believe you will agree that the election of the Shareholder Nominees as directors will provide Gambier with the right Board of Directors to move Gambier forward without conflicting agendas.

Background and Reasons: Questionable and Damaging Behaviour of Incumbent Directors

Over the past several years, disclosure by the Corporation has been limited and we have fought behind the scenes for transparency and good corporate governance of Gambier. We stood up against self interested actions taken by Michael Schuss, Tor Bruland, Casey Forward and Geoff Balderson (the “Incumbent Directors“). We have, over the last year, contacted the Incumbent Directors and Officers of the Corporation on several occasions to express our concerns over how poorly Gambier was being managed. We are major shareholders and the Incumbent Directors have consistently failed to address our concerns. We asked for a change of the board of directors and, again, the Incumbent Directors and management declined to accommodate our request. As a result, we requisitioned a meeting of shareholders to change the board of directors on March 21, 2022 (which the Corporation has failed to disclose in breach of securities laws). The Corporation has now set an annual general meeting for June 1, 2022.

Gambier has built up an enviable portfolio of exploration projects. However, all of this is being threatened by the actions of the Incumbent Directors and the management team that they have appointed. It is important that you be made aware of the following serious concerns before you cast your vote:

Lack of Public Disclosure and Corporate Governance

Background

In our view current management of Gambier, have not properly managed the business and affairs of Gambier, and in our view the Incumbent Directors have failed to discharge their fiduciary duties or to properly manage or supervise the management of the business and affairs of Gambier. In particular:

- There has been incredibly poor communication and even non-existent communication with Shareholders over the last year. For example, there were no news releases issued between May 10, 2021 and February 18, 2022. This lack of communication is further detailed below.

- The Incumbent Directors failed to cause the Corporation to carry out a Winter Drill Program as was discussed in their News Releases. Further, Michael Schuss, Director, President and CEO, provided no operational update in the second half of 2021, despite our requests. The March 31, 2022 News Release was poorly drafted and did not evidence a sound exploration program. They tried to blame others for their failures.

- There are a series of gaps in disclosure. The latest unaudited financial statements for the period ending December 31, 2021 do not set out the changes to the board of directors and there is no disclosure of an advisory board. We understand that Messrs. Michael Burns and Rafael Vaudrin resigned in February, 2022, which was stated in a News Release.

- Michael Schuss spent an excessive amount of his time on Twitter rather than running the business of the Corporation. For example during the period April 11, 2022 to May 5, 2022, over 150 Twitter tweets/replies/retweets were released.

- In our view, this lack of proper governance and disclosure by the Incumbent Directors has depressed the share price and placed the Detour West Property, the Corporation’s main asset, at risk.

- In addition, there has been an increase in the salary of the CEO (Michael Schuss) without any regard to the lack of performance. Mr. Schuss’ total annual compensation to March 31, 2021 is disclosed as $56,500. In the management discussion and analysis for the nine months ended December 31, 2021 his total compensation is set out as $105,000 which, extrapolated over 12 months, would be $140,000, an annualized increase of 148%.

- The business of the Corporation has deteriorated and is in need of significant cash injection. The Corporation will need to raise capital for future exploration and the confidence of the existing shareholder base as well as that of potential investors has been lost.

- Both Mr. Michael Schuss and Mr. Geoff Balderson provided their agreement, in writing, to resign or not stand for re-election and then refused to follow through with this. Mr. Bruland and Mr. Forward were just appointed February 18, 2022 and appear to have no vested interest in the Corporation and hold no shares. The Vendors and Royalty holders of the Detour West Property, have also expressed their dissatisfaction with the current management.

No Response to our Concerns Who Stood Up for the Rights of Shareholders

- We have tried on multiple occasions to improve the public disclosure with the Incumbent Directors, and had no response.

- Instead of accepting their accountability and addressing our concerns regarding poor communication and questionable corporate governance practices, the Incumbent Directors have consistently failed to address our concerns.

