Fintech

Revolutionizing Rewards: How ZBD and Finfare Connect Are Bringing Bitcoin to Everyday Spending

ZBD, a pioneer in merging gaming and payments through Bitcoin rewards, is taking a bold step beyond gaming with its new partnership with Finfare Connect. By offering instant Bitcoin cashback for everyday purchases at major retailers like Nike, Adidas, and Best Buy, ZBD is transforming how users engage with rewards. In this interview, Ben Cousens, CSO of ZBD, shares insights on the partnership, its impact on user loyalty, and how it’s shaping the future of Bitcoin adoption through seamless, real-world applications.

Q: ZBD has been a key player in merging gaming and payments through Bitcoin rewards. How does this new partnership with Finfare Connect enhance ZBD’s existing offerings, and what excites you most about giving users more ways to earn Bitcoin through everyday purchases?

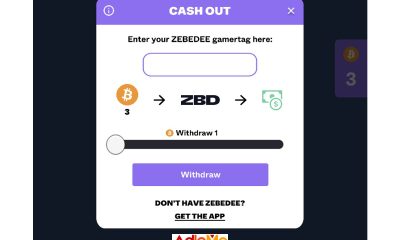

Ben: The ZBD app has been used by millions of players to earn rewards instantly within games; a process made possible through our payments system. We’re constantly looking to provide new ways for users to earn rewards within the ZBD app, building upon the credibility and growth we’ve seen in the games industry. Our partnership with Finfare provides instant cashback through the ZBD app to customers in the USA, as they shop at brands and retailers like Nike, Adidas, and BestBuy. What’s exciting to me is we get to flex the power of our payment system even more – instant payments with no minimums are an amazing cashback mechanic.

Q: With the ability for ZBD users to link payment cards and accounts to earn Bitcoin rewards from brands like Nike, Adidas, and Best Buy, how do you see this partnership impacting user engagement and loyalty within your platform?

Ben: I see audiences behaving in two ways. The first are users who may come to the shopping section of the app often to check available deals, and purchase accordingly to take advantage of the discounts offered.

At the same time, other users will just link their accounts, shop as they normally would, and automatically receive rewards in the ZBD app without even thinking about it. I actually find this second segment more exciting, as it just seems such a seamless and, from a payments point of view, pretty futuristic solution.

We are doing this to provide a valuable service and delight our users. If we can succeed in that, which so far seems to be the case, then engagement and loyalty will increase. It’s about fulfilling the promise of being the best place for rewards with real value, paid out instantly and available for people to use instantly.

Q: ZBD is known for integrating Bitcoin rewards with gaming and social experiences. How do you envision this partnership with Finfare Connect helping ZBD extend its appeal beyond gaming and into more mainstream shopping and daily transactions?

Ben: Providing more use cases outside of gaming fits with our ethos of being a tech-first company focused on revolutionizing online payments. Once payment accounts are linked to Finfare, ZBD seamlessly provides cashback with no input required from the user. This perfectly aligns with why users come to ZBD – we are using payments to make digital experiences more rewarding.

We believe the partnership allows us to bring our users a feature they will love, but it might also bring a different type of user to ZBD: one that comes primarily for the shopping aspects and sees the gaming and entertainment features as less important. This is something the market will show us and we’ll adapt based on the users and usage we see, but it’s certainly exciting.

Q: The collaboration with Finfare Connect seems to make Bitcoin rewards more accessible for everyday users. How important is this accessibility to ZBD’s strategy, and how do you see it contributing to broader Bitcoin adoption in the long term?

Ben: ZBD is a payments company that plays heavily in the rewards space and the way we revolutionize payments is by using the Bitcoin lightning network as our underlying rail. This isn’t about pushing Bitcoin or making users aware of it, though I won’t lie, it can make user acquisition easier. It’s about laying groundwork and building out meaningful steps forward in online payment experiences, starting with rewards, and then going beyond.

It’s always our goal to make everything we do accessible to everyday users with no Bitcoin knowledge. We want the experience to be simpler, more seamless and faster than any other type of financial technology. The majority of our users are new to Bitcoin and find us through games. Our goal is to educate them a bit, but mostly to just give them products they can use intuitively and get value from even if they aren’t at all interested in Bitcoin. Now, we’re bringing this approach to shopping rewards.

