Latest News

Sparta Capital Sends Letter to Board of Directors of Wood Group

LONDON, April 16, 2024 /PRNewswire/ — The full text of the letter follows:

Sparta Capital Management Ltd

1 Knightsbridge Green

London SW1X 7QA

John Wood Group PLC

15 Justice Mill Lane

Aberdeen AB11 6EQ

Attn: Roy A Franklin, Chair; the Board of Directors

Cc: Ken Gilmartin, Chief Executive Officer

15 April 2024

Dear Roy,

Thank you for the many opportunities you have given us to continue our discussions.

As you know, we have been a significant investor in Wood Group since early 2022, and like many of your shareholders we are frustrated by the continued underperformance of the shares. We are now one year on from the lapsed bid process with Apollo and 17 months since you announced your strategy refresh. Despite the many operational achievements that you have recorded since then, your shares languish at 130p – 140p, which, with the exception of just one occasion in the last five years, are the all-time lows for the shares.

In the context of this, we believe that the Board must be realistic on how it can best achieve fair value for shareholders; if the UK public markets are unwilling or unable to engage in Wood’s story, we believe you should undertake a strategic review and actively seek alternative solutions. We note, for example, the recent successful attempts by corporates to move their primary listing away from markets which they have determined do not recognise the true worth of their businesses. In particular, the US, where Wood’s peers Jacobs and KBR trade, and where you have significant operational and executive presence, would seem a logical potential listing venue. Equally, we have been pleased to see a significant up-tick in M&A activity in Q1 2024, and financing markets which appear to be supportive of public to private transactions.

We have spoken to many of your existing investors, and there is widespread agreement that something must be done to address the poor share price performance. As such, we urge you to conduct a strategic review with an open mind as to the best way to achieve fair value for shareholders. If you conclude that shareholder value will be maximised through a sale of the company, we encourage you to engage with any suitable bidders who may emerge during this process.

Operational Achievements

It is clear that you have made considerable progress as a business since the beginning of 2022. The sale of the Built Environment division, completed in September 2022, was transformative and made possible, a comprehensive and long overdue root & branch restructuring of the business. You appointed Ken Gilmartin in June 2022 to lead this process. We believe Ken is a talented executive who has very quickly implemented the right strategy for Wood. At the November 2022 CMD, Ken and the refreshed executive leadership team set out a clear vision and roadmap:

- Growth – returning the business to sustainable growth “ahead of” a market estimated to grow at 5%

- Derisking – moving the business away from risky lumpsum turnkey contracts

- Profitability – addressing central costs and improving operating margins

- Operating Cash – generating substantial operating cash

- Legacy Liabilities – retiring legacy liabilities

- Free Cash Flow – generating sustainable free cash flow

Against this list of objectives, we note the following very significant successes, with more to follow:

- Growth – in its first full year since the strategy refresh the business grew EBITDA some 11%(*) and has guided to 2024 EBITDA growth towards the upper end of its medium-term target and for 2025 EBITDA growth to exceed its medium-term target of mid to high single digit percentage growth annually(1)

- Derisking – lumpsum turnkey contracts now represent only a negligible portion of the total revenue, versus 16% in FY 2021(1)

- Profitability – after a year of investment in 2023 with margins flat on 2022 as guided, margins are now expected to expand significantly as the business continues to grow, shifts towards higher margin consulting projects and benefits from cost savings initiatives(1). As a consequence, analysts estimate that EBITDA margins will expand to 7.5% and 8.1% for 2024 and 2025 respectively(2) from 7.2% in 2023

- Operating Cash – over 2023 the company generated a dramatic positive inflection in operating cash, generating $194m of operating cash for the year, versus an outflow of $66m in 2022(1). The company is on course to achieve a further improvements, with operating cashflow set to grow to $355m(2) by 2025 according to consensus estimates

- Legacy Liabilities – the company has retired some $145m(3) of legacy obligations in 2023, with the final amount of $70m(4) being retired in H1 of 2024.