- We asked for a change of the board of directors and, again, they declined. Mr. Michael Burns and Mr. Rafael Vaudrin resigned in February, 2022 due to their concerns over management. We requisitioned a meeting of shareholders to change the board of directors on March 21, 2022 (which the Corporation failed to disclose), and the Corporation has now set an annual general meeting for June 1, 2022.

In accordance with the advance notice policy for the nomination of directors (the “Advance Notice Policy“) in Article 10.11 of the Articles of Gambier, on April 11, 2022, we delivered an advance notice for nomination of directors (the “Nominating Shareholder Notice“) for the nomination of the Shareholder Nominees for election to the board of directors to be included in the annual general meeting materials for the Meeting, as well as written Consents to Act of each of the five (5) Shareholder Nominees and the required information with respect to each of the five (5) Shareholder Nominees to be included in the annual general meeting materials. They declined to issue a news release disclosing this and refused to list the Shareholder Nominees in the proxy of management of the Corporation (a “Management Proxy“) in an attempt to undermine shareholder choice.

Corporate Governance Concerns

- Incumbent Directors breached British Columbia securities laws and regulations.

- Incumbent Directors rejected our requests for information and open corporate governance.

- Incumbent Directors opposed our request to appoint a new Board, even though agreeing, in writing, they would.

- Incumbent Directors did not disclose that Geoff Balderson, the CFO has, according to the British Columbia Securities Commission, had seven cease trade orders issued in the last 10 years and which were in effect for more than 30 consecutive days (Lords & Company Worldwide Holdings Inc., Lida Resources Inc., New Wave Holdings Corp., Vinergy Capital Inc., Core One Labs Inc. (twice), and Argentum Silver Corp). Two of the cease trade orders are still in effect. One Cease Trade Order was issued May 3, 2022 after the April 25, 2022 Management circular date. We point this out to show a pattern of behaviour that undermines the Corporation.

- Mr. Geoff Balderson is a director and/or officer of approximately 25 reporting companies, which does not leave the time for him to govern Gambier.

- The Corporation failed to file its executive compensation disclosure on a stand alone basis no later than 180 days after the end of its most recently completed financial year, as is required under National Instrument 51-102 – Continuous Disclosure Obligations (“NI 51-102“).

- Failed to issue a news release on the sale of the Wicheeda property.

Impeding the Rights of Shareholders to a Fair and Transparent Process

- In our opinion, Incumbent Directors purposely delayed the announcement of the Meeting to impede timely director nominations under the Corporation’s advance notice policy for the election of directors (the “Advance Notice Policy“).

- The submission of the Nominating Shareholder Notice for the proposed Shareholder Nominees was not disclosed, nor included in the Management Proxy, impeding the fundamental right of shareholders to nominate directors to the board.

- A special committee of the Incumbent Directors has not been formed to make decisions on all matters related to the contested Meeting. The special committee’s mandate would be to act independently and in the best interests of shareholders, among other responsibilities.

Gambier’s shareholders have a reasonable expectation that its directors will conduct the corporate governance of Gambier in a fair and transparent manner. By wrongfully dismissing our concerns, the Incumbent Directors have put their own self-interests ahead of Gambier’s. Further, by not acknowledging the Nominating Shareholder Notice, the Incumbent Directors have attempted to undermine shareholder democracy.

An Ethical and Experienced Board Who Will Act In the Best Interests of Shareholders

With the following five (5) Shareholder Nominees, we hope to usher in renewal and change for the better. The Shareholder Nominees possess a collection of diverse experience with the relevant skills to place Gambier on a path to succeed. Importantly, the Shareholder Nominees have demonstrated a commitment to focusing on the best interests of shareholders across multiple organizations. They also have the shareholder mindset necessary to ensure that shareholder value is maximized.

Highlights of the highly skilled and experienced Shareholder Nominees:

Daniel Rodriguez. Mr. Rodriguez is currently head of Corporate Development with Warrior Gold Inc. with over 14 years of capital markets and financial service experience. Previously, he was an Investment Advisor with a focus on the junior mining sector and managed a retail branch bank for a top-tier Canadian bank.