Bitcoin adoption will happen if Bitcoin is used by a wide range of people as part of their everyday lives. Bitcoin will be used if it is useful, simple and solves a problem. So we aren’t ever thinking about Bitcoin adoption. We’re just doing what we do the best we can and adoption will take care of itself.

Fintech

Fintech Pulse: Your Daily Industry Brief (IBANera, FIS, Citigroup, Gen Digital, Mynt)

The fintech sector is buzzing with developments today, ranging from strategic acquisitions to significant funding rounds and innovative product launches. Here’s an in-depth briefing on the latest news, crafted to keep you ahead of the curve.

IBANera Teams Up with FIS to Launch U.S. Prepaid Card Programme

IBANera, a global financial services provider, has partnered with FIS to roll out a new U.S. prepaid card program. This initiative is set to enhance payment solutions for consumers and businesses alike. By leveraging FIS’s advanced payment processing technology, IBANera aims to provide seamless, secure, and efficient financial services.

This move is part of IBANera’s broader strategy to diversify its offerings and strengthen its foothold in the U.S. market. The prepaid card program is designed to cater to a range of customer needs, from everyday transactions to business expenditures, reflecting a growing demand for flexible financial tools.

Source: Fintech Futures

Abu Dhabi Fintech Secures $500 Million Credit Line from Citi

In a significant development, an Abu Dhabi-based fintech company has secured a $500 million line of credit from Citigroup. This funding aims to bolster the company’s operational capabilities and support its expansion plans.

The credit line highlights Citi’s confidence in the UAE’s burgeoning fintech ecosystem, which is rapidly becoming a global hub for financial innovation. The unnamed fintech’s strategic initiatives include leveraging this capital to enhance its digital platforms, enter new markets, and broaden its product offerings.

Source: Bloomberg

Gen Digital Acquires MoneyLion in $1 Billion Deal

Cybersecurity giant Gen Digital has acquired fintech platform MoneyLion for a whopping $1 billion. This landmark deal underscores the increasing convergence of cybersecurity and financial technology. MoneyLion’s robust financial tools, including personal finance management and investment solutions, will now integrate with Gen Digital’s cybersecurity expertise.

This acquisition is poised to create a unique synergy, offering consumers comprehensive financial and digital protection services. Gen Digital’s move also signifies a broader trend where cybersecurity firms are diversifying their portfolios to include fintech solutions.

Source: Fintech Futures

Australian Fintech Report Highlights Blockchain and Crypto Sector Decline Amid AI Boom

A recent report from Australia sheds light on a contraction in the country’s blockchain and cryptocurrency sector. The decline is attributed to a global pivot toward artificial intelligence (AI) technologies, which are increasingly dominating the innovation landscape.

While blockchain and crypto startups face headwinds, AI-driven fintech solutions are witnessing robust growth. The report suggests that companies are reallocating resources to capitalize on AI’s transformative potential, indicating a significant shift in industry priorities.

Source: Bitcoin.com

Swedish Fintech Mynt Raises €22 Million in Series B Funding

Swedish fintech startup Mynt has successfully closed a €22 million Series B funding round. The funding was led by prominent investors, including local and international venture capital firms.

Mynt specializes in providing innovative financial solutions for small and medium-sized enterprises (SMEs). The new funding will be used to accelerate product development, enhance customer experience, and expand into new European markets. Mynt’s growth trajectory reflects a strong demand for SME-focused fintech services.

Source: Tech.eu

Analysis and Insights

Strategic Partnerships and Product Expansion

IBANera’s collaboration with FIS exemplifies the growing trend of fintechs partnering with established tech providers to co-create innovative solutions. Such partnerships are essential for scaling operations and meeting the ever-evolving demands of customers.

Funding Milestones and Market Confidence

The $500 million credit line secured by the Abu Dhabi fintech indicates a robust level of trust in the MENA region’s fintech potential. This aligns with broader efforts to position the UAE as a global fintech leader.

Mergers and Acquisitions Driving Industry Convergence

The Gen Digital-MoneyLion deal is a testament to the increasing overlap between fintech and cybersecurity. As financial services become more digital, the need for integrated cybersecurity solutions is paramount.

Shifting Technological Priorities

Australia’s report on blockchain and crypto highlights a critical inflection point. The shift towards AI demonstrates how quickly technological priorities can change, urging companies to adapt swiftly to maintain relevance.

Support for SMEs

Mynt’s successful funding round underscores the importance of fintech solutions tailored to SMEs. As SMEs are pivotal to economic growth, fintechs like Mynt play a crucial role in empowering this sector.