In total, some $362m(5) of liabilities faced by the group at the time of the CMD in 2022, equivalent to approximately 1/3rd of the group’s current market capitalisation, have been permanently retired - Free Cash Flow – as guided at the time of the CMD, the business is on course to generate material free cash flow in 2025

We note that as an engineering consultant, Wood benefits from the structural growth drivers of carbon emission reductions and energy security. Revenues for 2024 are backstopped by an order book of $6.3bn(1) and an increasing proportion of Wood’s revenues are linked to Carbon Emissions – at the last report date, the percentage of work encompassing “green” initiatives was 22% FY 2023 revenue, up from 20% just one year ago, while the current pipeline is now 43% exposed to sustainable solutions(1).

Relative Valuation & Performance

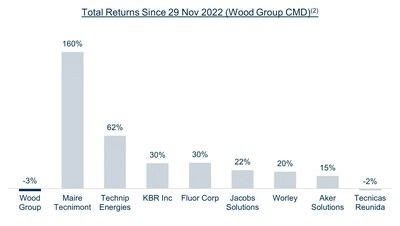

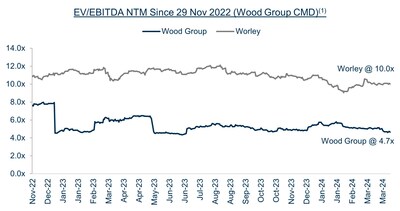

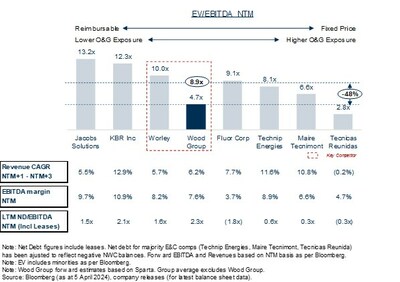

In spite of these many achievements, Wood’s share price has languished, and the company remains the lowliest valued company in the sector. Wood trades at 1/3rd(6) of the multiple of the comparable, higher quality peers like Worley (often cited as your key competitor and the business most like Wood), Jacobs and KBR and a 48%(6) discount to the sector average and with only Tecnicas Reunidas trading cheaper, which given that according to consensus numbers, it is ex-growth with close to half the margins, this is would appear to be a low bar.

- Wood’s share price has languished since the CMD

- Wood has delivered the lowest total return of its peers, including its former OFS peers

- The discount in valuation against Wood’s closest peer globally, Worley, remains stubbornly wide

- Wood remains at an unwarranted discount to its listed peers, including its former OFS peers

UK Mid-cap Curse

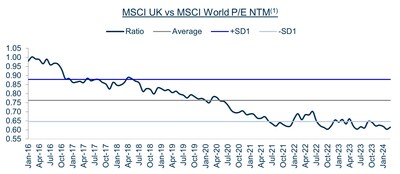

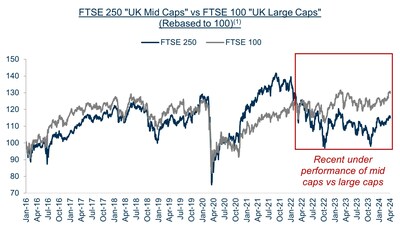

We accept and acknowledge that part of this underperformance and lack of shareholder engagement in the equity story is beyond your control. As can clearly be seen in the graphs below, UK mid-caps have chronically underperformed global equities in recent years. The first chart shows that the UK has materially de-rated against world equities, with a forward PE multiple now sitting at just 0.6x that of the MSCI World index, down from parity in 2016. Equally, within the UK, the second chart and recent past in particular (highlighted in red), shows that UK mid-caps have underperformed UK large-caps in the time since Covid, unfortunately coinciding with your strategic re-launch.

Whatever the reasons for this market-wide underperformance, as a transformation story with history of poor execution, you are a “show-me” story and, as such, will feel the full effect of this apparent indifference from public markets. We urge you to be realistic that these dynamics will not shift anytime soon when assessing how best to serve shareholders in the near term.

In Summary

You are delivering operationally, yet your shares trade at the all-time lows. In the context of the Apollo bid process, you described their approaches of 200p to 230p as proposals which “significantly undervalued the repositioned Group’s prospects.”(1). We don’t doubt that, fundamentally, Wood is worth significantly more than where it is currently trading in the public markets and indeed more than those offers. However, if there is no realistic prospect of achieving that value steady state in the public markets, then this is a moot point.