Sven Gollan. Mr. Gollan is currently a director of Sego Resources Inc., Alianza Minerals Ltd. and Teako Gold Corp. He spent 16 years as an Investment/Private Banker in Germany and Austria and was active in the education and training of securities advisors and investment bankers. He recently also works with FruchtExpress Grabher GmbH & Co KG.

Owen Garfield. Mr. Garfield is a Chartered Mineral Surveyor based in the United Kingdom who worked for the Valuation Office Agency as a specialist mineral valuer for over 10 years. Mr. Garfield is currently the Managing Director and owner of a successful Surveying company in the United Kingdom, advising multi-national clients on major infrastructure projects.

Rafael Vaudrin. Mr. Vaudrin is a Professional Geologist, and former Director of Gambier. He is a Senior Project Geologist and has great expertise in field planning, data analysis, and drilling initiatives. Mr. Vaudrin will also provide the historical knowledge of the Corporation.

Sebastien Ah Fat. Mr. Ah Fat is a Professional Geologist with over a decade of experience in the mining and energy sectors. He is the Vice President of Exploration at Pacific Bay Minerals Ltd., a precious- metal-focused mining company, and the co-founder and Vice President of Exploration at Glacier Resources Corp., a lithium exploration company.

Detailed backgrounds for each Shareholder Nominee can be found in the Concerned Shareholder’s Proxy Circular.

The Shareholder Nominees represent:

-

A slate of directors with diverse and relevant skills and experience, who have a history of value creation and a commitment to focusing on the best interests of shareholders across multiple organizations.

-

A highly experienced slate of directors who are focused on good governance, transparency and providing management with expert oversight.

-

A group that has a strong alignment with Gambier’s shareholders. The Shareholder Nominees, along with FruchtExpress Grabher GmbH & Co KG, hold a significant number of shares of the Corporation (collectively holding approximately 19.834% of the issued and outstanding common shares), meaning our interests are aligned with yours. (Incumbent Directors hold just approximately 3.79% of the issued and outstanding common shares of the Corporation).

The Path Forward

Many of you have noted that Gambier has some of the best and largest landholdings and cover the northwestern part of the Abitibi Greenstone Belt within the Superior Province in Ontario. You have also lamented the fact that Gambier’s share price should be higher and we have shared your concerns and frustrations.

Key Highlights

To this end, the Shareholder Nominees expect to take the following steps

- Maintain the highest standards of accountability and transparency, through regular communication with shareholders.

- Continue to build the team by bringing in more experts in the field including: Mark T. Brown, Robert Cameron and Bernie Kreft. Details of their experience are set out on pages 14 and 15 of the Concerned Shareholder’s Proxy Circular.

- Raise adequate funding to further proceed with the exploration and development of the assets mainly Detour West and Hemlo properties, including whatever actions the strategic review determines for the Detour West and Hemlo properties.

- Carry out an internal audit on both the finances and the assets of the Corporation.

- We are also reviewing a number of joint venture opportunities for the non-core projects. Additionally, we are reviewing with our technical team to prioritize and advance the main assets this upcoming field season. We hope to have the opportunity to continue with these positive initiatives.

Even after all the conflicts mentioned above, we still believe that we can take this opportunity to make Gambier all it can be. We are truly humbled to have such highly skilled and respected individuals in the industry join us on the proposed new board slate and the countless shareholders who support us in this effort to help take back your corporation.

Please allow us the opportunity along with a committed and experienced board to re-build the Gambier team that respects and acts in the best interests of its shareholders.

Vote Your Shares Today

You may soon read many false attacks leveled against us to deflect from the real issues that remain at the board level. I hope that as you read this letter and the Concerned Shareholder’s Proxy Circular, you will be able to see beyond these attacks and recognize the truth that we have continued and will continue to work for you.

We have had the pleasure of speaking with many of you. Your support has been greatly appreciated, especially during these challenging times and we welcome you to continue to reach us if you have any questions or concerns. We would be pleased to hear from you and may be contacted by phone or email as provided below.