Closing Thoughts

Today’s updates showcase the dynamism and resilience of the fintech industry. From strategic partnerships to bold acquisitions and shifts in technological focus, the sector continues to evolve at a remarkable pace. Staying attuned to these developments is essential for stakeholders looking to navigate this ever-changing landscape.

The post Fintech Pulse: Your Daily Industry Brief (IBANera, FIS, Citigroup, Gen Digital, Mynt) appeared first on News, Events, Advertising Options.

Fintech

Fintech Pulse: Your Daily Industry Brief (Waymo, Paytend, LexisNexis Risk Solutions, Centana Growth Partners, IDVerse)

The Shifting Sands of Fintech in 2024: Key Updates and Insights

The fintech industry continues to evolve as innovation, strategic hiring, and notable acquisitions define the landscape. Today’s briefing delves into Australia’s crypto shakeup, Waymo’s autonomous vehicle advancements, Centana Growth Partners’ funding milestone, Paytend’s leadership appointment, and LexisNexis Risk Solutions’ latest acquisition.

Australia’s Crypto Exodus: A Warning Sign for the Industry?

Australia’s fintech and crypto ecosystem is witnessing a seismic shift. According to a report by KPMG, nearly 30% of the country’s crypto-related businesses are set to shut down in 2024. This alarming trend stems from stricter regulatory measures, waning investor confidence, and an increasingly competitive global environment.

While some view this contraction as a natural market correction, others express concerns about stifling innovation. As regulators demand more transparency and tighter compliance, businesses that cannot meet these standards are bowing out.

The impact could resonate beyond Australia’s borders, offering lessons for other nations balancing growth and regulation in the crypto space.

Source: Cointelegraph

Waymo Expands Autonomous Ride Services to Miami

Autonomous driving leader Waymo has announced the expansion of its ride-hailing services to Miami, marking another milestone in the company’s strategic growth. Miami residents will soon have access to fully driverless rides, reflecting Waymo’s confidence in its technology’s reliability in diverse urban environments.

The Florida city presents unique challenges, including unpredictable weather and heavy pedestrian traffic. However, Waymo’s previous successes in Phoenix and San Francisco suggest the company is well-prepared to navigate Miami’s bustling streets.

This move further cements autonomous vehicles as a transformative force in urban mobility and a burgeoning opportunity for fintech players exploring payments and insurance integrations within this ecosystem.

Source: Waymo Blog

Centana Growth Partners Closes $600 Million Fund III

Centana Growth Partners has successfully closed its third fund at $600 million, underscoring the strength of investor interest in fintech and adjacent sectors. Fund III aims to back companies at the intersection of technology and financial services, focusing on growth-stage investments.

Centana’s previous portfolio includes trailblazing firms in payments, compliance, and insurance tech, showcasing its ability to identify and nurture game-changing startups. With Fund III, the firm intends to double down on innovative solutions addressing efficiency, customer experience, and regulatory needs within the financial ecosystem.

The substantial capital inflow highlights the sustained appetite for fintech innovation, despite broader market uncertainties.

Source: BusinessWire

Paytend Appoints Thibault Verbiest as Chairman

Lithuanian fintech company Paytend has tapped industry veteran Thibault Verbiest as its new chairman. Verbiest, a seasoned legal and fintech expert, brings decades of experience in blockchain, compliance, and digital payments to the role.

Under his leadership, Paytend aims to strengthen its position in Europe’s competitive fintech landscape. The company has ambitious plans to expand its offerings in digital banking and cross-border payments. Verbiest’s appointment is seen as a strategic move to navigate complex regulatory landscapes while accelerating innovation.

This leadership change underscores the importance of expertise in steering fintech firms toward sustainable growth in an era of heightened competition and scrutiny.

Source: Fintech Futures

LexisNexis Risk Solutions to Acquire IDVerse

In a strategic move to bolster its identity verification capabilities, LexisNexis Risk Solutions has entered into a definitive agreement to acquire IDVerse. The acquisition aligns with LexisNexis’s commitment to enhancing digital identity and fraud prevention solutions, critical components of modern financial ecosystems.

IDVerse, known for its advanced AI-powered identity verification technology, complements LexisNexis’s existing suite of tools. The deal is expected to accelerate the adoption of secure, seamless onboarding processes across sectors, including fintech, e-commerce, and banking.