When we look at the behaviour of your core holders at the time of the previous approach, we note that institutional holders sold millions of shares at an average price of 214p(2) – their actions speaking louder perhaps than any assurances of their belief in the fundamental value they may have offered at the time. This trading pattern suggests that, at the time of the offer, shareholders accepted, out of brutal pragmatism, that realising 200p+ today, was a better course than hoping for a multiple of that price, at some point in the future.

You have given the UK public markets 17 months to recognise the value creation possible in a 36 month turn-around plan. The disconnect between intrinsic value and the value assigned by the market has never been wider. We believe that it is time to recognise that the next chapter of Wood’s journey could be best supported by different owners, and we urge you to undertake a strategic review and explore the best way to maximise shareholder value, including a sale of the company.

We have sent this letter to you first, but we have also chosen to make this letter public so that the debate can be open and transparent, and we encourage other shareholders to make their views known to you.

We look forward to continuing our discussions.

Best wishes,

Franck Tuil, CIO

Sparta Capital Management Ltd

About Sparta Capital

Sparta Capital is a multi-strategy investment fund launched in 2021 investing globally in a broad range of public and private securities, across both equity and credit markets. Our investment process relies on intensively researching the fundamentals of our targeted companies and identifying investment opportunities where, for a variety of clearly identifiable reasons, we believe a disconnect exists between the price of the securities in question and their underlying value – in short, we look for mispriced, catalyst-driven, investment opportunities.

Core to our investment process is the belief that constructive engagement with the companies in which we invest is not only our duty as responsible investors, but a highly effective way to drive value creation for the mutual benefit of shareholders and companies alike. We believe that the evolution of stock market dynamics of the past several years, has created increasingly stark disconnects between share price performance and investment fundamentals and our philosophy is to work with the companies that we invest in to address this.

Media Contacts

Greenbrook

Rob White / Michael Russell

[email protected]

+44 207 952 2000

Sparta Capital Management Limited (“Sparta”) is authorised and regulated by the Financial Conduct Authority of the United Kingdom (the “FCA”). This presentation is made by Sparta to John Wood group PLC (“Wood”) in Sparta’s capacity as an investor in Wood and not as part of an advisory or other professional service to Wood or any other person. Sparta is not advising the recipients of this presentation and will not be held responsible for providing them with the regulatory protections under the FCA rules. The presentation is based on information which we consider to be reliable but we make no representation or warranty, express or implied, as to its accuracy, reliability or completeness. Sparta is a Private Limited Company registered in England and Wales, Company No: 11178462. Registered Office: 1 Knightsbridge Green, London SW1X 7QA.

This document is not an offer to, or solicitation of, any potential clients or investors for the provision by Sparta of investment management, advisory or any other comparable or related services. No statement in this overview is or should be construed as investment, legal, or tax advice, nor is any statement an offer to sell, or a solicitation of an offer to buy, any security or other instrument, or an offer to arrange any transaction, or to enter into legal relations.

No representation is made as to the accuracy or completeness of any information contained herein, and the recipient accepts all risk in relying on this information for any purpose whatsoever. Without prejudice to the foregoing, any views expressed herein are the opinions of Sparta as of the date on which this document has been prepared and are subject to change at any time without notice. Sparta does not undertake to update this information. Any forward-looking statements herein are inherently subject to material business, economic and competitive risks and uncertainties, many of which are beyond our control. In addition, these forward-looking statements are subject to assumptions with respect to future business strategies and decisions that are subject to change.

[1] Source: Company financial reports. (*) Refers to constant FX reported figures.

[2] Source: Sparta-compiled consensus based on Research Analysts who have updated their model post FY 23 results. Based on company defined OCF: Adj. EBITDA – cash adj. JV elements – Provisions – Others – NWC.

[3] Source: Company CMD presentation: summation of expected exceptional cash outflow FY 23 – 25

[4] Source: Company FY 23 Results Presentation ($120m including $50m simplification programme costs).

[5] Source: Company FY 23, FY 22 and H1 22 Results Presentation: includes $145m settled in FY 23 and $217m settled in H2 22 ($319m – $102m).