Vote only the GREEN voting form for a positive future that keeps you and your Corporation in mind. You deserve better and no longer should you come last. Vote for the committed Shareholder Nominees and ensure that your investment is protected.

Sincerely Yours,

FRUCHTEXPRESS GRABHER GMBH & CO KG

Per: “Felix Grabher”

Felix Grabher, Executive Director

THE FUTURE OF GAMBIER GOLD CORP.

Per: “Daniel Rodriguez”

Daniel Rodriguez, Proposed Chief Executive Officer

If you have any questions or require any assistance in executing your Green proxy or voting instruction form, please contact:

Daniel Rodriguez

Telephone: 604-353-4080

Email: [email protected]

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/123859

Fintech

How to identify authenticity in crypto influencer channels

Modern brands stake on influencer marketing, with 76% of users making a purchase after seeing a product on social media.The cryptocurrency industry is no exception to this trend. However, promoting crypto products through influencer marketing can be particularly challenging. Crypto influencers pose a significant risk to a brand’s reputation and ROI due to rampant scams. Approximately 80% of channels provide fake statistics, including followers counts and engagement metrics. Additionally, this niche is characterized by high CPMs, which can increase the risk of financial loss for brands.

In this article Nadia Bubennnikova, Head of agency Famesters, will explore the most important things to look for in crypto channels to find the perfect match for influencer marketing collaborations.

-

Comments

There are several levels related to this point.

LEVEL 1

Analyze approximately 10 of the channel’s latest videos, looking through the comments to ensure they are not purchased from dubious sources. For example, such comments as “Yes sir, great video!”; “Thanks!”; “Love you man!”; “Quality content”, and others most certainly are bot-generated and should be avoided.

Just to compare:

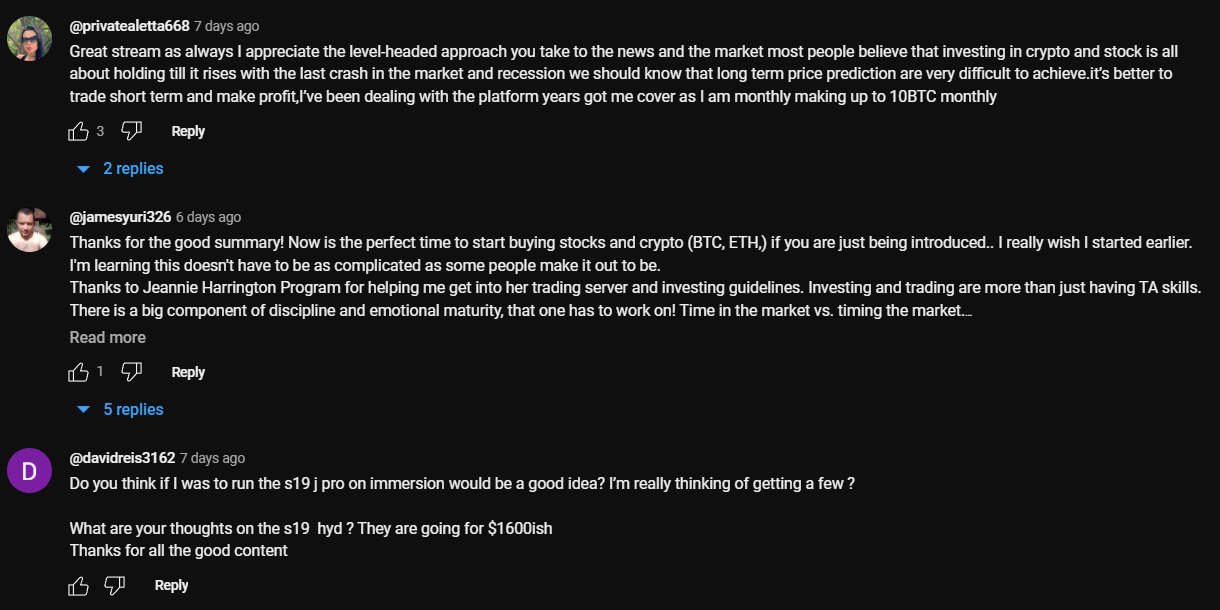

LEVEL 2

Don’t rush to conclude that you’ve discovered the perfect crypto channel just because you’ve come across some logical comments that align with the video’s topic. This may seem controversial, but it’s important to dive deeper. When you encounter a channel with logical comments, ensure that they are unique and not duplicated under the description box. Some creators are smarter than just buying comments from the first link that Google shows you when you search “buy YouTube comments”. They generate topics, provide multiple examples, or upload lists of examples, all produced by AI. You can either manually review the comments or use a script to parse all the YouTube comments into an Excel file. Then, add a formula to highlight any duplicates.

LEVEL 3

It is also a must to check the names of the profiles that leave the comments: most of the bot-generated comments are easy to track: they will all have the usernames made of random symbols and numbers, random first and last name combinations, “Habibi”, etc. No profile pictures on all comments is also a red flag.

LEVEL 4

Another important factor to consider when assessing comment authenticity is the posting date. If all the comments were posted on the same day, it’s likely that the traffic was purchased.

2. Average views number per video

This is indeed one of the key metrics to consider when selecting an influencer for collaboration, regardless of the product type. What specific factors should we focus on?

First & foremost: the views dynamics on the channel. The most desirable type of YouTube channel in terms of views is one that maintains stable viewership across all of its videos. This stability serves as proof of an active and loyal audience genuinely interested in the creator’s content, unlike channels where views vary significantly from one video to another.

Many unauthentic crypto channels not only buy YouTube comments but also invest in increasing video views to create the impression of stability. So, what exactly should we look at in terms of views? Firstly, calculate the average number of views based on the ten latest videos. Then, compare this figure to the views of the most recent videos posted within the past week. If you notice that these new videos have nearly the same number of views as those posted a month or two ago, it’s a clear red flag. Typically, a YouTube channel experiences lower views on new videos, with the number increasing organically each day as the audience engages with the content. If you see a video posted just three days ago already garnering 30k views, matching the total views of older videos, it’s a sign of fraudulent traffic purchased to create the illusion of view stability.

3. Influencer’s channel statistics

The primary statistics of interest are region and demographic split, and sometimes the device types of the viewers.

LEVEL 1

When reviewing the shared statistics, the first step is to request a video screencast instead of a simple screenshot. This is because it takes more time to organically edit a video than a screenshot, making it harder to manipulate the statistics. If the creator refuses, step two (if only screenshots are provided) is to download them and check the file’s properties on your computer. Look for details such as whether it was created with Adobe Photoshop or the color profile, typically Adobe RGB, to determine if the screenshot has been edited.