This acquisition reflects the growing demand for robust identity solutions as digital fraud continues to rise globally.

Source: PR Newswire

Key Takeaways

- Regulatory Realities: Australia’s crypto shutdown highlights the delicate balance between fostering innovation and enforcing compliance.

- Tech-Driven Mobility: Waymo’s Miami expansion signals the mainstreaming of autonomous ride-hailing.

- Venture Resilience: Centana Growth Partners’ $600 million Fund III underscores confidence in fintech’s potential.

- Leadership Matters: Paytend’s strategic appointment of Thibault Verbiest highlights the role of expertise in navigating complex markets.

- Fraud Prevention Evolution: LexisNexis’s acquisition of IDVerse reaffirms the centrality of secure identity solutions in fintech.

The post Fintech Pulse: Your Daily Industry Brief (Waymo, Paytend, LexisNexis Risk Solutions, Centana Growth Partners, IDVerse) appeared first on News, Events, Advertising Options.

Fintech

Ibanera Leverages FIS Innovation to Launch Comprehensive Prepaid Card Program

Ibanera, a leading digital banking platform, is tapping into the expertise of global financial services provider FIS to launch its prepaid card program. This collaboration is set to deliver cutting-edge payment solutions tailored for both businesses and individual consumers across the United States.

This new prepaid card program, supported by Visa’s global network, offers users the flexibility to make payments wherever Visa is accepted, granting convenience and security. The program’s unique features include instant issuance, allowing users to receive virtual or physical prepaid cards immediately, and the ability to conduct transactions in multiple currencies, making it ideal for both domestic and international use.

“We are thrilled to have the support of FIS in bringing this robust prepaid solution to market,” said Michael Carbonara, CEO of Ibanera. “Our collaboration is a crucial step in our commitment to delivering innovative, secure, and accessible financial solutions. Whether for managing business expenses or everyday personal use, our prepaid cards offer a seamless payment experience that aligns with the needs of today’s consumers and businesses.”

The collaboration with FIS leverages its extensive experience in the prepaid industry, having processed more than 21.1 billion U.S. card and money movement transactions. This new prepaid card program empowers users with various solutions, including payroll, travel expenses, government payments, and more, while also providing branding opportunities by placing logos on prepaid cards.

In addition to traditional plastic cards, the program offers tokenized cards compatible with major digital wallets, enabling secure mobile payments. Users can also manage and monitor their transactions in real-time through Ibanera’s comprehensive online portal, providing greater control over their finances.

The Ibanera prepaid card program is available to U.S. residents and businesses, offering multiple load options including Fedwire, ACH Direct Deposit, FedNow, P2C, and Visa ReadyLink, ensuring that users have versatile ways to fund their cards.

The post Ibanera Leverages FIS Innovation to Launch Comprehensive Prepaid Card Program appeared first on News, Events, Advertising Options.

-

Fintech6 days ago

Fintech6 days agoFintech Pulse: Your Daily Industry Brief (Pennant Technologies, MogoPlus, Stash, Kennel Connection, RedRover)

-

Fintech1 day ago

Fintech1 day agoFintech Pulse: Your Daily Industry Brief (Waymo, Paytend, LexisNexis Risk Solutions, Centana Growth Partners, IDVerse)

-

Fintech PR6 days ago

Fintech PR6 days agoSchneider Electric Wins ‘Business Continuity/ Disaster Recovery Project of the Year’ and ‘ESG/CSR Company Initiative’ at the SDC Awards 2024

-

Fintech PR5 days ago

Fintech PR5 days agoThomson Reuters named a Leader in 2024 IDC MarketScape for Worldwide SaaS and Cloud-enabled Sales and Use Tax Automation Software for Enterprise

-

Fintech PR6 days ago

Fintech PR6 days agoOver 10,000 People Attended the 2024 AWDPI Conference to Jointly Advance Asian Women’s Empowerment and Leadership

-

Fintech PR5 days ago

Fintech PR5 days agoEthara: EMIRATI SISTERS AMNA AND HAMDA AL QUBAISI RETURN TO YAS MARINA CIRCUIT FOR F1 ACADEMY SEASON FINALE

-

Fintech PR7 days ago

Fintech PR7 days agoProfessional Trader Awards Celebrate Industry’s Best Brokers

-

Fintech PR5 days ago

Fintech PR5 days agoGuangzhou and Aksu Spotlight Cultural Heritage at the 2024 Understanding China Conference