[6] Source: Based on Bloomberg EV/EBITDA NTM. Sector includes Jacobs Solutions, KBR, Worley, Fluor Corp, Technip Energies, Maire Tecnimont, Tecnicas Reunidas.

[1] Source: Bloomberg as of 5th April 2024.

2 Source: Bloomberg as of 5th April 2024. Assumes that any dividends are reinvested into the security.

[1] Source: Bloomberg as of 5th April 2024.

[1] Source: Bloomberg as of 5th April 2024.

[1] Source: Company Press Release 22 February 2023.

[2] Source: Based on best efforts compilation of Form 8.3 data, focusing only institutional investors and their shares sold. Daily Bloomberg VWAP used as an approximation of price of shares sold.

Photo – https://mma.prnewswire.com/media/2387745/Sparta_Capital_Management_Ltd.jpg

Photo – https://mma.prnewswire.com/media/2387746/Sparta_Capital_Management_Ltd.jpg

Photo – https://mma.prnewswire.com/media/2387747/Sparta_Capital_Management_Ltd.jpg

Photo – https://mma.prnewswire.com/media/2387748/Sparta_Capital_Management_Ltd.jpg

Photo – https://mma.prnewswire.com/media/2387749/Sparta_Capital_Management_Ltd.jpg

Photo – https://mma.prnewswire.com/media/2387750/Sparta_Capital_Management_Ltd.jpg

![]() View original content to download multimedia:https://www.prnewswire.co.uk/news-releases/sparta-capital-sends-letter-to-board-of-directors-of-wood-group-302117261.html

View original content to download multimedia:https://www.prnewswire.co.uk/news-releases/sparta-capital-sends-letter-to-board-of-directors-of-wood-group-302117261.html

Latest News

Flowcore: Synthetik Insurance Analytics announces successful demonstration of AI powered flood modeling and loss prediction tool

AUSTIN, Texas and LONDON, April 29, 2024 /PRNewswire/ — Synthetik has announced the successful demonstration of their “Flood Data Collection and Analysis” platform, Flowcore – an end-to-end tool for modeling of flood scenarios and prediction of resulting damage and financial/insurance losses. Flowcore incorporates Synthetik’s proprietary GPU-accelerated flood simulation code, and uniquely leverages artificial intelligence (AI) to deliver results in seconds on standard laptop systems – enabling measurement of cumulative events or high-volume probabilistic analysis.

Flowcore has undergone significant validation using real world events and was used to recreate a flash flooding event in Fort Lauderdale, FL from April 2023 with virtually perfect accuracy at unprecedented speeds.

Flowcore meets the Federal Emergency Management Agency (FEMA) and National Flood Insurance Program’s (NFIP) objectives of better understanding historical flood impact, real-time analysis and damage forecasting for future events across the country and represents a step-change in scalability for physics-based flood simulation. Flowcore is already being marketed and utilized by Synthetik’s partners in the insurance industry.

Josh Hatfield, Director of Research and Development for Synthetik said:

‘Climate change is rapidly and radically changing the landscape of risk in climate-related events, so we are delighted with the success of Flowcore and its potential to assist public and private sector partners in understanding and predicting flooding damage, and to help guide disaster mitigation efforts across impacted communities.’

Synthetik COO Tim Brewer commented:

‘Flowcore joins our successful products for insurance analytics based on the characterization of assets, perils and vulnerability that deliver industry leading intelligence to insurance companies and risk holders all over the world. We’re motivated to extend this framework to a wide-range of insurable assets and perils including human and climate-based threats to deliver on our mission of developing breakthrough technology for a safer world.’

For all inquiries: Contact Synthetik Applied Technologies PR [email protected]

Logo – https://mma.prnewswire.com/media/2067510/Synthetik_Applied_Technologies_Logo.jpg

![]() View original content:https://www.prnewswire.co.uk/news-releases/flowcore-synthetik-insurance-analytics-announces-successful-demonstration-of-ai-powered-flood-modeling-and-loss-prediction-tool-302130519.html

View original content:https://www.prnewswire.co.uk/news-releases/flowcore-synthetik-insurance-analytics-announces-successful-demonstration-of-ai-powered-flood-modeling-and-loss-prediction-tool-302130519.html

Latest News

New Amsterdam Invest N.V. annual reporting 2023

AMSTERDAM, April 29, 2024 /PRNewswire/ — New Amsterdam Invest N.V. (the “Company”, or “New Amsterdam Invest”, or “NAI”), a commercial real estate company listed on Euronext Amsterdam, announces a slight delay in reporting its annual results 2023, today.