LEVEL 2

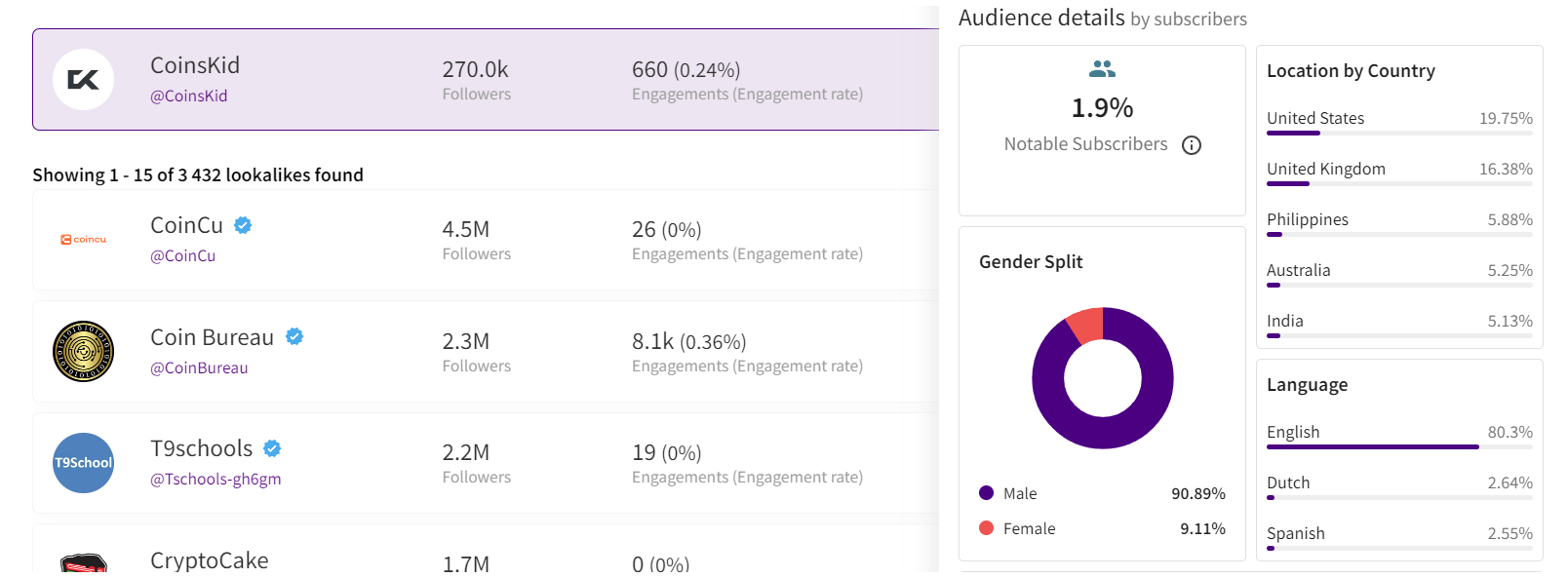

After confirming the authenticity of the stats screenshot, it’s crucial to analyze the data. For instance, if you’re examining a channel conducted in Spanish with all videos filmed in the same language, it would raise concerns to find a significant audience from countries like India or Turkey. This discrepancy, where the audience doesn’t align with regions known for speaking the language, is a red flag.

If we’re considering an English-language crypto channel, it typically suggests an international audience, as English’s global use for quality educational content on niche topics like crypto. However, certain considerations apply. For instance, if an English-speaking channel shows a significant percentage of Polish viewers (15% to 30%) without any mention of the Polish language, it could indicate fake followers and views. However, if the channel’s creator is Polish, occasionally posts videos in Polish alongside English, and receives Polish comments, it’s important not to rush to conclusions.

Example of statistics

Example of statistics

Wrapping up

These are the main factors to consider when selecting an influencer to promote your crypto product. Once you’ve launched the campaign, there are also some markers to show which creators did bring the authentic traffic and which used some tools to create the illusion of an active and engaged audience. While this may seem obvious, it’s still worth mentioning. After the video is posted, allow 5-7 days for it to accumulate a basic number of views, then check performance metrics such as views, clicks, click-through rate (CTR), signups, and conversion rate (CR) from clicks to signups.

If you overlooked some red flags when selecting crypto channels for your launch, you might find the following outcomes: channels with high views numbers and high CTRs, demonstrating the real interest of the audience, yet with remarkably low conversion rates. In the worst-case scenario, you might witness thousands of clicks resulting in zero to just a few signups. While this might suggest technical issues in other industries, in crypto campaigns it indicates that the creator engaged in the campaign not only bought fake views and comments but also link clicks. And this happens more often than you may realize.

Summing up, choosing the right crypto creator to promote your product is indeed a tricky job that requires a lot of resources to be put into the search process.

Author

Nadia Bubennikova, Head of agency at Famesters

Fintech

Central banks and the FinTech sector unite to change global payments space

The BIS, along with seven leading central banks and a cohort of private financial firms, has embarked on an ambitious venture known as Project Agorá.

Named after the Greek word for “marketplace,” this initiative stands at the forefront of exploring the potential of tokenisation to significantly enhance the operational efficiency of the monetary system worldwide.