Due to circumstances, the preparation and finalization of the audit of the annual report 2023 has been slightly delayed. As we consider delivering a high-quality completion of this process of the utmost importance, we decided to delay publication of the audited annual report 2023 to publication of the AGM agenda on DV. 8 May 2024.

Strategic Highlights 2023

- On 2 June 2023, all Company’s shareholders approved the proposed Somerset Group Business Combination, changing New Amsterdam Invest from a Special Purpose Acquisition Company (“SPAC”) into a commercial real estate company listed on Euronext Amsterdam.

- On 2 June 2023 NAI acquired four properties in the UK and one in the USA via different subsidiaries.

- In line with its strategy NAI acquired another investment property in the UK via one of its subsidiaries, on 26 September 2023.

Outline 2023 results

Net Rental Income for full year 2023 is consistent with outlook as provided at Half Year 2023 and the Net Result from Operations over 2023 is positive in accordance with written expectations. Given accounting requirements, one-off costs (in connection with the transition from SPAC to operational company) and (non-cash) revaluations of investment property were required, resulting in a 2023 net loss.

Outlook 2024

For 2024 NAI expects to be profitable and well on track to realize the financial objectives the Company has set out at listing. More specific NAI reiterates that its current portfolio should enable it to realize a 2024 net rental income of approximately € 6.6 million and a result before tax of € 2.6 million, excluding potential impact of revaluation of investment property and or the acquisition of new investment property.

Annual General Meeting scheduled for 21 June 2024 DV

The agenda for the 21 June 2024 DV AGM will be published on 8 May 2024 DV.

Financial Calendar

- 8 May 2024, Publication Agenda General Meeting of Shareholders 21 June 2024 and Annual Report 2023

- 21 June 2024, General Meeting of Shareholders

- 29 August 2024, half year 2024 results publication

About New Amsterdam Invest

New Amsterdam Invest N.V. is a commercial real estate company listed at Euronext Amsterdam with operating companies in the United States and the United Kingdom.

The main objective of New Amsterdam Invest is running commercial activities including the owning, (re-)developing, acquiring, divesting, maintaining, letting out and/or otherwise operating commercial real estate, all in the broadest possible meaning.

All information about New Amsterdam Invest, including its principles and objectives can be found in the Shareholder Circular dated April 21, 2023, and the prospectus dated June 21, 2021. This and all other relevant documentation can be found on the company website: www.newamsterdaminvest.com

Not for publication

Disclaimer

Elements of this press release contain or may contain information about New Amsterdam Invest N.V. within the meaning of Article 7(1) to (4) of the EU Market Abuse Regulation.

This press release may include statements, including NAI’s financial and operational medium-term objectives that are, or may be deemed to be, ”forward-looking statements”. These forward-looking statements may be identified by the use of forward-looking terminology, including the terms ”believes”, ”estimates”, ”plans”, ”projects”, ”anticipates”, ”expects”, ”intends”, ”may”, ”will” or ”should” or, in each case, their negative or other variations or comparable terminology, or by discussions of strategy, plans, objectives, goals, future events or intentions. Forward-looking statements may and often do differ materially from actual results. Any forward-looking statements reflect NAI’s current view with respect to future events and are subject to risks relating to future events and other risks, uncertainties and assumptions relating to NAI’s business, results of operations, financial position, liquidity, prospects, growth or strategies. Forward-looking statements speak only as of the date they are made.

View original content:https://www.prnewswire.co.uk/news-releases/new-amsterdam-invest-nv-annual-reporting-2023-302130199.html

Latest News

Repurchases of shares by EQT AB during week 17, 2024

STOCKHOLM, April 29, 2024 /PRNewswire/ — Between 23 April 2024 and 26 April 2024 EQT AB (LEI code 213800U7P9GOIRKCTB34) (“EQT”) has repurchased 398,534 own ordinary shares (ISIN: SE0012853455)

The repurchases form part of the repurchase program of a maximum of 2,154,000 own ordinary shares for a total maximum amount of SEK 1,000,000,000 that EQT announced on 22 April 2024. The repurchase program, which runs between 23 April 2024 and 24 May 2024, is being carried out in accordance with the Market Abuse Regulation (EU) No 596/2014 and the Commission Delegated Regulation (EU) No 2016/1052.

EQT ordinary shares have been repurchased as follows:

|

Date: |

Aggregated daily volume (number of shares): |

Weighted average share price per day (SEK): |

Total daily transaction value (SEK): |

|

23 April 2024 |

100,000 |

295.9264 |

29,592,640.00 |

|

24 April 2024 |

98,534 |

297.3100 |

29,295,143.54 |

|

25 April 2024 |

100,000 |

289.3646 |

28,936,460.00 |

|

26 April 2024 |

100,000 |

298.6324 |

29,863,240.00 |

|

Total accumulated over week 17/2024 |

398,534 |

295.3010 |

117,687,483.54 |

|

Total accumulated during the repurchase program |

398,534 |

295.3010 |

117,687,483.54 |

All acquisitions have been carried out on Nasdaq Stockholm by Skandinaviska Enskilda Banken AB on behalf of EQT.

Following the above acquisitions and as of 26 April 2024, the number of shares in EQT, including EQT’s holding of own shares is set out in the table below.

|

Ordinary shares |

Class C shares1 |

Total |

|

|

Number of issued shares |

1,245,048,412 |

881,555 |

1,245,929,967 |

|

Number of shares owned by EQT AB2 |

60,873,363 |

– |

60,873,363 |

|

Number of outstanding shares |

1,184,175,049 |

881,555 |

1,185,056,604 |

1) Carry one tenth (1/10) of a vote.

2) EQT AB shares owned by EQT AB are not entitled to dividends or carry votes at shareholders’ meetings.

A full breakdown of the transactions is attached to this announcement.

Contact

Olof Svensson, Head of Shareholder Relations, +46 72 989 09 15

EQT Press Office, [email protected], +46 8 506 55 334

This information was brought to you by Cision http://news.cision.com

https://news.cision.com/eqt/r/repurchases-of-shares-by-eqt-ab-during-week-17–2024,c3970207

The following files are available for download:

|

EQT – Repurchases of shares – Weekly press release w17 |

|

|

EQT AB Group |

|

|

https://mb.cision.com/Public/87/3970207/a1867d34c8d8d8dd.pdf |

EQT Transactions Week 17 |

View original content:https://www.prnewswire.co.uk/news-releases/repurchases-of-shares-by-eqt-ab-during-week-17-2024-302130317.html

-

Latest News7 days ago

Nium Expands Regional Footprint in Asia; Signs Partnership MOU with Indonesian Payments Infrastructure Leader, Artajasa

-

Latest News6 days ago

Clayfin Technologies and Jana Small Finance Bank Honored with Prestigious IBSi Digital Banking Award 2024

-

Latest News4 days ago

Trakx launches a new product: Trakx USDc Earn CTI powered by OpenTrade

-

Latest News6 days ago

HANDSHAKE SPEAKEASY IN MEXICO CITY NAMED AS THE BEST BAR IN NORTH AMERICA AS RANKING OF NORTH AMERICA’S 50 BEST BARS IS REVEALED AT THIRD ANNUAL AWARDS CEREMONY

-

Latest News6 days ago

SDAX Unveils World’s First Securitised Gold Tokens for Digital Exchange Users

-

Latest News7 days ago

Fortis Digital Solutions secures $20 million Series A funding to expand its presence in the MENA region

-

Latest News5 days ago

BINGHATTI LAUNCHES ITS DEBUT PROJECT ADJACENT TO DUBAI HILLS

-

Latest News7 days ago

LANZAJET ANNOUNCES INVESTMENT FROM MICROSOFT’S CLIMATE INNOVATION FUND, SUPPORTING CONTINUED COMPANY GROWTH