Central to this pioneering project are the Bank of France (on behalf of the Eurosystem), the Bank of Japan, the Bank of Korea, the Bank of Mexico, the Swiss National Bank, the Bank of England, and the Federal Reserve Bank of New York. These institutions have joined forces under the banner of Project Agorá, in partnership with an extensive assembly of private financial entities convened by the Institute of International Finance (IIF).

At the heart of Project Agorá is the pursuit of integrating tokenised commercial bank deposits with tokenised wholesale central bank money within a unified, public-private programmable financial platform. By harnessing the advanced capabilities of smart contracts and programmability, the project aspires to unlock new transactional possibilities that were previously infeasible or impractical, thereby fostering novel opportunities that could benefit businesses and consumers alike.

The collaborative effort seeks to address and surmount a variety of structural inefficiencies that currently plague cross-border payments. These challenges include disparate legal, regulatory, and technical standards; varying operating hours and time zones; and the heightened complexity associated with conducting financial integrity checks (such as anti-money laundering and customer verification procedures), which are often redundantly executed across multiple stages of a single transaction due to the involvement of several intermediaries.

As a beacon of experimental and exploratory projects, the BIS Innovation Hub is committed to delivering public goods to the global central banking community through initiatives like Project Agorá. In line with this mission, the BIS will soon issue a call for expressions of interest from private financial institutions eager to contribute to this ground-breaking project. The IIF will facilitate the involvement of private sector participants, extending an invitation to regulated financial institutions representing each of the seven aforementioned currencies to partake in this transformative endeavour.

Source: fintech.globa

The post Central banks and the FinTech sector unite to change global payments space appeared first on HIPTHER Alerts.

Fintech

TD Bank inks multi-year strategic partnership with Google Cloud

TD Bank has inked a multi-year deal with Google Cloud as it looks to streamline the development and deployment of new products and services.

The deal will see the Canadian banking group integrate the vendor’s cloud services into a wider portion of its technology solutions portfolio, a move which TD expects will enable it “to respond quickly to changing customer expectations by rolling out new features, updates, or entirely new financial products at an accelerated pace”.

This marks an expansion of the already established relationship between TD Bank and Google Cloud after the group previously adopted the vendor’s Google Kubernetes Engine (GKE) for TD Securities Automated Trading (TDSAT), the Chicago-based subsidiary of its investment banking unit, TD Securities.

TDSAT uses GKE for process automation and quantitative modelling across fixed income markets, resulting in the development of a “data-driven research platform” capable of processing large research workloads in trading.

Dan Bosman, SVP and CIO of TD Securities, claims the infrastructure has so far supported TDSAT with “compute-intensive quantitative analysis” while expanding the subsidiary’s “trading volumes and portfolio size”.

TD’s new partnership with Google Cloud will see the group attempt to replicate the same level of success across its entire portfolio.

Source: fintechfutures.com

The post TD Bank inks multi-year strategic partnership with Google Cloud appeared first on HIPTHER Alerts.

-

Latest News3 days ago

Trina Storage Recognized as Tier 1 Energy Storage Manufacturer by BNEF for Second Consecutive Quarter

-

Latest News7 days ago

Talino, Chemonics invest in startup Higala, the Philippines’ pioneering inclusive instant payment system

-

Latest News3 days ago

Latest News3 days agoGenome and Chilli Partners join forces to revolutionize iGaming affiliate payouts

-

Latest News3 days ago

Bank of Spain grants Amadeus’ Outpayce EMI licence

-

Latest News3 days ago

Newmark Reports First Quarter 2024 Financial Results

-

Latest News3 days ago

Lunar Poised for Nationwide Rollout in Sweden After Securing €24.1 Million in Funding

-

Latest News3 days ago

EQT to acquire WSO2, a leading global provider of digital transformation technologies

-

Latest News3 days ago

REALTY ONE GROUP CELEBRATES 19TH ANNIVERSARY WITH GLOBAL ‘ONE DAY’ OF VOLUNTEERING & GIVING BACK